Honeywell 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

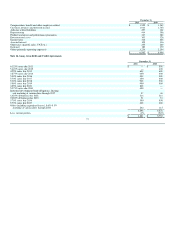

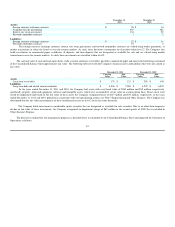

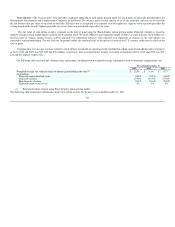

We are authorized to issue up to 40,000,000 shares of preferred stock, without par value, and can determine the number of shares of each series, and the

rights, preferences and limitations of each series. At December 31, 2011, there was no preferred stock outstanding.

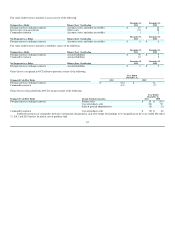

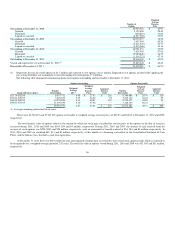

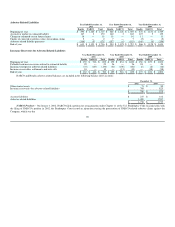

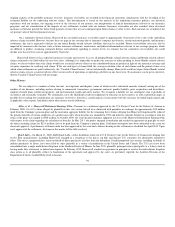

Note 19. Accumulated Other Comprehensive Income (Loss)

Total accumulated other comprehensive income (loss) is included in the Consolidated Statement of Shareowners' Equity. Comprehensive Income (Loss)

attributable to non-controlling interest consisted predominantly of net income. The changes in Accumulated Other Comprehensive Income (Loss) are as

follows:

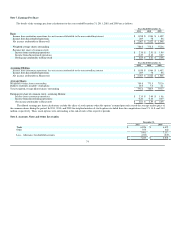

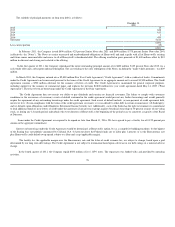

Pretax Tax After Tax

Year Ended December 31, 2011

Foreign exchange translation adjustment $ (146) $ — $ (146)

Pensions and other post retirement benefit adjustments (317) 108 (209)

Changes in fair value of available for sale investments 12 — 12

Changes in fair value of effective cash flow hedges (41) 7 (34)

$ (492) $ 115 $ (377)

Year Ended December 31, 2010

Foreign exchange translation adjustment $ (249) $ — $ (249)

Pensions and other post retirement benefit adjustments 26 18 44

Changes in fair value of available for sale investments 90 — 90

Changes in fair value of effective cash flow hedges (6) 2 (4)

$ (139) $ 20 $ (119)

Year Ended December 31, 2009

Foreign exchange translation adjustment $ 259 $ — $ 259

Pensions and other post retirement benefit adjustments (407) 136 (271)

Changes in fair value of available for sale investments (1) 112 — 112

Changes in fair value of effective cash flow hedges 38 (8) 30

$ 2 $ 128 $ 130

(1) Includes reclassification adjustment for losses included in net income

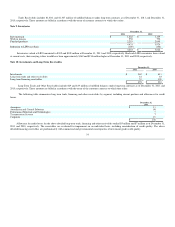

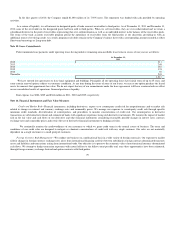

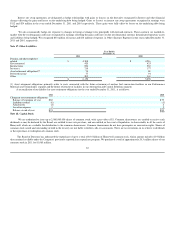

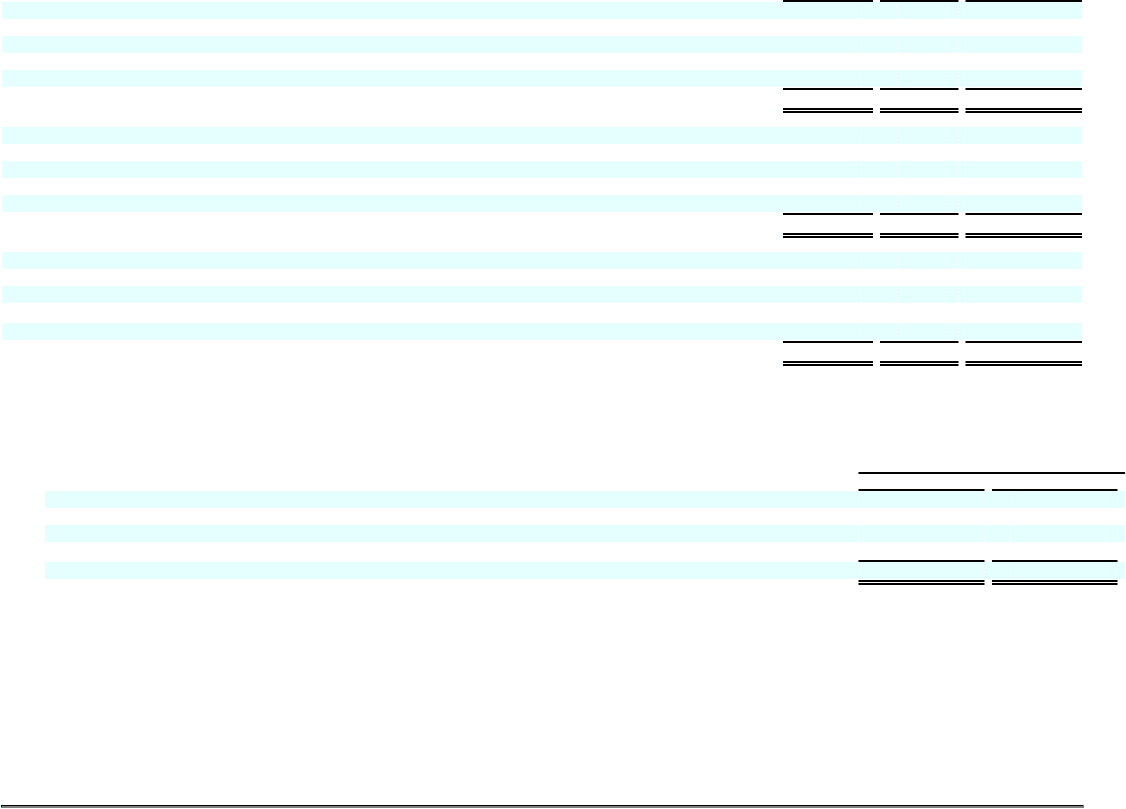

Components of Accumulated Other Comprehensive Income (Loss)

December 31,

2011 2010

Cumulative foreign exchange translation adjustment $ 74 $ 220

Pensions and other post retirement benefit adjustments (1,650) (1,441)

Change in fair value of available for sale investments 163 151

Change in fair value of effective cash flow hedges (31) 3

$ (1,444) $ (1,067)

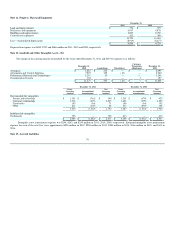

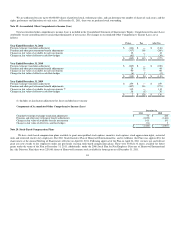

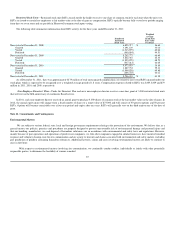

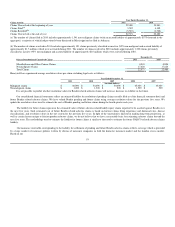

Note 20. Stock-Based Compensation Plans

We have stock-based compensation plans available to grant non-qualified stock options, incentive stock options, stock appreciation rights, restricted

units and restricted stock to key employees. The 2011 Stock Incentive Plan of Honeywell International Inc. and its Affiliates (the Plan) was approved by the

shareowners at the Annual Meeting of Shareowners effective on April 26, 2011. Following approval of the Plan on April 26, 2011 we have not and will not

grant any new awards to key employees under any previously existing stock-based compensation plans. There were 39,582,132 shares available for future

grants under the terms of the Plan at December 31, 2011. Additionally, under the 2006 Stock Plan for Non-Employee Directors of Honeywell International

Inc. (the Directors Plan) there were 229,000 shares of Honeywell common stock available for future grant as of December 31, 2011.

84