Honeywell 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

(Dollars in millions, except per share amounts)

The following Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A") is intended to help the reader

understand the results of operations and financial condition of Honeywell International Inc. ("Honeywell") for the three years ended December 31, 2011. All

references to Notes related to Notes to the Financial Statements in "Item 8-Financial Statements and Supplementary Data".

The Consumer Products Group (CPG) automotive aftermarket business had historically been part of the Transportation Systems reportable segment. In

accordance with generally accepted accounting principles, CPG results are excluded from continuing operations and are presented as discontinued operations

in all periods presented. See Note 2 Acquisitions and Divestitures for further details.

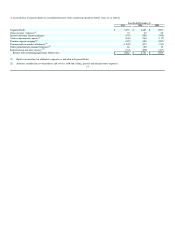

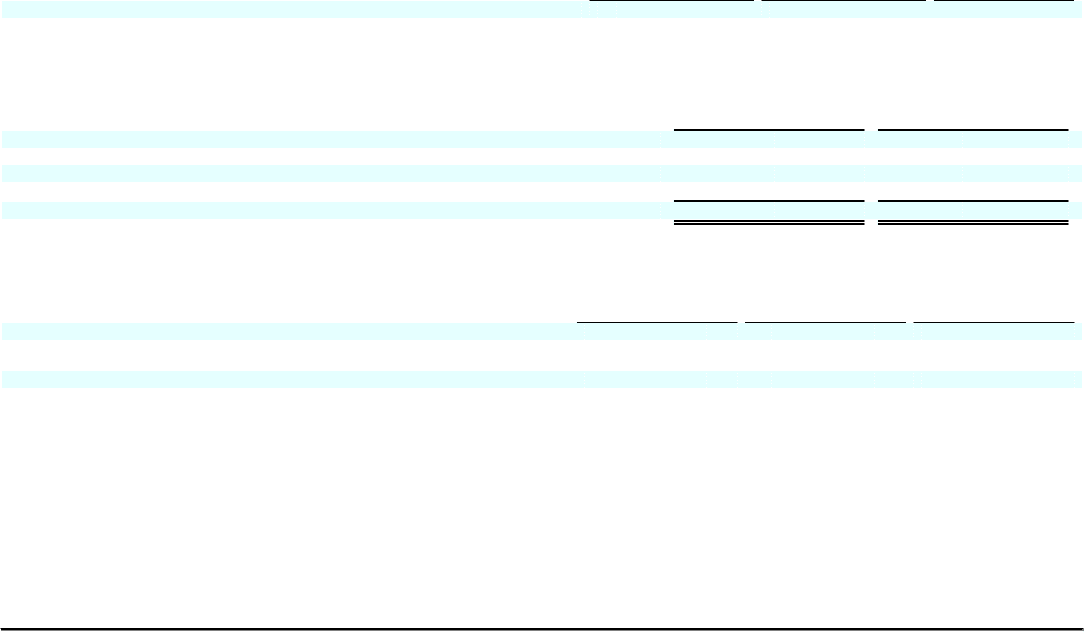

CONSOLIDATED RESULTS OF OPERATIONS

Net Sales

2011 2010 2009

Net sales $ 36,529 $ 32,350 $ 29,951

% change compared with prior period 13% 8%

The change in net sales compared to the prior year period is attributable to the following:

2011

Versus

2010

2010

Versus

2009

Volume 6% 5%

Price 2% 2%

Acquisitions/Divestitures 3% 1%

Foreign Exchange 2% 0%

13% 8%

A discussion of net sales by segment can be found in the Review of Business Segments section of this MD&A.

Cost of Products and Services Sold

2011 2010 2009

Cost of products and services sold $ 28,556 $ 24,721 $ 23,260

% change compared with prior period 16% 6%

Gross Margin percentage 21.8% 23.6% 22.3%

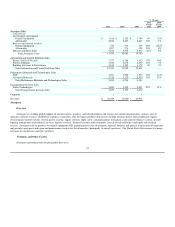

Cost of products and services sold increased by $3,835 million or 16 percent in 2011 compared with 2010 principally due to an estimated increase in

direct material costs, labor costs and indirect costs of approximately $2 billion, $520 million, and $280 million, respectively, driven substantially by a 13

percent increase in sales as a result of the factors (excluding price) discussed above and in the Review of Business Segments section of this MD&A, an

increase in pension and other postretirement expense of approximately $880 million (primarily driven by the increase in the pension mark-to-market

adjustment allocated to cost of goods sold of $1.1 billion) and an increase in repositioning and other charges of approximately $90 million.

Gross margin percentage decreased by 1.8 percentage points in 2011 compared with 2010 primarily due to higher pension and other postretirement

expense (approximate 2.8 percentage point impact primarily driven by an unfavorable 3.3 percentage point impact resulting from the increase in the pension

mark-to-market adjustment allocated to cost of goods sold) and repositioning and other charges (approximate 0.2 percentage point impact),

25