Honeywell 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•New aircraft production rates and delivery schedules set by commercial air transport, regional jet, business and general aviation OE

manufacturers, as well as airline profitability, platform mix and retirement of aircraft from service;

•Global demand for commercial air travel as reflected in global flying hours and utilization rates for corporate and general aviation aircraft, as

well as the demand for spare parts and maintenance and repair services for aircraft currently in use;

• Level and mix of U.S. Government appropriations for defense and space programs and military activity;

• Changes in customer platform development schedules, requirements and demands for new technologies; and

• Availability and price volatility of raw materials such as titanium and other metals.

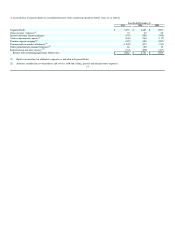

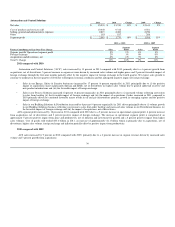

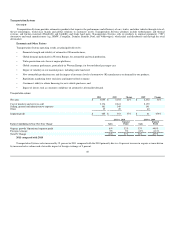

Aerospace

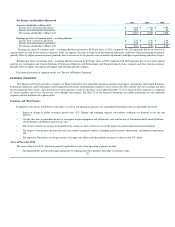

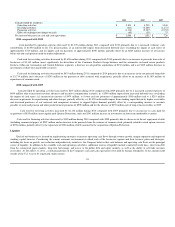

2011 2010 Change 2009 Change

Net sales $ 11,475 $ 10,683 7% $ 10,763 (1)%

Cost of products and services sold 8,665 8,099 8,099

Selling, general and administrative expenses 591 553 570

Other 196 196 201

Segment profit $ 2,023 $ 1,835 10% $ 1,893 (3)%

2011 vs. 2010 2010 vs. 2009

Factors Contributing to Year-Over-Year Change Sales Segment

Profit Sales Segment

Profit

Organic growth/ Operational segment profit 7% 9% 0% 0%

Acquisitions and divestitures, net 0% 0% 0% 0%

Other 0% 1% (1)% (3)%

Total % Change 7% 10% (1)% (3)%

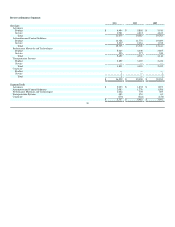

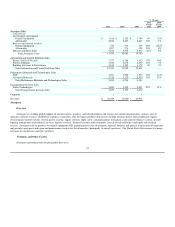

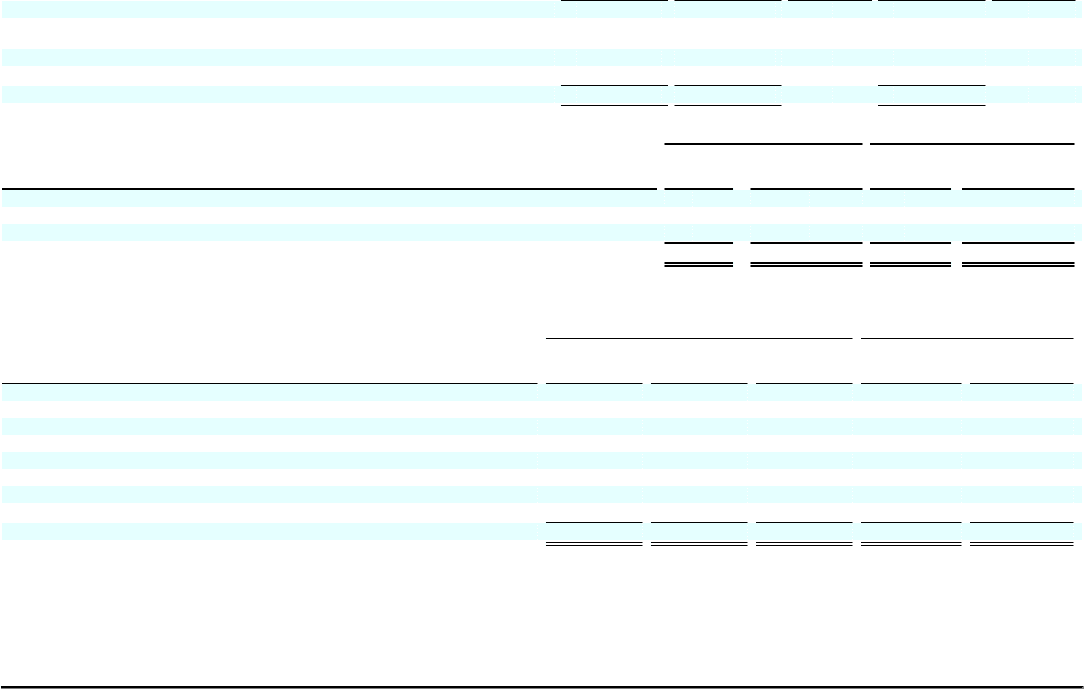

Aerospace sales by major customer end-markets were as follows:

% of Aerospace

Sales % Change in

Sales

Customer End-Markets 2011 2010 2009

2011

Versus

2010

2010

Versus

2009

Commercial:

Air transport and regional

Original equipment 13% 13% 13% 6% (2)%

Aftermarket 25% 23% 22% 16% 1%

Business and general aviation

Original equipment 6% 5% 7% 41% (27)%

Aftermarket 11% 9% 8% 24% 8%

Defense and Space 45% 50% 50% (2)% 1%

Total 100% 100% 100% 7% (1)%

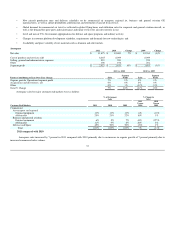

2011 compared with 2010

Aerospace sales increased by 7 percent in 2011 compared with 2010 primarily due to an increase in organic growth of 7 percent primarily due to

increased commercial sales volume.

33