Honeywell 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

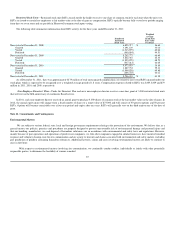

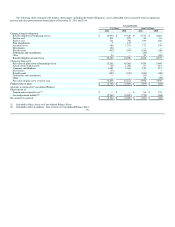

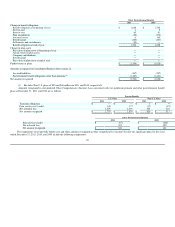

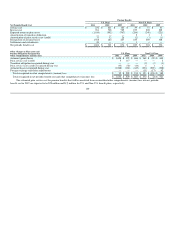

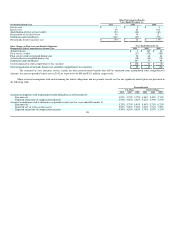

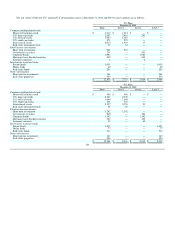

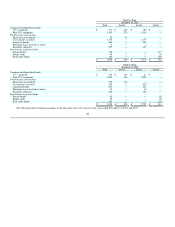

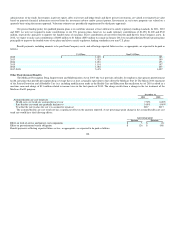

Note 22. Pension and Other Postretirement Benefits

We sponsor both funded and unfunded U.S. and non-U.S. defined benefit pension plans covering the majority of our employees and retirees. Pension

benefits for substantially all U.S. employees are provided through non-contributory, qualified and non-qualified defined benefit pension plans. U.S. defined

benefit pension plans comprise 77 percent of our projected benefit obligation. Non-U.S. employees, who are not U.S. citizens, are covered by various

retirement benefit arrangements, some of which are considered to be defined benefit pension plans for accounting purposes. Non-U.S. defined benefit pension

plans comprise 23 percent of our projected benefit obligation.

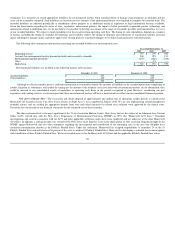

We also sponsor postretirement benefit plans that provide health care benefits and life insurance coverage to eligible retirees. Our retiree medical plans

mainly cover U.S. employees who retire with pension eligibility for hospital, professional and other medical services. Most of the U.S. retiree medical plans

require deductibles and copayments, and virtually all are integrated with Medicare. Retiree contributions are generally required based on coverage type, plan

and Medicare eligibility. All non-union hourly and salaried employees joining Honeywell after January 1, 2000 are not eligible to participate in our retiree

medical and life insurance plans. Only approximately 5 percent of Honeywell's U.S. employees are eligible for a retiree medical subsidy from the Company;

and this subsidy is limited to a fixed-dollar amount. In addition more than half of its current retirees either have no Company subsidy or have a fixed dollar

subsidy amount. This significantly limits our exposure to the impact of future health care cost increases. The retiree medical and life insurance plans are not

funded. Claims and expenses are paid from our operating cash flow.

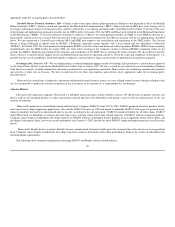

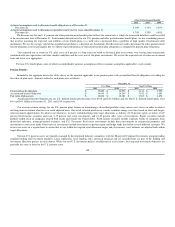

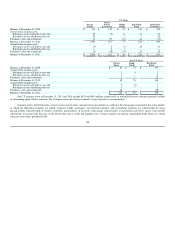

In 2011, in connection with new collective bargaining agreements reached with several of its union groups, Honeywell amended its U.S. retiree medical

plans eliminating the subsidy for those union employees resulting in curtailment gains totaling $167 million. The curtailment gains represent the recognition

in net periodic postretirement benefit cost of prior service credits attributable to the future years of service of the union groups for which future accrual of

benefits has been eliminated.

In 2010, Honeywell amended its U.S. retiree medical plan to no longer offer certain post-age-65 retirees Honeywell group coverage and facilitate their

purchase of an individual plan in the Medicare marketplace. This plan amendment reduced the accumulated postretirement benefit obligation by $137 million

which will be recognized as part of net periodic postretirement benefit cost over the average future service period to full eligibility of the remaining active

union employees still eligible for a retiree medical subsidy. Also in 2010, in connection with a new collective bargaining agreement reached with one of its

union groups, Honeywell amended its U.S. retiree medical plan eliminating the subsidy for those union employees who retire after February 1, 2013. This

plan amendment reduced the accumulated postretirement benefit obligation by $39 million which will be recognized as part of net periodic postretirement

benefit cost over the average future service period to full eligibility of the remaining active union employees still eligible for a retiree medical subsidy. This

plan amendment also resulted in a curtailment gain of $37 million in 2010 which represented the recognition in net periodic postretirement benefit cost of

prior service credits attributable to the future years of service of the union group for which future accrual of benefits was eliminated.

In 2009, Honeywell amended the U.S. retiree medical plan eliminating the subsidy for active non-union employees who retire after September 1, 2009.

Employees already retired or who retired on or before September 1, 2009 were not affected by this change. This plan amendment reduced the accumulated

postretirement benefit obligation by $180 million representing the elimination of benefits attributable to years of service already rendered by active non-union

employees who are not eligible to retire and those eligible non-union employees who were assumed not to retire prior to September 1, 2009. This reduction in

the accumulated postretirement benefit obligation will be recognized as part of net periodic postretirement benefit cost over the average future service period

to full eligibility of the remaining active union employees still eligible for a retiree medical subsidy. This plan amendment also resulted in a curtailment gain

of $98 million in 2009 which represented the recognition in net periodic post retirement benefit cost of prior service credits attributable to the future years of

service of the employee group for which future accrual of benefits was eliminated.

97