Honeywell 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

HONEYWELL INTERNATIONAL INC (HON) 10-K Annual report pursuant to section 13 and 15(d) Filed on 02/17/2012 Filed Period 12/31/2011 -

Page 2

... Jersey (Address of principal executive offices) Registrant's telephone number, including area code (973) 455-2000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Common Stock, par value $1 per share* 9½% Debentures due June 1, 2016 * The common stock is also listed... -

Page 3

...About Market Risk 8 Financial Statements and Supplementary Data 9 Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 9A Controls and Procedures 9B Other Information 10 Directors and Executive Officers of the Registrant 11 Executive Compensation 12 Security Ownership... -

Page 4

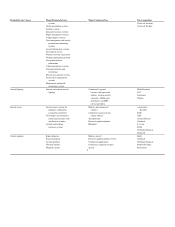

... Code of Business Conduct applies to all Honeywell directors, officers (including the Chief Executive Officer, Chief Financial Officer and Controller) and employees. Major Businesses We globally manage our business operations through four businesses that are reported as operating segments: Aerospace... -

Page 5

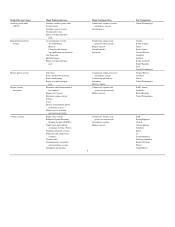

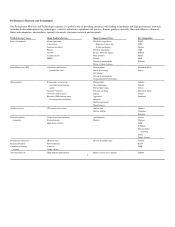

...Air conditioning Bleed air Cabin pressure control Air purification and treatment Gas Processing Heat Exchangers Repair, overhaul and spare parts Major Customers/Uses Commercial, regional, business and military aircraft Ground power Key Competitors United Technologies Environmental control systems... -

Page 6

... and health monitoring systems Major Customers/Uses Key Competitors Universal Avionics Universal Weather Aircraft lighting Interior and exterior aircraft lighting Commercial, regional, business, helicopter and military aviation aircraft (operators, OEMs, parts distributors and MRO service... -

Page 7

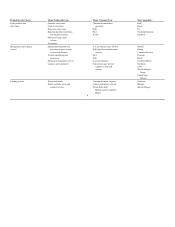

... and facilities Systems engineering and integration Information technology services Logistics and sustainment Major Customers/Uses Commercial and military spacecraft DoD FAA NASA Key Competitors BAE Ithaco L3 Northrop Grumman Raytheon Management and technical services U.S. government space (NASA... -

Page 8

... management products and services Security products and systems Fire products and systems Access controls and closed circuit television Home health monitoring and nurse call systems Gas detection products and systems Emergency lighting Distribution Personal protection equipment Major Customers/Uses... -

Page 9

... batch and hybrid operations Production management software Communications systems for Industrial Control equipment and systems Consulting, networking engineering and installation Terminal automation solutions Process control instrumentation Field instrumentation Analytical instrumentation Recorders... -

Page 10

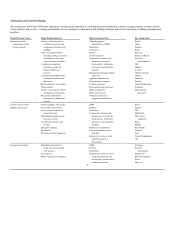

..., specialty chemicals, electronic materials and chemicals. Product/Service Classes Resins & chemicals Major Products/Services Nylon 6 polymer Caprolactam Ammonium sulfate Phenol Acetone Cyclohexanone MEKO Major Customers/Uses Nylon for carpet fibers, Engineered resins and flexible packaging... -

Page 11

... Technology licensing and engineering design of process units and systems Engineered products Proprietary equipment Training and development of technical personnel Gas processing technology Coatings and inks PVC pipe, siding & profiles Plastics Reflective coatings Safety & security applications... -

Page 12

... sales to commercial aftermarket customers of aerospace products and services were 11 percent of our total sales in each of 2011, 2010 and 2009. Our Aerospace results of operations can be impacted by various industry and economic conditions. See "Item 1A. Risk Factors." U.S. Government Sales Sales... -

Page 13

...in 2011, 2010 and 2009, respectively. Approximately 18 percent of total 2011 sales of Aerospace-related products and services were exports of U.S. manufactured products and systems and performance of services such as aircraft repair and overhaul. Exports were principally made to Europe, Asia, Canada... -

Page 14

...gas applications in our Transportation Systems segment and new product development in our Automation and Control Solutions segment. The increase in R&D expense of 10 percent in 2010 compared to 2009 was mainly due to additional product design and development costs in Automation and Control Solutions... -

Page 15

... future on the Company's business or markets that it serves, nor on its results of operations, capital expenditures or financial position. We will continue to monitor emerging developments in this area. Further information, including the current status of significant environmental matters and the... -

Page 16

... demand for air travel and our Aerospace aftermarket sales and margins. The operating results of our Automation and Control Solutions (ACS) segment, which generated 43 percent of our consolidated revenues in 2011, are impacted by the level of global residential and commercial construction (including... -

Page 17

... required recertification of parts obtained from new suppliers with our customers and/or regulatory agencies. In addition, because our businesses cannot always immediately adapt their cost structure to changing market conditions, our manufacturing capacity for certain products may at times exceed or... -

Page 18

... controls regarding global cash management to guard against cash or investment loss and to ensure our ability to fund our operations and commitments, a material disruption to the financial institutions with whom we transact business could expose Honeywell to financial loss. Sales and purchases... -

Page 19

...debt and equity markets. A change in the level of U.S. Government defense and space funding or the mix of programs to which such funding is allocated could adversely impact Aerospace's defense and space sales and results of operations. Sales of our defense and space-related products and services are... -

Page 20

... the conduct of our business, including matters relating to commercial transactions, government contracts, product liability (including asbestos), prior acquisitions and divestitures, employment, employee benefits plans, intellectual property, import and export matters and environmental, health and... -

Page 21

... related to pension funding obligations. For a discussion regarding the significant assumptions used to estimate pension expense, including discount rate and the expected long-term rate of return on plan assets, and how our financial statements can be affected by pension plan accounting policies... -

Page 22

...(leased) Pune, India (leased) Chihuahua, Mexico Juarez, Mexico (partially leased) Tijuana, Mexico (leased) Emmen, Netherlands Newhouse, Scotland Colonial Heights, VA Hopewell, VA Spokane, WA Seelze, Germany Mobile, AL Des Plaines, IL Metropolis, IL Baton Rouge, LA Geismar, LA Shanghai, China Glinde... -

Page 23

...are subject to a number of lawsuits, investigations and claims (some of which involve substantial amounts) arising out of the conduct of our business. See a discussion of environmental, asbestos and other litigation matters in Note 21 of Notes to Financial Statements. Environmental Matters Involving... -

Page 24

... Environmental and Combustion Controls from September 2002 to February 2008. Senior Vice President and Chief Financial Officer since June 2003. Senior Vice President Engineering and Operations since April 2010 and President Honeywell Technology Solutions since January 2009. Vice President Honeywell... -

Page 25

... our savings plans. The amount and timing of future repurchases may vary depending on market conditions and the level of operating, financing and other investing activities. The following table summarizes Honeywell's purchase of its common stock, par value $1 per share, for the three months ended... -

Page 26

... conducted by Honeywell. The annual changes for the five-year period shown in the graph are based on the assumption that $100 had been invested in Honeywell stock and each index on December 31, 2006 and that all dividends were reinvested. Dec 2006 Dec 2007 Dec 2008 Dec 2009 Dec 2010 Dec 2011... -

Page 27

...Financial Statements and related Notes included elsewhere in this Annual Report as well as the section of this Annual Report titled Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. Item 6. Selected Financial Data Years Ended December 31, 2011 2010 2009... -

Page 28

... Foreign Exchange 2011 Versus 2010 6% 2% 3% 2% 13% 2010 Versus 2009 5% 2% 1% 0% 8% A discussion of net sales by segment can be found in the Review of Business Segments section of this MD&A. Cost of Products and Services Sold 2011 2010 2009 Cost of products and services sold % change compared... -

Page 29

...automotive on-board sensors products business within our Automation and Control Solutions segment and the reduction of approximately $12 million of acquisition related costs compared to 2010 included within "Other, net". Other income increased by $43 million in 2010 compared to 2009 primarily due to... -

Page 30

... our Automation and Control Solutions segment in 2009, included within "Gain on sale of non-strategic businesses and assets", and $22 million of acquisition related costs in 2010, included within "Other, net". Interest and Other Financial Charges 2011 2010 2009 Interest and other financial charges... -

Page 31

...emerging regions) and industry conditions on demand in our key end markets; Overall sales mix, in particular the mix of Aerospace original equipment and aftermarket sales and the mix of Automation and Control Solutions (ACS) products, distribution and services sales; The extent to which cost savings... -

Page 32

... to return value to shareholders; Maintaining a flexible cost structure to ensure our ability to proactively respond to trends in short-cycle end markets such as the Transportation Systems Turbo business, ACS Energy, Safety & Security businesses, Aerospace commercial after-market and Performance... -

Page 33

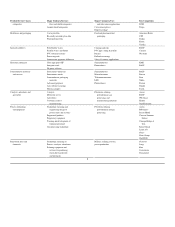

Review of Business Segments 2011 2010 2009 Net Sales Aerospace Product Service Total Automation and Control Solutions Product Service Total Performance Materials and Technologies Product Service Total Transportation Systems Product Service Total Corporate Product Service Total Segment Profit ... -

Page 34

... operations before taxes are as follows: 2011 Years Ended December 31, 2010 2009 Segment Profit Other income/ (expense)(1) Interest and other financial charges Stock compensation expense(2) Pension expense-ongoing(2) Pension mark-to-market adjustment(2) Other postretirement income/(expense... -

Page 35

...% Change 2011 2010 Versus Versus 2010 2009 Aerospace Sales Commercial: Air transport and regional Original equipment Aftermarket Business and general aviation Original equipment Aftermarket Defense and Space Sales Total Aerospace Sales Automation and Control Solutions Sales Energy Safety & Security... -

Page 36

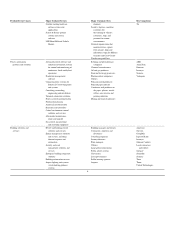

... % of Aerospace Sales Customer End-Markets 2011 2010 2009 % Change in Sales 2011 Versus 2010 2010 Versus 2009 Commercial: Air transport and regional Original equipment Aftermarket Business and general aviation Original equipment Aftermarket Defense and Space Total 2011 compared with 2010 13% 25... -

Page 37

...customers, consistent with higher production rates, platform mix and a higher win rate on selectables (components selected by purchasers of new aircraft). Air transport and regional aftermarket sales increased by 16 percent for 2011 primarily due to (i) increased maintenance activity and spare parts... -

Page 38

... ACS products and services include controls for heating, cooling, indoor air quality, ventilation, humidification, lighting and home automation; advanced software applications for home/building control and optimization; sensors, switches, control systems and instruments for measuring pressure, air... -

Page 39

Automation and Control Solutions 2011 2010 Change 2009 Change Net sales Cost of products and services sold Selling, general and administrative expenses Other Segment profit $ 15,535 $ 10,448 2,819 185 2,083 $ 13,749 9,312 2,480 187 1,770 2011 vs. 2010 13% $ 12,611 8,561 2,256 206 1,588 2010 ... -

Page 40

... in our Energy, Safety & Security businesses increased by 14 percent in 2010 primarily reflecting higher sales volumes in our businesses tied to industrial production (environmental and combustion controls, sensing and control, gas detection, personal protective equipment and scanning and mobility... -

Page 41

... demand; Global demand for caprolactam and ammonium sulfate; and Demand for new products including renewable energy and biofuels. Performance Materials and Technologies 2011 2010 Change 2009 Change Net sales Cost of products and services sold Selling, general and administrative expenses Other... -

Page 42

... efficiency, the environment and security, as well as position the portfolio for higher value; Commercializing new products and technologies in the petrochemical, gas processing and refining industries and renewable energy sector; Investing to increase plant capacity and reliability and improving... -

Page 43

... to obtain financing for new vehicle purchases; and Impact of factors such as consumer confidence on automotive aftermarket demand. Transportation systems 2011 2010 Change 2009 Change Net sales Cost of products and services sold Selling, general and administrative expenses Other Segment profit... -

Page 44

... sales to both light vehicle and commercial vehicle engine manufacturers partially offset by the negative impacts of foreign exchange. Transportation Systems segment profit increased by $292 million in 2010 compared with 2009 predominantly due to the positive impact from increased sales volume. Cost... -

Page 45

... committed credit lines, short-term debt from the commercial paper market, long-term borrowings, and access to the public debt and equity markets, as well as the ability to sell trade accounts receivables. We continue to balance our cash and financing uses through investment in our existing core... -

Page 46

... the Consumer Products Group business and the automotive on-board sensor products business within our Automation and Control Solutions segment), a decrease in cash paid for acquisitions of $330 million, and a net $315 million decrease in investments of short-term marketable securities. Cash used for... -

Page 47

... statement filed with the Securities and Exchange Commission under which we may issue additional debt securities, common stock and preferred stock that may be offered in one or more offerings on terms to be determined at the time of the offering. Net proceeds of any offering would be used... -

Page 48

... future option exercises, restricted unit vesting and matching contributions under our savings plans (see Part II, Item 5 for share repurchases in the fourth quarter of 2011). In July 2011, the Company sold its Consumer Products Group business (CPG) to Rank Group Limited. The sale was completed for... -

Page 49

... 21 to the financial statements for additional information. These amounts represent our insurance recoveries that are deemed probable for asbestos related liabilities as of December 31, 2011. The timing of insurance recoveries are impacted by the terms of insurance settlement agreements, as well as... -

Page 50

... actions related to pension funding obligations. Payments due under our OPEB plans are not required to be funded in advance, but are paid as medical costs are incurred by covered retiree populations, and are principally dependent upon the future cost of retiree medical benefits under our plans... -

Page 51

... contingencies, including those related to environmental matters and toxic tort litigation. Financial Instruments As a result of our global operating and financing activities, we are exposed to market risks from changes in interest and foreign currency exchange rates and commodity prices, which may... -

Page 52

... 31, 2011 Interest Rate Sensitive Instruments Long-term debt (including current maturities) Interest rate swap agreements Foreign Exchange Rate Sensitive Instruments Foreign currency exchange contracts(2) Commodity Price Sensitive Instruments Forward commodity contracts(3) December 31, 2010 Interest... -

Page 53

... conduct of our global business operations or those of previously owned entities, including matters relating to commercial transactions, government contracts, product liability (including asbestos), prior acquisitions and divestitures, employee benefit plans, intellectual property, and environmental... -

Page 54

... to change each year. Further information on all our major actuarial assumptions is included in Note 22 to the financial statements. The key assumptions used in developing our 2011, 2010 and 2009 net periodic pension expense for our U.S. plans included the following: 2011 2010 2009 Discount rate... -

Page 55

...to our U.S. pension plans in 2011, 2010 and 2009, respectively, primarily to improve the funded status of our plans which has been adversely impacted by relatively low discount rates and asset losses in 2011 and 2008 resulting from the poor performance of the equity markets. In 2012, we plan to make... -

Page 56

...a discounted cash flow approach utilizing cash flow forecasts in our five year strategic and annual operating plans adjusted for terminal value assumptions. This impairment test involves the use of accounting estimates and assumptions, changes in which could materially impact our financial condition... -

Page 57

... long-term contracts in our Automation and Control Solutions, Aerospace and Performance Materials and Technologies segments. These long-term contracts are measured on the cost-to-cost basis for engineering-type contracts and the units-of-delivery basis for production-type contracts. Accounting for... -

Page 58

... of recent accounting pronouncements. Item 7A. Quantitative and Qualitative Disclosures About Market Risk Information relating to market risk is included in Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations under the caption "Financial Instruments". 55 -

Page 59

... 8. Financial Statements and Supplementary Data Honeywell International Inc. Consolidated Statement of Operations Years Ended December 31, 2011 2010 2009 (Dollars in millions, except per share amounts) Product sales Service sales Net sales Costs, expenses and other Cost of products sold Cost of... -

Page 60

... sale Total current liabilities Long-term debt Deferred income taxes Postretirement benefit obligations other than pensions Asbestos related liabilities Other liabilities SHAREOWNERS' EQUITY Capital - common stock issued - additional paid-in capital Common stock held in treasury, at cost Accumulated... -

Page 61

... from sales of businesses,net of fees paid Other Net cash used for investing activities Cash flows from financing activities: Net increase/(decrease) in commercial paper Net (decrease)/increase in short-term borrowings Payment of debt assumed with acquisitions Proceeds from issuance of common stock... -

Page 62

... Statement of Shareowners' Equity 2011 Shares $ Years Ended December 31, 2010 2009 Shares $ Shares (in millions) $ 957.6 958 957.6 Common stock, par value Additional paid-in capital Beginning balance 3,977 Issued for employee savings and option plans 14 Contributed to pension plans - Stock... -

Page 63

...have readily determinable fair values are accounted for under the cost method. All intercompany transactions and balances are eliminated in consolidation. The Consumer Products Group (CPG) automotive aftermarket business had historically been part of the Transportation Systems reportable segment. In... -

Page 64

... as services are rendered. Sales under long-term contracts in the Aerospace and Automation and Control Solutions segments are recorded on a percentage-of-completion method measured on the cost-to-cost basis for engineering-type contracts and the units-of-delivery basis for production-type contracts... -

Page 65

..., predominately wheel and braking system hardware and auxiliary power units, for installation on commercial aircraft. These incentives principally consist of free or deeply discounted products, but also include credits for future purchases of product and upfront cash payments. These costs are... -

Page 66

... number of common shares outstanding and all dilutive potential common shares outstanding. Use of Estimates-The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported... -

Page 67

... included in the Automation and Control Solutions segment and were not material to the consolidated financial statements. As of December 31, 2011, the purchase accounting for KSW is subject to final adjustment primarily for the valuation of inventory, property, plant and equipment, useful lives of... -

Page 68

...the Aerospace and Automation and Control Solutions segments and were not material to the consolidated financial statements. As of December 31, 2011, the purchase accounting for EMS is subject to final adjustment primarily for the valuation of inventory and property, plant and equipment, useful lives... -

Page 69

... 2011, 2010 and 2009, assuming these acquisitions had been made at the beginning of the comparable prior year, would not be materially different from consolidated reported results. Divestitures-In July 2011, the Company sold its Consumer Products Group business (CPG) to Rank Group Limited. The sale... -

Page 70

... facility in our Transportation Systems segment, cost savings actions taken in connection with our ongoing functional transformation and productivity initiatives, factory transitions in connection with acquisition-related synergies in our Automation and Control Solutions and Aerospace segments, the... -

Page 71

... and administrative positions mainly in our Automation and Control Solutions, Transportation Systems and Aerospace segments. The workforce reductions were primarily related to the adverse market conditions experienced by many of our businesses, cost savings actions taken in connection with... -

Page 72

... exit and disposal costs related to 2011 and 2010 repositioning actions which we were not able to recognize at the time the actions were initiated. 2011 Repositioning Actions Aerospace Automation and Control Solutions Transportation Systems Total Expected exit and disposal costs Costs incurred year... -

Page 73

...within Investments and long-term receivables on our Balance Sheet will be accounted for under the equity method on a prospective basis. Other, net for 2009 includes an other than-temporary impairment charge of $62 million. See Note 16 Financial Instruments and Fair Value Measures for further details... -

Page 74

... points in 2011 compared with 2010 primarily due to a change in the mix of earnings related to higher U.S. pension expense (primarily driven by an approximate 7.6 percentage point impact which resulted from the increase in pension mark-to-market expense), an increased benefit from manufacturing... -

Page 75

... are as follows: December 31, 2011 2010 Property, plant and equipment basis differences Postretirement benefits other than pensions and post employment benefits Investment and other asset basis differences Other accrued items Net operating and capital losses Tax credits Undistributed earnings of... -

Page 76

... summarizes the activity related to our unrecognized tax benefits: 2011 2010 2009 Change in unrecognized tax benefits: Balance at beginning of year Gross increases related to current period tax positions Gross increases related to prior periods tax positions Gross decreases related to prior periods... -

Page 77

...average market price of the common shares during the period. In 2011, 2010, and 2009 the weighted number of stock options excluded from the computations were 9.5, 14.8, and 34.0 million, respectively. These stock options were outstanding at the end of each of the respective periods. Note 8. Accounts... -

Page 78

... they relate. The following table summarizes long term trade, financing and other receivables by segment, including current portions and allowances for credit losses. December 31, 2011 Aerospace Automation and Control Solutions Performance Materials and Technologies Transportation Systems Corporate... -

Page 79

... the years ended December 31, 2011 and 2010 by segment is as follows: December 31, 2010 Currency Translation Adjustment December 31, 2011 Acquisitions Divestitures Aerospace Automation and Control Solutions Performance Materials and Technologies Transportation Systems $ $ 1,883 7,907 1,291 194... -

Page 80

... 31, 2011 2010 Compensation, benefit and other employee related Customer advances and deferred income Asbestos related liabilities Repositioning Product warranties and performance guarantees Environmental costs Income taxes Accrued interest Other taxes (payroll, sales, VAT etc.) Insurance Other... -

Page 81

... under Employee Retirement Income Security Act. Additionally, each of the banks has the right to terminate its commitment to lend additional funds or issue letters of credit under the agreement if any person or group acquires beneficial ownership of 30 percent or more of our voting stock, or... -

Page 82

... currency exchange rates and commodity prices and restrict the use of derivative financial instruments to hedging activities. We continually monitor the creditworthiness of our customers to which we grant credit terms in the normal course of business. The terms and conditions of our credit sales are... -

Page 83

... available for sale investments in marketable equity securities are level 1 and our remaining financial assets and liabilities are level 2 in the fair value hierarchy. The following table sets forth the Company's financial assets and liabilities that were accounted for at fair value on a recurring... -

Page 84

... 2010, primarily in connection with our repositioning actions (see Note 3 Repositioning and Other Charges). The Company has determined that the fair value measurements of these nonfinancial assets are level 3 in the fair value hierarchy. The Company holds investments in marketable equity securities... -

Page 85

... Cash Flow Hedge Income Statement Location Year Ended December 31, 2011 2010 Foreign currency exchange contracts Product sales Cost of products sold Sales & general administrative $ 29 $ (34) (8) (19) 30 (3) Commodity contracts Cost of products sold $ (2) $ (8) Ineffective portions of... -

Page 86

... 2010 Change in asset retirement obligations: Balance at beginning of year $ 80 Liabilities settled (6) Adjustments (2) Accretion expense 2 Balance at end of year $ 74 Note 18. Capital Stock $ 79 (3) 2 2 $ 80 We are authorized to issue up to 2,000,000,000 shares of common stock, with a par value... -

Page 87

...$ $ December 31, 2011 2010 Cumulative foreign exchange translation adjustment Pensions and other post retirement benefit adjustments Change in fair value of available for sale investments Change in fair value of effective cash flow hedges Note 20. Stock-Based Compensation Plans $ $ 74 $ (1,650... -

Page 88

..., term and other conditions applicable to each option granted under our stock plans are generally determined by the Management Development and Compensation Committee of the Board. The exercise price of stock options is set on the grant date and may not be less than the fair market value per share of... -

Page 89

..., respectively, of this benefit as a financing cash inflow in the Consolidated Statement of Cash Flows, and the balance was classified as cash from operations. At December 31, 2011 there was $119 million of total unrecognized compensation cost related to non-vested stock option awards which is... -

Page 90

... anniversary of continuous Board service. In 2011, each non-employee director received an annual grant to purchase 5,000 shares of common stock at the fair market value on the date of grant. In 2012, the annual equity grant will change from a fixed number of shares to a target value of $75,000 and... -

Page 91

...at a predecessor Honeywell site located in Jersey City, New Jersey, known as Study Area 7, was completed in January 2010. We are also implementing related groundwater remedial actions, and are seeking the appropriate permits from state and federal agencies for related river sediment work approved by... -

Page 92

...produced refractory products (bricks and cement used in high temperature applications). We sold the NARCO business in 1986 and agreed to indemnify NARCO with respect to personal injury claims for products that had been discontinued prior to the sale (as defined in the sale agreement). NARCO retained... -

Page 93

...16) (38) (38) 831 $ 1,003 NARCO and Bendix asbestos related balances are included in the following balance sheet accounts: December 31, 2011 2010 Other current assets Insurance recoveries for asbestos related liabilities Accrued liabilities Asbestos related liabilities $ $ $ $ 71 $ 709 780 $ 237... -

Page 94

... to asbestos containing products, epidemiological studies to estimate the number of people likely to develop asbestos related diseases, NARCO asbestos claims filing history, general asbestos claims filing rates in the tort system and in certain operating asbestos trusts, and the claims experience... -

Page 95

...in October 2009. A related New Jersey action brought by Honeywell has been dismissed, but all coverage claims against plaintiffs have been preserved in the New York action. Based upon (i) our understanding of relevant facts and applicable law, (ii) the terms of insurance policies at issue, (iii) our... -

Page 96

... corresponding to the liability for settlement of pending and future Bendix asbestos claims reflects coverage which is provided by a large number of insurance policies written by dozens of insurance companies in both the domestic insurance market and the London excess market. Based on our 93 -

Page 97

... substantial amounts claimed) arising out of the conduct of our business, including matters relating to commercial transactions, government contracts, product liability, prior acquisitions and divestitures, employee benefit plans, intellectual property, and environmental, health and safety matters... -

Page 98

.... Honeywell v. United Auto Workers ("UAW") et. al-In July 2011, Honeywell filed an action in federal court (District of New Jersey) against the UAW and all former employees who retired under a series of Master Collective Bargaining Agreements ("MCBAs") between Honeywell and the UAW. The Company is... -

Page 99

...2010 2009 Beginning of year Accruals for warranties/guarantees issued during the year Adjustment of pre-existing warranties/guarantees Settlement of warranty/guarantee claims End of year Product warranties and product performance guarantees are included in the following balance sheet accounts: 2011... -

Page 100

... limits our exposure to the impact of future health care cost increases. The retiree medical and life insurance plans are not funded. Claims and expenses are paid from our operating cash flow. In 2011, in connection with new collective bargaining agreements reached with several of its union groups... -

Page 101

...year Actual return on plan assets Company contributions Divestitures Benefits paid Settlements and curtailments Other Fair value of plan assets at end of year Funded status of plans Amounts recognized in Consolidated Balance Sheet consist of: Prepaid pension benefit cost(1) Accrued pension liability... -

Page 102

... obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Company contributions Benefits paid Fair value of plan assets at end of year Funded status of plans Amounts recognized in Consolidated Balance Sheet consist of: Accrued... -

Page 103

Pension Benefits Net Periodic Benefit Cost 2011 U.S. Plans 2010 2009 2011 Non-U.S. Plans 2010 2009 Service cost Interest cost Expected return on plan assets Amortization of transition obligation Amortization of prior service cost (credit) Recognition of actuarial losses Settlements and curtailments... -

Page 104

... and net periodic benefit cost for our significant benefit plans are presented in the following table. Pension Benefits U.S. Plans Non-U.S. Plans 2011 2010 2009 2011 2010 2009 Actuarial assumptions used to determine benefit obligations as of December 31: Discount rate Expected annual rate of... -

Page 105

... at December 31, 2011 and 2010, respectively. Our asset investment strategy for our U.S. pension plans focuses on maintaining a diversified portfolio using various asset classes in order to achieve our long-term investment objectives on a risk adjusted basis. Our actual invested positions in various... -

Page 106

... Plans December 31, 2010 Level 1 Level 2 Level 3 Common stock/preferred stock: Honeywell common stock U.S. large cap stocks U.S. mid cap stocks U.S. small cap stocks International stocks Real estate investment trusts Fixed income investments: Short term investments Government securities Corporate... -

Page 107

... Plans December 31, 2010 Level 1 Level 2 Level 3 Common stock/preferred stock: U.S. companies Non-U.S. companies Fixed income investments: Short-term investments Government securities Corporate bonds Mortgage/Asset-backed securities Insurance contracts Investments in private funds: Private funds... -

Page 108

... equity futures contracts. The Company enters into futures contracts to gain exposure to certain markets. Common stocks, preferred stocks, real estate investment trusts, and short-term investments are valued at the closing price reported in the active market in which the individual securities... -

Page 109

... in January 2012) to our global defined benefit pension plans principally to improve the funded status of our plans and also to satisfy regulatory funding standards in our non-U.S. plans. Benefit payments, including amounts to be paid from Company assets, and reflecting expected future service, as... -

Page 110

... Energy, Safety & Security (controls for heating, cooling, indoor air quality, ventilation, humidification, lighting and home automation; advanced software applications for home/building control and optimization; sensors, switches, control systems and instruments for measuring pressure, air flow... -

Page 111

2011 Years Ended December 31, 2010 2009 Net Sales Aerospace Product Service Total Automation and Control Solutions Product Service Total Performance Materials and Technologies Product Service Total Transportation Systems Product Service Total Corporate Product Service Total Depreciation and ... -

Page 112

... (2) Amounts included in cost of products and services sold and selling, general and administrative expenses. Note 24. Geographic Areas - Financial Data Net Sales(1) Years Ended December 31, 2010 Long-lived Assets(2) Years Ended December 31, 2010 2011 2009 2011 2009 United States Europe Other... -

Page 113

... amounts capitalized Income taxes paid, net of refunds Non-cash investing and financing activities: Common stock contributed to savings plans Common stock contributed to U.S. pension plans Marketable securities contributed to non-U.S. pension plans Note 26. Unaudited Quarterly Financial Information... -

Page 114

... Market Price per share High 45.27 48.52 44.46 53.72 53.72 Low 36.87 39.03 38.53 43.61 36.87 (1) For the year ended December 31, 2011, Income from discontinued operations includes a $178 million, net of tax gain, resulting from the sale of the CPG business which funded a portion of the 2011... -

Page 115

... opinions on these financial statements, on the financial statement schedule and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those... -

Page 116

... and Financial Disclosure Controls and Procedures Not Applicable Honeywell management, including the Chief Executive Officer and Chief Financial Officer, conducted an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this Annual Report... -

Page 117

... "accounting or related financial management expertise" criteria established by the NYSE. All members of the Audit Committee are "independent" as that term is defined in applicable SEC Rules and NYSE listing standards. Honeywell's Code of Business Conduct is available, free of charge, on our website... -

Page 118

... process used by the Company (whereas the value of shares required to meet employee statutory minimum tax withholding requirements are not issued). 1,266,309 growth plan units were issued for the performance cycle commencing on January 1, 2010 and ending December 31, 2011 pursuant to the 2006 Stock... -

Page 119

... sub-plans of the Honeywell Global Stock Plan, the Honeywell International Technologies Employees Share Ownership Plan (Ireland) and the Honeywell Measurex (Ireland) Limited Group Employee Profit Sharing Scheme, allow eligible Irish employees to contribute specified percentages of base pay, bonus or... -

Page 120

... price for notional shares allocated to employees under Honeywell's equity compensation plans not approved by shareowners because all of these shares are notionally allocated as a matching contribution under the non-tax qualified savings plans or as a notional investment of deferred bonuses or fees... -

Page 121

... of Cash Flows for the years ended December 31, 2011, 2010 and 2009 Consolidated Statement of Shareowners' Equity for the years ended December 31, 2011, 2010 and 2009 Notes to Financial Statements Report of Independent Registered Public Accounting Firm Page Number in Form 10-K 56 57 58 59 60 112... -

Page 122

...: February 17, 2012 By: /s/ Kathleen A. Winters Kathleen A. Winters Vice President and Controller (on behalf of the Registrant and as the Registrant's Principal Accounting Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this annual report has been signed below by the... -

Page 123

... and restated (incorporated by reference to Honeywell's Proxy Statement, dated March 10, 2011, filed pursuant to Rule 14a-6 of the Securities and Exchange Act of 1934) Supplemental Non-Qualified Savings Plan for Highly Compensated Employees of Honeywell International Inc. and its Subsidiaries, as... -

Page 124

..., 2009 Honeywell Supplemental Defined Benefit Retirement Plan, as amended and restated (incorporated by reference to Exhibit 10.13 to Honeywell's Form 10-K for the year ended December 31, 2008), and amended by Exhibit 10.13 to Honeywell's Form 10-K for the year ended December 31, 2009 Letter between... -

Page 125

...December 31, 2008) 2007 Honeywell Global Employee Stock Plan (incorporated by reference to Honeywell's Proxy Statement, dated March 12, 2007, filed pursuant to Rule 14a-6 of the Securities and Exchange Act of 1934) Letter Agreement dated July 20, 2007 between Honeywell and Roger Fradin (incorporated... -

Page 126

... Citigroup Global Markets Inc. and J.P. Morgan Securities LLC, as joint lead arrangers and co- book managers (incorporated by reference to Exhibit 10.1 to Honeywell's 8-K filed April 4, 2011) Purchase and Sale Agreement between Catalysts, Adsorbents and Process Systems, Inc., and Honeywell Specialty... -

Page 127

...quarter ended June 30, 2010) Stock and Asset Purchase Agreement dated January 27, 2011 by and among Honeywell International Inc., Rank Group Limited and Autoparts Holdings Limited, (incorporated by reference to Exhibit 10.1 to Honeywell's Form 8-K filed January 31, 2011) Statement re: Computation of... -

Page 128

...December 31, 2011 (Dollars in millions) Allowance for Doubtful Accounts: Balance December 31, 2008 Provision charged to income Deductions from reserves Acquisitions Balance December 31, 2009 Provision charged to income Deductions from reserves Acquisitions Balance December 31, 2010 Provision charged... -

Page 129

Exhibit 10.27 AMENDMENT TO THE 2006 STOCK PLAN FOR NON-EMPLOYEE DIRECTORS OF HONEYWELL INTERNATIONAL INC. Pursuant to the authority granted to proper officers of Honeywell International Inc. (the "Company") by the Management Development and Compensation Committee of the Board of Directors on ... -

Page 130

... Change in Control. The Participant may defer receipt of payment of such Restricted Units on substantially the same terms and conditions as officers of the Company with respect to grants of restricted units they receive. Annual Grants of Stock Options and Restricted Units. Subject to any limitations... -

Page 131

... Company has granted you an Option to purchase _____ Shares of Common Stock, subject to the provisions of this Agreement and the 2011 Stock Incentive Plan for Employees of Honeywell International Inc. and its Affiliates (the "Plan"). This Option is a nonqualified Option. Exercise Price. The purchase... -

Page 132

...not limited to income taxes, capital gain taxes, transfer taxes, and social security contributions, and National Insurance Contributions, that are required by law to be withheld with respect to the grant of the Option, any exercise of the your rights under this Agreement, the sale of Shares acquired... -

Page 133

... Honeywell, your nonsolicitation of Honeywell's employees, customers, suppliers, business partners and vendors, and/or your conduct with respect to Honeywell's trade secrets and proprietary and confidential information. For purposes of this Section 11, the term "Honeywell" is defined as Honeywell... -

Page 134

..., by means of an automated data file, certain personal information about you, including, but not limited to, name, home address and telephone number, date of birth, social insurance number, salary, nationality, job title, any shares or directorships held in the Company, details of all options or... -

Page 135

...The benefits and rights provided under the Plan are not to be considered part of your salary or compensation under your employment with your local employer for purposes of calculating any severance, resignation, redundancy or other end of service payments, vacation, bonuses, long-term service awards... -

Page 136

... in this Agreement or the Plan gives you any right to continue in the employ of the Company or any of its Affiliates or to interfere in any way with the right of the Company or any Affiliate to terminate your employment at any time. Payment of Shares is not secured by a trust, insurance contract or... -

Page 137

...be deemed to consent to the application of the terms and conditions set forth in this Agreement and the Plan. If you do not wish to accept this Award, you must contact Honeywell International Inc., Executive Compensation/AB-1D, 101 Columbia Road, Morristown, New Jersey 07962 in writing within thirty... -

Page 138

... hereinafter referred to as the "Company") and [EMPLOYEE NAME] (the "Employee"). 1. 2. Grant of Awards. The Company has granted to you [NUMBER] Growth Plan Units, subject to the terms of this Agreement and the terms of the 2011 Stock Incentive Plan of Honeywell International Inc. and Its Affiliates... -

Page 139

... your Local Currency using the rate in effect for compensation planning at the beginning of the Performance Cycle. If your Actual Award is paid in Shares, the number of Shares shall be determined by dividing the Actual Award by the Fair Market Value (as defined in the Plan) of the Shares as of the... -

Page 140

... Honeywell, your nonsolicitation of Honeywell's employees, customers, suppliers, business partners and vendors, and/or your conduct with respect to Honeywell's trade secrets and proprietary and confidential information. For purposes of this Section 11, the term "Honeywell" is defined as Honeywell... -

Page 141

..., Company policy or the requirements of an exchange on which the Shares are listed for trading, to recoup compensation paid to you pursuant to the Plan, and you agree to comply with any Company request or demand for recoupment. 12.Withholdings. The Company or your local employer shall have the power... -

Page 142

...of an automated data file, certain personal information about you, including, but not limited to, name, home address and telephone number, date of birth, social insurance number, salary, nationality, job title, any shares or directorships held in the Company, details of all restricted units or other... -

Page 143

... be considered part of your salary or compensation under your employment with your local employer for purposes of calculating any severance, resignation, redundancy or other end of service payments, vacation, bonuses, long-term service awards, indemnification, pension or retirement benefits, or any... -

Page 144

...be deemed to consent to the application of the terms and conditions set forth in this Agreement and the Plan. If you do not wish to accept this Award, you must contact Honeywell International Inc., Executive Compensation/AB-1D, 101 Columbia Road, Morristown, New Jersey 07962 in writing within thirty... -

Page 145

EXHIBIT 12 HONEYWELL INTERNATIONAL INC. STATEMENT RE: COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES (Dollars in millions) 2011 2010 2009 2008 2007 Determination of Earnings: Income before taxes Add (Deduct): Amortization of capitalized interest Fixed charges Equity income, net of distributions... -

Page 146

... Honeywell Limited Honeywell Limitee Honeywell Luxembourg Holding S.a.r.l. Honeywell Pte. Ltd. Honeywell Specialty Chemicals Seelze GmbH Honeywell spol. sr.o. Honeywell Technologies Sarl Honeywell Technology Solutions Inc. Honeywell Technology Solutions Lab Pvt. Ltd. Honeywell UK Limited Life Safety... -

Page 147

...) and Form S-4 (No. 333-82049) of Honeywell International Inc. of our report dated February 17, 2012 relating to the financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appears in this Form 10 K. /s/ PricewaterhouseCoopers... -

Page 148

... name, place and stead in any and all capacities, (i) (ii) to sign the Company's Annual Report on Form 10-K under the Securities Exchange Act of 1934 for the year ended December 31, 2011, to sign any amendment to the Annual Report referred to in (i) above, and (iii) to file the documents described... -

Page 149

... shares of the Company's Common Stock (or participations where appropriate) to be offered pursuant to the Honeywell Savings and Ownership Plan, the Honeywell Puerto Rico Savings and Ownership Plan, the Honeywell Supplemental Savings Plan, the 1993 Stock Plan for Employees of Honeywell International... -

Page 150

This Power of Attorney may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. /s/ Gordon M. Bethune Gordon M. Bethune, Director /s/ Kevin Burke Kevin Burke, Director /s/ Jaime Chico ... -

Page 151

... of common stock to be offered under the Dividend Reinvestment and Share Purchase Plan of the Company and any successor or new plan for such purposes; (ii) shares of the Company's preferred stock, without par value; (iii) debt securities of the Company, with such terms as may be from time to time... -

Page 152

This Power of Attorney may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. /s/ Gordon M. Bethune Gordon M. Bethune, Director /s/ Kevin Burke Kevin Burke, Director /s/ Jaime Chico ... -

Page 153

...name, place and stead in any and all capacities, (i) (ii) (iii) to sign the Company's Annual Report on Form 10-K under the Securities Exchange Act of 1934 for the year ended December 31, 2011, to sign any amendment to the Annual Report referred to in (i) above, and to file the documents described in... -

Page 154

... shares of the Company's Common Stock (or participations where appropriate) to be offered pursuant to the Honeywell Savings and Ownership Plan, the Honeywell Puerto Rico Savings and Ownership Plan, the Honeywell Supplemental Savings Plan, the 1993 Stock Plan for Employees of Honeywell International... -

Page 155

... of common stock to be offered under the Dividend Reinvestment and Share Purchase Plan of the Company and any successor or new plan for such purposes; (ii) shares of the Company's preferred stock, without par value; (iii) debt securities of the Company, with such terms as may be from time to time... -

Page 156

... and report financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ David M. Cote David M. Cote Chief Executive Officer Date: February 17, 2012 -

Page 157

... report financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ David J. Anderson David J. Anderson Chief Financial Officer Date: February 17, 2012 -

Page 158

... ACT OF 2002 In connection with the Annual Report of Honeywell International Inc. (the Company) on Form 10-K for the period ending December 31, 2011 as filed with the Securities and Exchange Commission on the date hereof (the Report), I, David M. Cote, Chief Executive Officer of the Company, certify... -

Page 159

... OF 2002 In connection with the Annual Report of Honeywell International Inc. (the Company) on Form 10-K for the period ending December 31, 2011 as filed with the Securities and Exchange Commission on the date hereof (the Report), I, David J. Anderson, Chief Financial Officer of the Company, certify...