Hertz 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

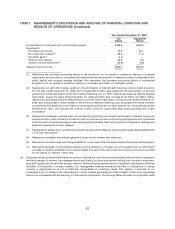

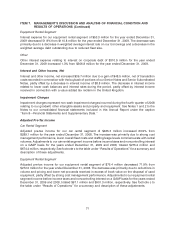

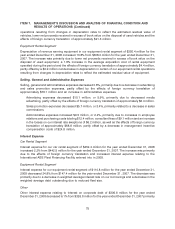

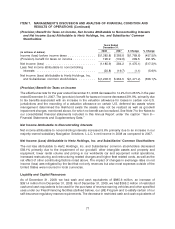

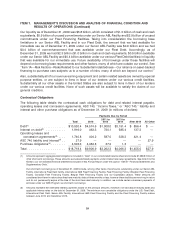

(Provision) Benefit for Taxes on Income, Net Income Attributable to Noncontrolling Interests

and Net Income (Loss) Attributable to Hertz Holdings, Inc. and Subsidiaries’ Common

Stockholders

Years Ended

December 31,

2008 2007 $ Change % Change

(in millions of dollars)

Income (loss) before income taxes ............... $(1,382.8) $ 386.8 $(1,769.6) (457.5)%

(Provision) benefit for taxes on income ............ 196.9 (102.6) 299.5 291.9%

Net income (loss) ........................... (1,185.9) 284.2 (1,470.1) (517.2)%

Less: Net income attributable to noncontrolling

interests ................................ (20.8) (19.7) (1.1) (5.6)%

Net income (loss) attributable to Hertz Holdings, Inc.

and Subsidiaries’ common stockholders ......... $(1,206.7) $ 264.5 $(1,471.2) (556.1)%

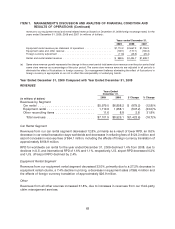

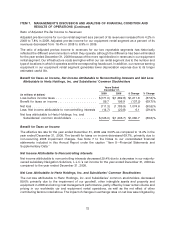

(Provision) Benefit for Taxes on Income

The effective tax rate for the year ended December 31, 2008 decreased to 14.2% from 26.5% in the year

ended December 31, 2007. The (provision) benefit for taxes on income decreased 291.9%, primarily due

to tax benefits associated with an increase in the valuation allowance for losses in certain non-U.S.

jurisdictions and the recording of a valuation allowance on certain U.S. deferred tax assets where

management determined the likelihood exists the assets may not be realized as well as goodwill

impairment charges, mentioned above, for which no benefit can be realized. See Note 7 to the Notes to

our consolidated financial statements included in this Annual Report under the caption ‘‘Item 8—

Financial Statements and Supplementary Data.’’

Net Income Attributable to Noncontrolling Interests

Net income attributable to noncontrolling interests increased 5.6% primarily due to an increase in our

majority-owned subsidiary Navigation Solutions, L.L.C.’s net income in 2008 as compared to 2007.

Net Income (Loss) Attributable to Hertz Holdings, Inc. and Subsidiaries’ Common Stockholders

The net loss attributable to Hertz Holdings, Inc. and Subsidiaries’ common stockholders decreased

556.1% primarily due to the impairment of our goodwill, other intangible assets and property and

equipment, lower rental volume and pricing in our worldwide car and equipment rental operations,

increased restructuring and restructuring related charges and higher fleet related costs, as well as the

net effect of other contributing factors noted above. The impact of changes in exchange rates on net

income (loss) was mitigated by the fact that not only revenues but also most expenses outside of the

United States were incurred in local currencies.

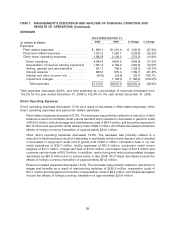

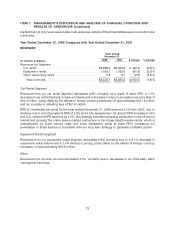

Liquidity and Capital Resources

As of December 31, 2009, we had cash and cash equivalents of $985.6 million, an increase of

$391.4 million from December 31, 2008. As of December 31, 2009, we had $365.2 million of restricted

cash and cash equivalents to be used for the purchase of revenue earning vehicles and other specified

uses under our Fleet Financing facilities (defined below), our LKE Program and to satisfy certain of our

self-insurance regulatory reserve requirements. The decrease in restricted cash and cash equivalents of

77