Hertz 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

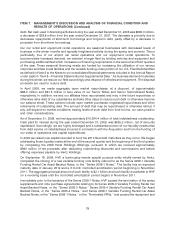

addition, if an amortization event continues for 30 days or longer, the noteholders of the affected series of

notes would have the right to require liquidation of a portion of the fleet sufficient to repay such notes,

provided that the exercise of the right was exercised by a majority of the affected noteholders.

Since MBIA and Ambac are facing financial instability, have been downgraded one or more times and

are on review for further credit downgrade or under developing outlook by one or more credit agencies,

we did not have the Series 2009-1 Notes or the Series 2009-2 Notes guaranteed. Accordingly, if a

bankruptcy of MBIA or Ambac were to occur prior to the 2005 Notes maturing, we expect that we would

use our corporate liquidity and the borrowings under or proceeds from the Series 2009-1 Notes and the

Series 2009-2 Notes to pay down the amounts owed under the affected series of 2005 Notes.

Financing

We have a significant amount of indebtedness. For information on our indebtedness, see Note 3 to the

Notes to our consolidated financial statements included in this Annual Report under the caption

‘‘Item 8—Financial Statements and Supplementary Data.’’

Covenants

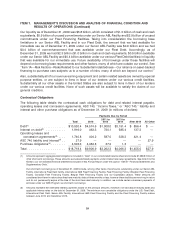

Certain of our debt instruments and credit facilities contain a number of covenants that, among other

things, limit or restrict the ability of the borrowers and the guarantors to dispose of assets, incur

additional indebtedness, incur guarantee obligations, prepay other indebtedness, make dividends and

other restricted payments, create liens, make investments, make acquisitions, engage in mergers,

change the nature of their business, make capital expenditures, or engage in certain transactions with

affiliates. The agreements governing our corporate indebtedness require us to comply with two key

covenants based on a consolidated leverage ratio and a consolidated interest expense coverage ratio.

Our failure to comply with the obligations contained in any agreements governing our indebtedness

could result in an event of default under the applicable instrument, which could result in the related debt

becoming immediately due and payable and could further result in a cross default or cross acceleration

of our debt issued under other instruments. However, as a result of the above-mentioned actions and

planned future actions, we believe that we will remain in compliance with our corporate debt covenants

and that cash generated from operations, together with amounts available under various liquidity

facilities will be adequate to permit us to meet our debt service obligations, ongoing costs of operations,

working capital needs and capital expenditure requirements for the next twelve months. Our future

financial and operating performance, ability to service or refinance our debt and ability to comply with

covenants and restrictions contained in our corporate debt agreements will be subject to future

economic conditions and to financial, business and other factors, many of which are beyond our control.

As of December 31, 2009, we were in compliance with all of these financial covenants.

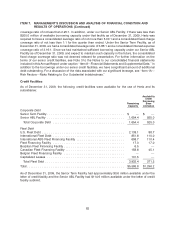

As of December 31, 2009, we had an aggregate principal amount outstanding of $1,358.6 million

pursuant to our Senior Term Facility and no amounts outstanding in our Senior ABL Facility. Under our

Senior Credit Facilities, we are required to maintain a specified minimum level of borrowing capacity

under our Senior ABL Facility, if we fail to meet these requirements, we will then be subject to financial

covenants under that facility, including covenants that will obligate us to maintain a specified debt to

Corporate EBITDA leverage ratio and a specified Corporate EBITDA to fixed charges coverage ratio. The

financial covenants in our Senior Term Facility include obligations to maintain a specified debt to

Corporate EBITDA leverage ratio and a specified Corporate EBITDA to interest expense coverage ratio

for specified periods. As of December 31, 2009, Hertz was required under the Senior Term Facility to

have a consolidated leverage ratio of not more than 5.00:1 and a consolidated interest expense

82