Hertz 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

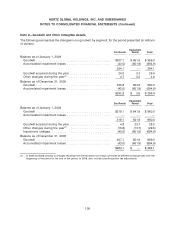

The aggregate amounts of maturities of debt for each of the twelve-month periods ending December 31

(in millions of dollars) are as follows: 2010, $4,574.6 (including $1,598.9 of other short-term borrowings);

2011, $122.4; 2012, $1,785.6; 2013, $250.8; 2014, $2,900.6; after 2014, $896.4.

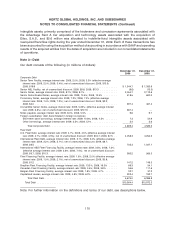

Our short-term borrowings as of December 31, 2009 include, among other items, the amounts

outstanding under our International Fleet Debt facility, International ABS Fleet Financing Facility, Fleet

Financing Facility, Brazilian Fleet Financing Facility, Canadian Fleet Financing Facility, Belgian Fleet

Financing Facility and Capitalized Leases. These amounts are considered short-term in nature since

they have maturity dates of three months or less; however these facilities are revolving in nature and do

not expire at the time of the short-term debt maturity. In addition, we include certain scheduled payments

of principal under our ABS Program as short-term borrowings.

As of December 31, 2009, there were outstanding standby letters of credit totaling $586.3 million. Of this

amount, $300.0 million has been issued for the benefit of the ABS Program ($200.0 million of which was

issued by Ford Motor Company, or ‘‘Ford,’’ and $100.0 million of which was used under the Senior Credit

Facilities) and the remainder is primarily to support self-insurance programs (including insurance

policies with respect to which we have indemnified the policy issuers for any losses) in the United States,

Canada and Europe and to support airport concession obligations in the United States and Canada. As

of December 31, 2009, none of these letters of credit have been drawn upon. In November 2010 the

‘‘Ford’’ letter of credit will expire in conjunction with the maturity of the 2005 Series Notes.

Senior Credit Facilities

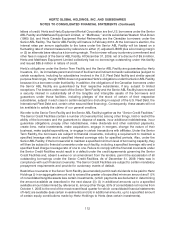

Senior Term Facility: In connection with the Acquisition, Hertz entered into a credit agreement, dated

December 21, 2005, with respect to its Senior Term Facility with Deutsche Bank AG, New York Branch as

administrative agent and collateral agent, Lehman Commercial Paper Inc. as syndication agent, Merrill

Lynch & Co., Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated as documentation agent, and the

other financial institutions party thereto from time to time. The facility consisted of a $1,400.0 million

secured term loan facility providing for loans denominated in U.S. dollars. In addition, there is a

pre-funded synthetic letter of credit facility in an aggregate principal amount of $250.0 million. The term

loan facility and the synthetic letter of credit facility will mature in December 2012. The term loan

amortizes in nominal quarterly installments (not exceeding one percent of the aggregate principal

amount thereof per annum) until the maturity date. At the borrower’s election, the interest rates per

annum applicable to the loans under the Senior Term Facility are based on a fluctuating rate of interest

measured by reference to either (1) an adjusted London inter-bank offered rate, or ‘‘LIBOR,’’ plus a

borrowing margin or (2) an alternate base rate plus a borrowing margin. In addition, the borrower pays

letter of credit participation fees on the full amount of the synthetic letter of credit facility plus fronting fees

for the letter of credit issuing banks and other customary fees in respect of the Senior Term Facility. As of

December 31, 2009, we had $1,344.7 million in borrowings outstanding under this facility, which is net of

a discount of $13.9 million and had issued $249.4 million in letters of credit.

Senior ABL Facility: Hertz, Hertz Equipment Rental Corporation and certain other subsidiaries of Hertz

entered into a credit agreement, dated December 21, 2005, with respect to the Senior ABL Facility with

Deutsche Bank AG, New York Branch as administrative agent, Lehman Commercial Paper Inc. as

syndication agent, Merrill Lynch & Co., Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated as

documentation agent and the financial institutions party thereto from time to time. This facility provided

(subject to availability under a borrowing base) for aggregate maximum borrowings of $1,800.0 million

under a revolving loan facility providing for loans denominated in U.S. dollars, Canadian dollars, Euros

and Pound Sterling. Up to $200.0 million of the revolving loan facility is available for the issuance of

111