Hertz 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

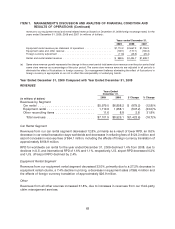

Equipment Rental Segment

Interest expense for our equipment rental segment of $53.3 million for the year ended December 31,

2009 decreased 51.9% from $110.8 million for the year ended December 31, 2008. The decrease was

primarily due to a decrease in weighted average interest rate on our borrowings and a decrease in the

weighted average debt outstanding due to reduced fleet size.

Other

Other interest expense relating to interest on corporate debt of $310.9 million for the year ended

December 31, 2009 increased 1.3% from $306.8 million for the year ended December 31, 2008.

Interest and Other Income, Net

Interest and other income, net increased $39.7 million due to a gain of $48.5 million, net of transaction

costs recorded in connection with the buyback of portions of our Senior Notes and Senior Subordinated

Notes, partly offset by a decrease in interest income of $8.8 million. The decrease in interest income

related to lower cash balances and interest rates during the period, partly offset by interest income

received in connection with a value added tax reclaim in the United Kingdom.

Impairment Charges

Impairment charges represent non-cash impairment charges incurred during the fourth quarter of 2008

relating to our goodwill, other intangible assets and property and equipment. See Notes 1 and 2 to the

Notes to our consolidated financial statements included in this Annual Report under the caption

‘‘Item 8—Financial Statements and Supplementary Data.’’

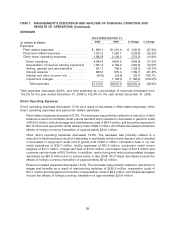

Adjusted Pre-Tax Income

Car Rental Segment

Adjusted pre-tax income for our car rental segment of $465.3 million increased 60.9% from

$289.1 million for the year ended December 31, 2008. The increase was primarily due to strong cost

management performance, lower overall fleet costs and staffing/wage levels commensurate with rental

volumes. Adjustments to our car rental segment income before income taxes and noncontrolling interest

on a GAAP basis for the years ended December 31, 2009 and 2008, totaled $275.2 million and

$674.4 million, respectively. See footnote c to the table under ‘‘Results of Operations’’ for a summary and

description of these adjustments.

Equipment Rental Segment

Adjusted pre-tax income for our equipment rental segment of $76.4 million decreased 71.9% from

$272.0 million for the year ended December 31, 2008. The decrease was primarily due to reductions in

volume and pricing and lower net proceeds received in excess of book value on the disposal of used

equipment, partly offset by strong cost management performance. Adjustments to our equipment rental

segment income before income taxes and noncontrolling interest on a GAAP basis for the years ended

December 31, 2009 and 2008, totaled $97.1 million and $901.3 million, respectively. See footnote c to

the table under ‘‘Results of Operations’’ for a summary and description of these adjustments.

71