Hertz 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Belgian Fleet Financing Facility

On June 21, 2007, our Belgian subsidiary, Hertz Belgium BVBA, entered into a secured revolving credit

facility with varying facility limits of up to e27.4 million (or $39.4 million) maturing in December 2010. The

new facility refinanced the Belgian portion of the International Fleet Debt facilities. This facility is

guaranteed by HIL and the fleet assets used in the Belgian operations are pledged as collateral for this

debt. Interest is charged at a spread over the EURIBOR. This facility contains a number of covenants

typical for this type of facility, including restrictions on additional indebtedness, creation of liens,

engaging in mergers and change of business. As of December 31, 2009, the foreign currency equivalent

of $33.7 million in borrowings were outstanding under this facility.

Capitalized Leases

Capitalized Leases includes capitalized lease financings outstanding in the United Kingdom (the ‘‘U.K.

Leveraged Financing’’), Australia and Netherlands. The U.K. Leveraged Financing which is the largest

portion of the Capitalized Leases consists of an agreement for a sale and leaseback facility entered into

with a financial institution in the United Kingdom, or the ‘‘U.K.,’’ by our subsidiary in the U.K., Hertz (U.K.)

Limited on December 21, 2007, under which we may sell and lease back fleet up to the value of

£165.0 million (or $267.5 million). The amount available under this facility increases over the term of the

facility. The facility is scheduled to mature in February 2013. This facility refinanced the U.K. portion of the

International Fleet Debt facilities. This facility contains covenants typical for this type of facility including

restriction on engaging in mergers and change of business, and includes requirements to meet, on a

quarterly basis, certain ratios measuring utilization, interest coverage and net worth. The Australian and

Netherlands subsidiaries conducting the car rental business may, at their option, continue to engage in

capital lease financings relating to revenue earning equipment outside the International Fleet Debt

facilities. As of December 31, 2009, Capitalized Leases have maturities ranging from January 2010 to

March 2012. As of December 31, 2009, the foreign currency equivalent of $222.4 million in capital leases

were outstanding.

Covenants

Certain of our debt instruments and credit facilities contain a number of covenants that, among other

things, limit or restrict the ability of the borrowers and the guarantors to dispose of assets, incur

additional indebtedness, incur guarantee obligations, prepay other indebtedness, make dividends and

other restricted payments, create liens, make investments, make acquisitions, engage in mergers,

change the nature of their business, make capital expenditures, or engage in certain transactions with

affiliates. Some of these agreements also require the maintenance of certain financial covenants. As of

December 31, 2009, we were in compliance with all of these financial covenants.

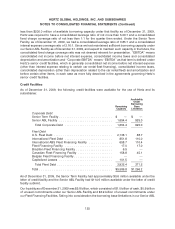

As of December 31, 2009, we had an aggregate principal amount outstanding of $1,358.6 million

pursuant to our Senior Term Facility and no amounts outstanding in our Senior ABL Facility. Under our

Senior Credit Facilities, we are required to maintain a specified minimum level of borrowing capacity

under our Senior ABL Facility, if we fail to meet these requirements, we will then be subject to financial

covenants under that facility, including covenants that will obligate us to maintain a specified debt to

Corporate EBITDA (defined below) leverage ratio and a specified Corporate EBITDA to fixed charges

coverage ratio. The financial covenants in our Senior Term Facility include obligations to maintain a

specified debt to Corporate EBITDA leverage ratio and a specified Corporate EBITDA to interest expense

coverage ratio for specified periods. As of December 31, 2009, Hertz was required under the Senior Term

Facility to have a consolidated leverage ratio of not more than 5.00:1 and a consolidated interest

expense coverage ratio of not less than 2.25:1. In addition, under our Senior ABL Facility, if there was

124