Hertz 2009 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

European car rental businesses incurred charges mainly for facility lease obligations related to

previously announced off-airport location closures that were completed during the quarters. In the first

quarter of 2009, our European car rental business also eliminated certain specialty rental equipment as a

future cost reduction initiative and incurred related lease termination costs. The first and second quarter

2009 restructuring charges included employee termination liabilities covering approximately 500 and

600 employees, respectively.

During the third and fourth quarters of 2009, our equipment rental business incurred charges mainly for

costs related to facility lease obligations for previously closed branches and additional losses on the

disposal of remaining surplus equipment related to these locations. Our European car rental business

incurred employee termination benefits costs associated with the migration of work to the European

shared service center and the creation of two regions within Europe to manage our European country

operations. Additionally, in the third quarter of 2009, our European car rental business recognized a loss

on sale of a building due to reduced office space needs resulting from headcount reductions. The third

and fourth quarter 2009 restructuring charges included employee termination liabilities covering

approximately 300 and 250 employees, respectively.

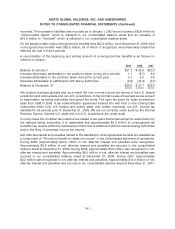

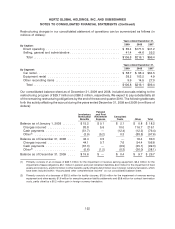

For the year ended December 31, 2009, our consolidated statement of operations includes restructuring

charges relating to the initiatives discussed above of $106.8 million, which is composed of $44.1 million

of termination benefits, $15.6 million in asset impairment charges, $29.8 million in facility closure and

lease obligation costs, $7.6 million in consulting costs, $4.1 million in relocation costs, $1.7 million in

contract termination costs, $0.7 million in pension settlement losses and $3.2 million of other

restructuring charges. The after-tax effect of the restructuring charges reduced diluted earnings per

share by $0.23 for the year ended December 31, 2009.

For the year ended December 31, 2008, our consolidated statement of operations includes restructuring

charges relating to the initiatives discussed above of $216.1 million, which is composed of $83.8 million

of termination benefits, $89.1 million in asset impairment charges, $14.1 million in facility closure and

lease obligation costs, $4.0 million in facility fixed asset and inventory impairment costs, $10.0 million in

consulting costs, $5.6 million in pension settlement losses and $9.5 million of other restructuring

charges. The after-tax effect of the restructuring charges reduced diluted earnings per share by $0.48 for

the year ended December 31, 2008.

For the year ended December 31, 2007, our consolidated statement of operations includes restructuring

charges relating to the initiatives discussed above of $96.4 million, which is composed of $65.2 million of

involuntary termination benefits, $21.7 million in consulting costs, a net gain of $0.4 million related to

pension and post employment benefits and other charges of $9.9 million. The after-tax effect of the

restructuring charges reduced diluted earnings per share by $0.22 for the year ended December 31,

2007.

Additional efficiency and cost saving initiatives are being developed in 2010. However, we presently do

not have firm plans or estimates of any related expenses.

151