Hertz 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

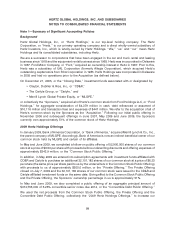

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

for income taxes and related uncertain tax positions, pension costs valuation, useful lives and

impairment of long-lived tangible and intangible assets, valuation of stock-based compensation, public

liability and property damage reserves, reserves for restructuring, allowance for doubtful accounts and

fair value of derivatives.

Reclassifications

Certain prior period amounts have been reclassified to conform with current reporting, including those

relating to noncontrolling interests which conform with the provisions of ASC 810-10, which became

effective for us in January 2009.

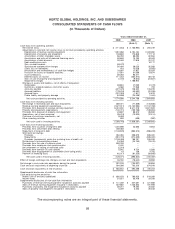

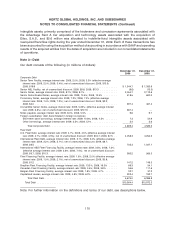

For 2008 and 2007 periods presented in this Report we have revised our consolidated statements of

cash flows to exclude the impact of non-cash purchases and sales of revenue earning equipment and

property and equipment which were included in ‘‘accounts payable’’ or ‘‘receivables’’ at the end of the

period. Cash provided by operating activities for the years ended December 31, 2008 and 2007 was

revised to $2,544.2 million and $2,804.7 million from the $2,095.5 million and $3,089.5 million,

respectively, previously reported, while cash used for investing activities was revised to $1,908.3 million

and $2,058.8 million from the $1,459.6 million and $2,343.6 million, respectively, previously reported.

See Note 17 in our Form 10-Q for the quarterly period ended June 30, 2009 filed with the SEC on

August 7, 2009, or the ‘‘Second Quarter Form 10-Q.’’

Revenue Recognition

Rental and rental-related revenue (including cost reimbursements from customers where we consider

ourselves to be the principal versus an agent) are recognized over the period the revenue earning

equipment is rented based on the terms of the rental or leasing contract. Revenue related to new

equipment sales and consumables is recognized at the time of delivery to, or pick-up by, the customer

and when collectability is reasonably assured. Fees from our licensees are recognized over the period

the underlying licensees’ revenue is earned (over the period the licensees’ revenue earning equipment

is rented).

Sales tax amounts collected from customers have been recorded on a net basis.

Cash and Cash Equivalents and Other

We consider all highly liquid debt instruments purchased with an original maturity of three months or less

to be cash equivalents.

In our Consolidated Statements of Cash Flows, we net cash flows from revolving borrowings in the line

item ‘‘Proceeds (repayments) under the revolving lines of credit, net.’’ The contractual maturities of such

borrowings may exceed 90 days in certain cases.

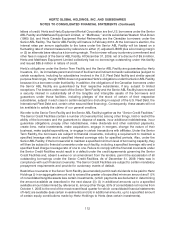

Restricted Cash and Cash Equivalents

Restricted cash and cash equivalents includes cash and cash equivalents that are not readily available

for our normal disbursements. Restricted cash and cash equivalents are restricted for the purchase of

revenue earning vehicles and other specified uses under our Fleet Debt facilities, for our Like-Kind

Exchange Program, or ‘‘LKE Program,’’ and to satisfy certain of our self-insurance regulatory reserve

requirements. As of December 31, 2009 and 2008, the portion of total restricted cash and cash

equivalents that was associated with our Fleet Debt facilities was $295.0 million and $557.2 million,

respectively. The decrease in restricted cash and cash equivalents associated with our fleet debt of

102