Hertz 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

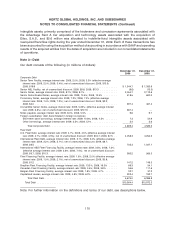

cancellation in full of the Terminated VFNs. The Terminated VFNs had expected final maturity dates

ranging from November 2009 to November 2010 and we had an aggregate of approximately $2.0 billion

of total capacity (prior to borrowing base or other limitations) under the Terminated VFNs. In effect we

replaced the $2.0 billion of total capacity under the Terminated VFNs with the $2.1 billion of capacity that

we have under the Series 2009-1 Notes while extending the expected final maturity date to January 2012.

In October 2009 HVF issued $1.2 billion in aggregate principal amount of new medium term (3 and

5 year) Series 2009-2 rental car asset backed notes, or the ‘‘Series 2009-2 Notes.’’ The 3 year notes carry

a 4.26% coupon (4.30% yield) and the 5 year notes carry a 5.29% coupon (5.35% yield) with expected

final maturities in 2013 and 2015, respectively. The advance rate on the notes is approximately 66%. In

general, we expect to use the Series 2009-2 Notes to replace the Series 2005-1 and 2005-2 Rental Car

Asset Backed Notes, or the ‘‘2005 Notes,’’ as they mature in 2010.

Based on all that we have accomplished in 2009, our current availability under our various credit facilities

and our business plan, we believe we have sufficient liquidity to meet our 2010 debt maturities. We still

need to refinance approximately $1.2 billion of our international fleet debt that matures in December

2010 and we are currently in discussions with banks and lenders to review our refinancing options;

however there can be no assurance that we will be able to refinance this indebtedness on terms

comparable to our recent refinancings, or at all.

The agreements governing our corporate indebtedness require us to comply with two key covenants

based on a consolidated leverage ratio and a consolidated interest expense coverage ratio. Our failure

to comply with the obligations contained in any agreements governing our indebtedness could result in

an event of default under the applicable instrument, which could result in the related debt becoming

immediately due and payable and could further result in a cross default or cross acceleration of our debt

issued under other instruments. However, as a result of the above-mentioned actions and planned future

actions, we believe that we will remain in compliance with our corporate debt covenants and that cash

generated from operations, together with amounts available under various liquidity facilities will be

adequate to permit us to meet our debt service obligations, ongoing costs of operations, working capital

needs and capital expenditure requirements for the next twelve months. Our future financial and

operating performance, ability to service or refinance our debt and ability to comply with covenants and

restrictions contained in our corporate debt agreements will be subject to future economic conditions

and to financial, business and other factors, many of which are beyond our control.

Basis of Presentation

Principles of Consolidation

The consolidated financial statements include the accounts of Hertz Holdings and our wholly-owned

and majority-owned domestic and international subsidiaries. All significant intercompany transactions

have been eliminated.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in

the United States of America, or ‘‘GAAP,’’ requires management to make estimates and assumptions that

affect the amounts reported in the financial statements and footnotes. Actual results could differ

materially from those estimates.

Significant estimates inherent in the preparation of the consolidated financial statements include

depreciation of revenue earning equipment, reserves for litigation and other contingencies, accounting

101