Hertz 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET PRICE OF COMMON STOCK

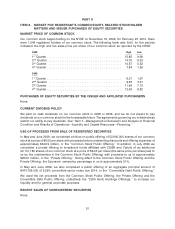

Our common stock began trading on the NYSE on November 16, 2006. On February 23, 2010, there

were 1,549 registered holders of our common stock. The following table sets forth, for the periods

indicated, the high and low sales price per share of our common stock as reported by the NYSE:

2008 High Low

1st Quarter ......................................... 15.85 9.90

2nd Quarter ........................................ 14.70 9.53

3rd Quarter ........................................ 10.57 5.52

4th Quarter ......................................... 7.84 1.55

2009

1st Quarter ......................................... 6.27 1.97

2nd Quarter ........................................ 9.55 3.61

3rd Quarter ........................................ 11.99 7.72

4th Quarter ......................................... 12.55 8.82

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

None.

CURRENT DIVIDEND POLICY

We paid no cash dividends on our common stock in 2008 or 2009, and we do not expect to pay

dividends on our common stock for the foreseeable future. The agreements governing our indebtedness

restrict our ability to pay dividends. See ‘‘Item 7—Management’s Discussion and Analysis of Financial

Condition and Results of Operations—Liquidity and Capital Resources—Financing.’’

USE OF PROCEEDS FROM SALE OF REGISTERED SECURITIES

In May and June 2009, we completed a follow-on public offering of 52,900,000 shares of our common

stock at a price of $6.50 per share with proceeds before underwriting discounts and offering expenses of

approximately $343.9 million, or the ‘‘Common Stock Public Offering.’’ In addition, in July 2009 we

completed a private offering to investment funds affiliated with CD&R and Carlyle of an additional

32,101,182 shares of our common stock at a price of $6.23 per share (the same price per share paid to

us by the underwriters in the Common Stock Public Offering) with proceeds to us of approximately

$200.0 million, or the ‘‘Private Offering.’’ Giving effect to the Common Stock Public Offering and the

Private Offering, the Sponsors’ ownership percentage in us is approximately 51%.

In May and June 2009, we also completed a public offering of an aggregate principal amount of

$474,755,000 of 5.25% convertible senior notes due 2014, or the ‘‘Convertible Debt Public Offering.’’

We used the net proceeds from the Common Stock Public Offering, the Private Offering and the

Convertible Debt Public Offering, collectively the ‘‘2009 Hertz Holdings Offerings,’’ to increase our

liquidity and for general corporate purposes.

RECENT SALES OF UNREGISTERED SECURITIES

None.

51