Hertz 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

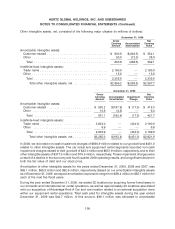

intangible assets, primarily comprised of the tradename and concession agreements associated with

the Advantage Rent A Car acquisition and technology assets associated with the acquisition of

Eileo, S.A.S., and $5.6 million was allocated to indefinite-lived intangible assets associated with

reacquired franchise rights during the year ended December 31, 2009. Each of these transactions has

been accounted for using the acquisition method of accounting in accordance with GAAP and operating

results of the acquired entities from the dates of acquisition are included in our consolidated statements

of operations.

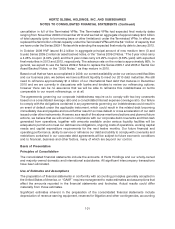

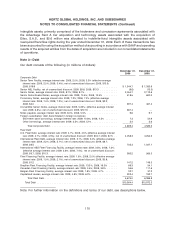

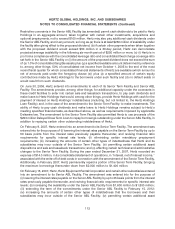

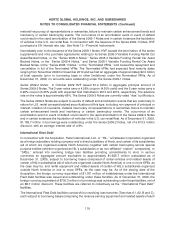

Note 3—Debt

Our debt consists of the following (in millions of dollars):

December 31, December 31,

2009 2008

Corporate Debt

Senior Term Facility, average interest rate: 2009, 2.0%; 2008, 3.3% (effective average

interest rate: 2009, 2.0%; 2008, 3.4%); net of unamortized discount: 2009, $13.9;

2008, $18.6 ................................................ $1,344.7 $ 1,353.6

Senior ABL Facility; net of unamortized discount: 2009, $9.6; 2008, $13.3 .......... (9.6) (13.3)

Senior Notes, average interest rate: 2009, 8.7%; 2008, 8.7% ................... 2,054.7 2,113.6

Senior Subordinated Notes, average interest rate: 2009, 10.5%; 2008, 10.5% ........ 518.5 600.0

Promissory Notes, average interest rate: 2009, 7.3%; 2008, 7.2% (effective average

interest rate: 2009, 7.4%; 2008, 7.3%); net of unamortized discount: 2009, $3.3;

2008, $4.0 ................................................. 391.4 461.4

Convertible Senior Notes, average interest rate: 2009, 5.25%; (effective average interest

rate: 2009, 6.8%); net of unamortized discount: 2009, $107.3 ................. 367.4 —

Notes payable, average interest rate: 2009, 8.0%; 2008, 5.5% .................. 9.6 9.7

Foreign subsidiaries’ debt denominated in foreign currencies:

Short-term bank borrowings, average interest rate: 2009, 10.8%; 2008, 4.5% ....... 7.3 54.9

Other borrowings, average interest rate: 2009, 2.5%; 2008, 5.1% ............... 5.4 5.6

Total Corporate Debt ........................................ 4,689.4 4,585.5

Fleet Debt

U.S. Fleet Debt, average interest rate: 2009, 4.7%; 2008, 4.3% (effective average interest

rate: 2009, 4.7%; 2008, 4.3%); net of unamortized discount: 2009, $16.7; 2008, $7.5 . . 4,058.3 4,254.5

International Fleet Debt, average interest rate: 2009, 2.1%; 2008, 5.0% (effective average

interest rate: 2009, 2.2%; 2008, 5.1%); net of unamortized discount: 2009, $8.7;

2008, $6.5 ................................................. 705.3 1,027.1

International ABS Fleet Financing Facility, average interest rate: 2009, 3.6%; 2008, 7.2%;

(effective average interest rate: 2009, 3.6%; 2008, 7.4%); net of unamortized discount:

2009, $5.7; 2008, $10.3 ......................................... 383.2 565.3

Fleet Financing Facility, average interest rate: 2009, 1.5%; 2008, 2.0% (effective average

interest rate: 2009, 1.5%; 2008, 2.1%); net of unamortized discount: 2009, $0.8;

2008, $1.2 ................................................. 147.2 149.3

Brazilian Fleet Financing Facility, average interest rate: 2009, 13.3%; 2008, 16.3% ..... 69.3 54.1

Canadian Fleet Financing Facility, average interest rate: 2009, 0.5%; 2008, 3.8% ...... 55.6 111.6

Belgian Fleet Financing Facility, average interest rate: 2009, 1.8%; 2008, 4.7% ....... 33.7 31.2

Capitalized Leases, average interest rate: 2009, 4.8%; 2008, 6.2% ............... 222.4 193.7

Total Fleet Debt ........................................... 5,675.0 6,386.8

Total Debt ................................................ $10,364.4 $10,972.3

Note: For further information on the definitions and terms of our debt, see descriptions below.

110