Hertz 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

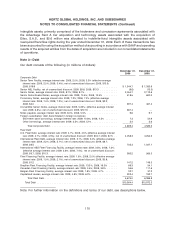

Our ‘‘Senior Dollar Notes’’ are the $1,800.0 million aggregate principal amount of 8.875% Senior Notes

issued by Hertz in connection with the Acquisition. Our ‘‘Senior Euro Notes’’ are the e225 million

aggregate principal amount of 7.875% Senior Notes issued by Hertz in connection with the Acquisition.

We refer to the Senior Dollar Notes and the Senior Euro Notes together as the ‘‘Senior Notes.’’ Our

‘‘Senior Subordinated Notes’’ refer to the $600.0 million aggregate principal amount of 10.5% Senior

Subordinated Notes due January 2016 issued by Hertz in connection with the Acquisition.

As of December 31, 2009, $2,054.7 million and $518.5 million in borrowings were outstanding under the

Senior Notes and Senior Subordinated Notes, respectively. On October 1, 2006, we designated our

Senior Euro Notes as an effective net investment hedge of our Euro-denominated net investment in our

international operations. As a result of this net investment hedge designation, as of December 31, 2009,

$19.2 million of losses, which is net of tax of $17.8 million, attributable to the translation of our Senior

Euro Notes into the U.S. dollar, are recorded in our consolidated balance sheet in ‘‘Accumulated other

comprehensive loss.’’ The Senior Notes will mature in January 2014, and the Senior Subordinated Notes

will mature in January 2016. Hertz’s obligations under the indentures are guaranteed by each of its direct

and indirect domestic subsidiaries that is a guarantor under the Senior Term Facility.

Both the indenture for the Senior Notes and the indenture for the Senior Subordinated Notes contain

covenants that, among other things, limit the ability of Hertz and its restricted subsidiaries, described in

the respective indentures, to incur more debt, pay dividends, redeem stock or make other distributions,

make investments, create liens, transfer or sell assets, merge or consolidate and enter into certain

transactions with Hertz’s affiliates. The indenture for the Senior Subordinated Notes also contains

subordination provisions and limitations on the types of senior subordinated debt that may be incurred.

The indentures also contain certain mandatory and optional prepayment or redemption provisions and

provide for customary events of default.

The restrictive covenants in the indentures governing the Senior Notes and the Senior Subordinated

Notes permit Hertz to make loans, advances, dividends or distributions to Hertz Holdings in an amount

determined by reference to, among other things, consolidated net income for the period from October 1,

2005 to the end of the most recently ended fiscal quarter for which consolidated financial statements of

Hertz are available, so long as Hertz’s consolidated coverage ratio remains greater than 2.00:1.00 after

giving pro forma effect to such restricted payments. Hertz is also permitted to make restricted payments

to Hertz Holdings in an amount not exceeding the greater of a specified minimum amount and 1% of

consolidated tangible assets (which payments are deducted in determining the amount available as

described in the preceding sentence), and in an amount equal to certain equity contributions to Hertz, in

each case, less certain investments and other restricted payments.

On January 12, 2007, Hertz completed exchange offers for its outstanding Senior Notes and Senior

Subordinated Notes whereby over 99% of the outstanding notes were exchanged for a like principal

amount of new notes with identical terms that were registered under the Securities Act of 1933 pursuant

to a registration statement on Form S-4.

In April 2009, we made aggregate open market repurchases, at a discount, of approximately

$68.0 million and $81.5 million in face value of our Senior Notes and Senior Subordinated Notes,

respectively. As a result of these repurchases, we recorded a gain of $48.5 million, net of transaction

costs, in ‘‘Interest and other income, net’’ for the year ended December 31, 2009.

Promissory Notes

As of December 31, 2009, we had approximately $391.4 million (net of a $3.3 million discount),

outstanding in pre-Acquisition promissory notes issued under three separate indentures existing prior to

115