Hertz 2009 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

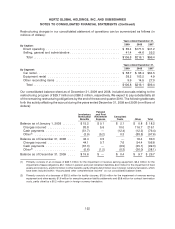

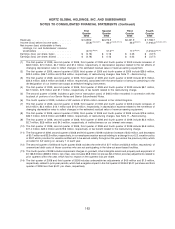

change in fair value of the HVF Swaps is recorded in ‘‘Accumulated other comprehensive loss.’’ As of

December 31, 2009 and 2008, the balance reflected in ‘‘Accumulated other comprehensive loss,’’ net of

tax, was a loss of $49.7 million (net of tax of $31.8 million) and a loss of $89.6 million (net of tax of

$57.4 million), respectively. The fair values of the HVF Swaps were calculated using the income

approach and applying observable market data (i.e. the 1-month LIBOR yield curve and credit default

swap spreads).

In connection with the entrance into the HVF Swaps, Hertz entered into seven differential interest rate

swap agreements, or the ‘‘differential swaps.’’ These differential swaps were required to be put in place

to protect the counterparties to the HVF Swaps in the event of an ‘‘amortization event’’ under the asset-

backed notes agreements. In the event of an ‘‘amortization event,’’ the amount by which the principal

balance on the floating rate portion of the U.S. Fleet Debt is reduced, exclusive of the originally

scheduled amortization, becomes the notional amount of the differential swaps and is transferred to

Hertz. There was no payment associated with these differential swaps and their notional amounts are

and will continue to be zero unless (1) there is an amortization event, which causes the amortization of

the loan balance, or (2) the debt is prepaid.

An ‘‘event of bankruptcy’’ (as defined in the ABS Base Indenture) with respect to MBIA or Ambac would

constitute an ‘‘amortization event’’ under the portion of the U.S. Fleet Debt facilities guaranteed by the

affected insurer.

On September 12, 2008, a supplement was signed to the Indenture, dated as of August 1, 2006,

between HVF and the Bank of New York Mellon Trust Company, N.A. This supplement created the

Series 2008-1 Notes for issuance by HVF. In order to satisfy rating agency requirements related to its

bankruptcy-remote status, HVF acquired an interest rate cap in an amount equal to the Series 2008-1

Notes maximum principal amount of $825.0 million with a strike rate of 7% and a term until August 15,

2011. HVF bought the cap on the date the supplement was signed for $0.4 million and in an associated

transaction, Hertz sold an equal and opposite cap for $0.3 million. In connection with the issuance of the

Series 2009-1 Notes, HVF caused the termination of the Series 2008-1 Notes, as well as both of the

associated interest rate caps.

On September 18, 2009, HVF completed the closing of the Series 2009-1 Notes. In order to satisfy rating

agency requirements related to its bankruptcy-remote status, HVF purchased an interest rate cap, for

$11.7 million, with a maximum notional amount equal to the Series 2009-1 Notes maximum principal

amount of $2.1 billion with a strike rate of 5% and a term until January 25, 2013. Additionally, Hertz sold a

5% interest rate cap, for $6.5 million, with a notional amount equal to 33.3% of the notional amount of the

HVF cap through January 2012, and then subsequently with a matching notional amount to the HVF cap

through its maturity date of January 25, 2013. The fair value of these interest rate caps was calculated

using a discounted cash flow method and applying observable market data. Gains and losses resulting

from changes in the fair value of these interest rate caps are included in our results of operations in the

periods incurred.

In May 2006, in connection with the forecasted issuance of the permanent take-out international asset-

based facilities, our subsidiary HIL purchased two swaptions for e3.3 million, to protect itself from

interest rate increases. These swaptions gave HIL the right, but not the obligation, to enter into three year

interest rate swaps, based on a total notional amount of e600 million at an interest rate of 4.155%. The

swaptions were renewed twice in 2007, prior to their scheduled expiration dates of March 15, 2007 and

September 5, 2007, at a total cost of e2.7 million, and expired on June 5, 2008. The fair values of the HIL

swaptions were calculated using the income approach and applying observable market data. On

June 4, 2008, these swaptions were sold for a realized gain of e9.4 million (or $14.8 million). Additionally,

156