Hertz 2009 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

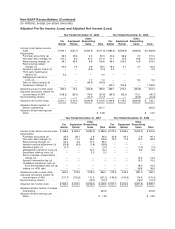

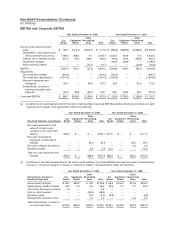

Non-GAAP Reconciliations (Continued)

(In millions)

EBITDA and Corporate EBITDA

Year Ended December 31, 2009 Year Ended December 31, 2008

Other Other

Car Equipment Reconciling Car Equipment Reconciling

Rental Rental Items Total Rental Rental Items Total

Income (loss) before income

taxes ................. $ 190.1 $ (20.7) $(340.4) $ (171.0) $ (385.3) $(629.3) $(368.2) $(1,382.8)

Depreciation, amortization and

other purchase accounting . . 1,766.3 388.0 8.1 2,162.4 2,003.7 423.6 6.0 2,433.3

Interest, net of interest income . 301.5 53.4 309.4 664.3 444.8 109.5 290.9 845.2

Impairment charges ........ —— — —443.0 725.9 — 1,168.9

Noncontrolling interest ...... ——(14.7) (14.7) ——(20.8) (20.8)

EBITDA ................. 2,257.9 420.7 (37.6) 2,641.0 2,506.2 629.7 (92.1) 3,043.8

Adjustments:

Car rental fleet interest ...... (319.0) ——(319.0) (450.7) ——(450.7)

Car rental fleet depreciation . . . (1,614.2) ——(1,614.2) (1,843.8) ——(1,843.8)

Non-cash expenses and

charges(a) ............ 130.1 — 36.9 167.0 83.0 — 30.0 113.0

Extraordinary, unusual or

non-recurring gains and

losses(b) ............. 105.3 38.5 (38.7) 105.1 108.1 106.3 23.5 237.9

Corporate EBITDA .......... $ 560.1 $459.2 $ (39.4) $ 979.9 $ 402.8 $ 736.0 $ (38.6) $ 1,100.2

(a) As defined in the credit agreements for the senior credit facilities, Corporate EBITDA excludes the impact of certain non-cash

expenses and charges. The adjustments reflect the following:

Year Ended December 31, 2009 Year Ended December 31, 2008

Other Other

Car Equipment Reconciling Car Equipment Reconciling

Non-Cash Expenses and Charges Rental Rental Items Total Rental Rental Items Total

Non-cash amortization and

write-off of debt costs

included in car rental fleet

interest .............. $130.1 $ — $ — $130.1 $71.0 $ — $ — $ 71.0

Non-cash stock-based

employee compensation

charges .............. —— 34.3 34.3 —— 28.0 28.0

Non-cash charges for pension . —— — ——— 2.0 2.0

Derivative losses .......... —— 2.6 2.6 12.0 ——12.0

Total non-cash expenses and

charges .............. $130.1 $ — $36.9 $167.0 $83.0 $ —$30.0 $113.0

(b) As defined in the credit agreements for the senior credit facilities, Corporate EBITDA excludes the impact of extraordinary,

unusual or non-recurring gains or losses or charges or credits. The adjustments reflect the following:

Year Ended December 31, 2009 Year Ended December 31, 2008

Other Other

Extraordinary, Unusual or Car Equipment Reconciling Car Equipment Reconciling

Non-Recurring Items Rental Rental Items Total Rental Rental Items Total

Restructuring charges ...... $ 58.7 $38.2 $ 9.9 $106.8 $ 98.4 $103.2 $14.6 $216.2

Restructuring related charges . 42.3 0.3 3.9 46.5 19.5 3.1 3.7 26.3

Third party bankruptcy reserve 4.3 ——4.3 —— — —

Gain on debt buyback ..... —— (48.5) (48.5) —— — —

Derivative gains .......... —— (5.0) (5.0) (9.8) ——(9.8)

Management transition costs . —— 1.0 1.0 —— 5.2 5.2

Total extraordinary, unusual or

non-recurring items ...... $105.3 $38.5 $(38.7) $105.1 $108.1 $106.3 $23.5 $237.9