Hertz 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

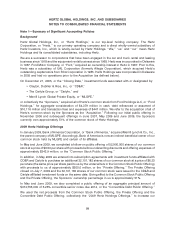

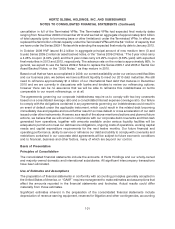

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

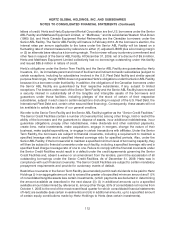

Recent Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board, or ‘‘FASB,’’ issued The FASB Accounting

Standards Codification. The Codification became the source of authoritative GAAP recognized by the

FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under

authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. On July 1,

2009, the Codification superseded all then-existing non-SEC accounting and reporting standards. All

other nongrandfathered non-SEC accounting literature not included in the Codification became

nonauthoritative.

Under ASC 470-20, ‘‘Debt with Conversion and Other Options’’, or ‘‘ASC 470-20,’’ cash settled

convertible securities are separated into their debt and equity components. The value assigned to the

debt component is the estimated fair value, as of the issuance date, of a similar debt instrument without

the conversion feature, and the difference between the proceeds for the convertible debt and the amount

reflected as a debt liability is recorded as additional paid-in capital. As a result, the debt is recorded at a

discount reflecting its below market coupon interest rate. The debt is subsequently accreted to its par

value over its expected life, with the rate of interest that reflects the market rate at issuance being

reflected on the consolidated statements of operations. We applied the provisions of ASC 470-20 to the

Convertible Debt Public Offering. See Note 3—Debt.

In January 2009, the FASB issued guidance which contains amendments to ASC 715, ‘‘Compensation—

Retirement Benefits’’ that are intended to enhance the transparency surrounding the types of assets and

associated risks in an employer’s defined benefit pension or other postretirement plan. These particular

amendments became effective for us beginning with this annual report and did not have a material

impact on our financial position or results of operations. See Note 4—Employee Retirement Benefits.

In June 2009, the FASB issued guidance relating to how a company determines when an entity that is

insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated.

The determination of whether a company is required to consolidate an entity is based on, among other

things, an entity’s purpose and design and a company’s ability to direct the activities of the entity that

most significantly impact the entity’s economic performance. These provisions became effective for us

on January 1, 2010, and it did not have a material impact on our financial position or results of

operations.

107