Hertz 2009 Annual Report Download - page 100

Download and view the complete annual report

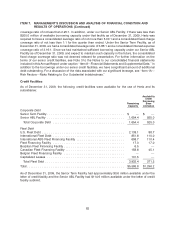

Please find page 100 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

cancellation in full of the Terminated VFNs. The Terminated VFNs had expected final maturity dates

ranging from November 2009 to November 2010 and we had an aggregate of approximately $2.0 billion

of total capacity (prior to borrowing base or other limitations) under the Terminated VFNs. In effect we

replaced the $2.0 billion of total capacity under the Terminated VFNs with the $2.1 billion of capacity that

we have under the Series 2009-1 Notes while extending the expected final maturity date to January 2012.

In October 2009 HVF issued $1.2 billion in aggregate principal amount of new medium term notes (3 and

5 year) Series 2009-2 rental car asset backed notes, or the ‘‘Series 2009-2 Notes.’’ The 3 year notes carry

a 4.26% coupon (4.30% yield) and the 5 year notes carry a 5.29% coupon (5.35% yield) with expected

final maturities in 2013 and 2015, respectively. The advance rate on the notes is approximately 66%. In

general, we expect to use the Series 2009-2 Notes to replace the Series 2005-1 and Series 2005-2 rental

car asset backed notes, or the ‘‘2005 Notes,’’ as they mature in 2010.

Based on all that we have been able to accomplish in 2009, our current availability under our various

credit facilities and our business plan, we believe we have sufficient liquidity to meet our 2010 debt

maturities. We still need to refinance approximately $1.2 billion of our international fleet debt that

matures in December 2010 and we are currently in discussions with banks and lenders to review our

refinancing options; however there can be no assurance that we will be able to refinance this

indebtedness on terms comparable to our recent refinancings, or at all.

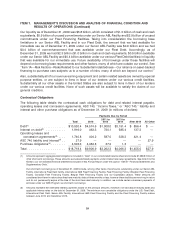

A significant number of cars that we purchase are subject to repurchase by car manufacturers under

contractual repurchase or guaranteed depreciation programs. Under these programs, car

manufacturers agree to repurchase cars at a specified price or guarantee the depreciation rate on the

cars during a specified time period, typically subject to certain car condition and mileage requirements.

We use this specified price or guaranteed depreciation rate to calculate our asset-backed financing

capacity. If any manufacturer of our cars fails to fulfill its repurchase or guaranteed depreciation

obligations, due to bankruptcy or otherwise, our asset-backed financing capacity could be decreased,

or we may be required to materially increase the credit enhancement levels relating to the financing of

the fleet vehicles provided by such bankrupt manufacturer under certain of our Fleet Financing Facilities.

For a discussion of the risks associated with a manufacturer’s bankruptcy or our reliance on asset-

backed financing, see ‘‘Item 1A—Risk Factors—Risks Related to Our Business—The failure of a

manufacturer of cars that we own to fulfill its obligations under a repurchase or guaranteed depreciation

program could expose us to loss on those cars and adversely impact our outstanding asset-backed

financing facilities, which could in turn adversely affect our liquidity and results of operations’’ and ‘‘Risks

Related to Our Substantial Indebtedness—Our reliance on asset-backed financing to purchase cars

subjects us to a number of risks, many of which are beyond our control.’’

We rely significantly on asset-backed financing to purchase cars for our domestic and international car

rental fleet. For further information concerning our asset-backed financing programs, see ‘‘Financing’’

below. The amount of financing available to us pursuant to these programs depends on a number of

factors, many of which are outside our control. In the past several years, Ford and Old General Motors

(as defined below), which are the significant suppliers of cars to us on both a program and non-program

basis, have experienced deterioration in their operating results and significant declines in their credit

ratings.

Immediately prior to Chrysler LLC’s bankruptcy, less than 1% of our fleet was comprised of Chrysler LLC

vehicles, so its bankruptcy filing has not had a material impact on our business, financial condition or

results of operations.

80