Hertz 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

coverage ratio of not less than 2.25:1. In addition, under our Senior ABL Facility, if there was less than

$200.0 million of available borrowing capacity under that facility as of December 31, 2009, Hertz was

required to have a consolidated leverage ratio of not more than 5.00:1 and a consolidated fixed charge

coverage ratio of not less than 1:1 for the quarter then ended. Under the Senior Term Facility, as of

December 31, 2009, we had a consolidated leverage ratio of 3.85:1 and a consolidated interest expense

coverage ratio of 3.16:1. Since we had maintained sufficient borrowing capacity under our Senior ABL

Facility as of December 31, 2009, and expect to maintain such capacity in the future, the consolidated

fixed charge coverage ratio was not deemed relevant for presentation. For further information on the

terms of our senior credit facilities, see Note 3 to the Notes to our consolidated financial statements

included in this Annual Report under caption ‘‘Item 8—Financial Statements and Supplemental Data.’’ In

addition to the borrowings under our senior credit facilities, we have a significant amount of additional

debt outstanding. For a discussion of the risks associated with our significant leverage, see ‘‘Item 1A—

Risk Factors—Risks Relating to Our Substantial Indebtedness.’’

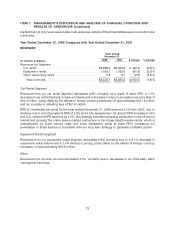

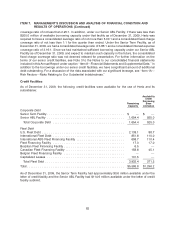

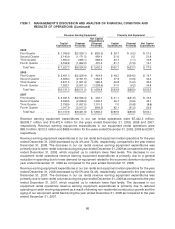

Credit Facilities

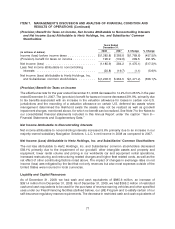

As of December 31, 2009, the following credit facilities were available for the use of Hertz and its

subsidiaries:

Availability

Under

Borrowing

Remaining Base

Capacity Limitation

Corporate Debt

Senior Term Facility .......................................... $ — $ —

Senior ABL Facility .......................................... 1,654.4 925.0

Total Corporate Debt ....................................... 1,654.4 925.0

Fleet Debt

U.S. Fleet Debt ............................................. 2,138.1 88.7

International Fleet Debt ....................................... 851.8 110.0

International ABS Fleet Financing Facility .......................... 658.7 110.4

Fleet Financing Facility ....................................... 17.0 17.0

Brazilian Fleet Financing Facility ................................. 6.5 —

Canadian Fleet Financing Facility ................................ 158.8 45.1

Belgian Fleet Financing Facility ................................. ——

Capitalized Leases .......................................... 101.5 —

Total Fleet Debt ........................................... 3,932.4 371.2

Total ..................................................... $5,586.8 $1,296.2

As of December 31, 2009, the Senior Term Facility had approximately $0.6 million available under the

letter of credit facility and the Senior ABL Facility had $114.6 million available under the letter of credit

facility sublimit.

83