Hertz 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

Management does not expect that the effect of inflation on our overall operating costs will be greater for

us than for our competitors.

Income Taxes

In January 2006, we implemented a LKE Program for our U.S. car rental business. Pursuant to the

program, we dispose of vehicles and acquire replacement vehicles in a form intended to allow such

dispositions and replacements to qualify as tax-deferred ‘‘like-kind exchanges’’ pursuant to section 1031

of the Internal Revenue Code. The program has resulted in deferral of federal and state income taxes for

fiscal 2007, 2008 and 2009. A LKE Program for HERC has been in place for several years. The program

allows tax deferral if a qualified replacement asset is acquired within a specific time period after asset

disposal. Accordingly, if a qualified replacement asset is not purchased within this limited time period,

taxable gain is recognized. For strategic purposes, such as cash management and fleet reduction, we

have triggered some taxable gains in the program. The bankruptcy filing of an OEM also resulted in

minimal gain recognition. We had sufficient net operating losses to fully offset the taxable gains

recognized. We cannot offer assurance that the expected tax deferral will continue or that the relevant

law concerning the programs will remain in its current form. An extended reduction in purchases or

downsizing of our car rental fleet could result in reduced deferrals in the future, which in turn could

require us to make material cash payments for federal and state income tax liabilities. Our inability to

obtain replacement financing as our fleet financing facilities mature would likely result in an extended

reduction in purchases or downsizing of the fleet. However, we believe the likelihood of making material

cash payments in the near future is low because of our significant net operating losses. For a discussion

of risks related to our reliance on asset-backed financing to purchase cars, see ‘‘Item 1A—Risk Factors’’

in this Annual Report.

On January 1, 2009, Bank of America acquired Merrill Lynch & Co., Inc., the parent company of MLGPE.

Accordingly, Bank of America is now an indirect beneficial owner of our common stock held by MLGPE

and certain of its affiliates. For U.S. income tax purposes the transaction, when combined with other

unrelated transactions during the previous 36 months, resulted in a change in control as that term is

defined in Section 382 of the Internal Revenue Code. Consequently, utilization of all pre-2009 U.S. net

operating losses is subject to an annual limitation. The limitation is not expected to result in a loss of net

operating losses or have a material adverse impact on taxes.

Employee Retirement Benefits

Pension

We sponsor defined benefit pension plans worldwide. Pension obligations give rise to significant

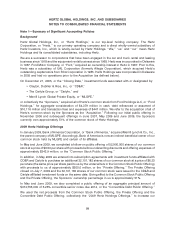

expenses that are dependent on assumptions discussed in Note 4 of the Notes to our consolidated

financial statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’ Our 2009 worldwide pre-tax pension expense was approximately $35.9 million,

which is a decrease of $3.5 million from 2008. The decrease in expense compared to 2008 is primarily

due to lower expense for U.S. plans, largely due to headcount reductions. To the extent that there are

layoffs affecting a significant number of employees covered by any pension plan worldwide, 2010

expense could vary significantly because of further charges or credits.

The funded status (i.e., the dollar amount by which the projected benefit obligations exceeded the

market value of pension plan assets) of our U.S. qualified plan, in which most domestic employees

participate, declined significantly as of December 31, 2009, compared with December 31, 2008 because

asset values decreased due to a drop in the securities markets. We contributed $42.6 million to our U.S.

90