Hertz 2009 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

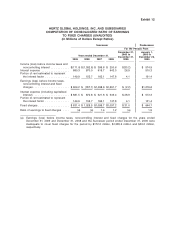

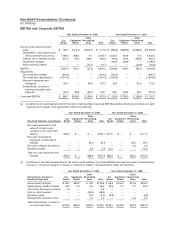

Non-GAAP Reconciliations (Continued)

(In millions, except per share amounts)

Adjusted Pre-Tax Income (Loss) and Adjusted Net Income (Loss)

Year Ended December 31, 2009 Year Ended December 31, 2008

Other Other

Car Equipment Reconciling Car Equipment Reconciling

Rental Rental Items Total Rental Rental Items Total

Income (loss) before income

taxes ................. $190.1 $(20.7) $(340.4) $(171.0) $(385.3) $(629.3) $(368.2) $(1,382.8)

Adjustments:

Purchase accounting (a) .... 38.2 49.6 2.5 90.3 40.2 58.8 2.0 101.0

Non-cash debt charges (b) . . . 131.7 9.0 31.2 171.9 71.1 10.3 18.8 100.2

Restructuring charges (c) .... 58.7 38.2 9.9 106.8 98.4 103.2 14.6 216.2

Restructuring related

charges (c) ........... 42.3 0.3 3.9 46.5 19.5 3.1 3.7 26.3

Derivative (gains) losses (c) . . —— (2.4) (2.4) 2.2 ——2.2

Third party banktruptcy

reserve (d) ............ 4.3 ——4.3 —— — —

Management transition

costs (d) ............. —— 1.0 1.0 —— 5.2 5.2

Gain on debt buyback (e) . . . —— (48.5) (48.5) —— — —

Impairment charges (f) ..... —— — —443.0 725.9 — 1,168.9

Adjusted pre-tax income (loss) . . 465.3 76.4 (342.8) 198.9 289.1 272.0 (323.9) 237.2

Assumed (provision) benefit for

income taxes of 34% ....... (158.2) (26.0) 116.6 (67.6) (98.3) (92.5) 110.1 (80.7)

Noncontrolling interest ....... —— (14.7) (14.7) ——(20.8) (20.8)

Adjusted net income (loss) .... $307.1 $ 50.4 $(240.9) $ 116.6 $ 190.8 $ 179.5 $(234.6) $ 135.7

Adjusted diluted number of

shares outstanding ........ 407.7 325.5

Adjusted diluted earnings per

share ................ $ 0.29 $ 0.42

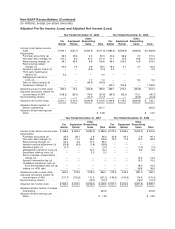

Year Ended December 31, 2007 Year Ended December 31, 2006

Other Other

Car Equipment Reconciling Car Equipment Reconciling

Rental Rental Items Total Rental Rental Items Total

Income (loss) before income taxes $ 468.6 $ 308.5 $(390.3) $ 386.8 $ 373.5 $ 269.5 $(442.4) $ 200.6

Adjustments:

Purchase accounting (a) ..... 35.3 58.1 1.8 95.2 23.8 64.7 1.9 90.4

Non-cash debt charges (b) .... 66.5 11.2 28.2 105.9 75.0 11.3 13.2 99.5

Restructuring charges (c) ..... 64.5 4.9 27.0 96.4 —— — —

Vacation accrual adjustment (c) . (25.8) (8.9) (1.8) (36.5) —— — —

Derivative gains (c) ......... (4.1) ——(4.1) —— (1.0) (1.0)

Management transition costs (d) —— 15.0 15.0 —— 9.8 9.8

Secondary offering costs (d) . . . —— 2.0 2.0 —— — —

Stock purchase compensation

charge (d) ............. —— — ——— 13.3 13.3

Sponsor termination fee (d) .... —— — ——— 15.0 15.0

Unrealized transaction loss on

Euro-denominated debt (d) (g) —— — ——— 19.2 19.2

Interest on HGH debt ....... —— — ——— 39.9 39.9

Adjusted pre-tax income (loss) . . . 605.0 373.8 (318.1) 660.7 472.3 345.5 (331.1) 486.7

Assumed (provision) benefit for

income taxes of 35% ........ (211.7) (130.8) 111.3 (231.2) (165.3) (120.9) 115.9 (170.3)

Noncontrolling interest ........ ——(19.7) (19.7) ——(16.7) (16.7)

Adjusted net income (loss) ..... $393.3 $ 243.0 $(226.5) $ 409.8 $ 307.0 $ 224.6 $(231.9) $ 299.7

Adjusted diluted number of shares

outstanding .............. 324.8 324.8

Adjusted diluted earnings per

share .................. $ 1.26 $ 0.92