Hertz 2009 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

under our ABS Program; and acted as dealer managers and solicitation agents for Hertz’s tender offers

for its existing debt securities in connection with the Acquisition.

Banc of America Securities LLC, an affiliate of MLGPE, acted as one of the joint lead bookrunners in the

issuance of the Series 2009-2 Notes, for which they received customary fees and expenses.

As of December 31, 2009, approximately $246 million of our outstanding debt was with related parties.

See Note 3—Debt.

Guarantees

Hertz’s obligations under the Senior Term Facility and Senior ABL Facility are guaranteed by Hertz’s

immediate parent, Hertz Investors, Inc. (previously known as CCMG Corporation). Hertz Holdings is not

a guarantor of these facilities. See Note 3—Debt.

Other Sponsor Relationships

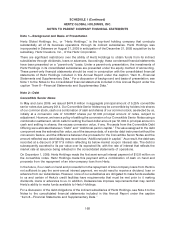

In May and June 2009, ML, an affiliate of one of our Sponsors, MLGPE, acted as an underwriter in the

Common Stock Public Offering and in the Convertible Debt Public Offering, for which they received

customary fees and expenses.

In May 2009 we entered into subscription agreements with investment funds affiliated with CD&R and

Carlyle to purchase an additional 32,101,182 shares of our common stock at a price of $6.23 per share

(the same price per share paid to us by the underwriters in the Common Stock Public Offering) with

proceeds to us of approximately $200.0 million. The Private Offering closed on July 7, 2009 and the

32,101,182 shares of our common stock were issued to CD&R and Carlyle affiliated investment funds on

the same date. Giving effect to the Common Stock Public Offering and the Private Offering the Sponsors’

ownership percentage in us is approximately 51%.

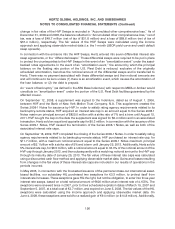

In the second quarter of 2007, we were advised by ML, that between November 17, 2006, and April 19,

2007, ML engaged in principal trading activity in our common stock. Some of those purchases and sales

of our common stock should have been reported to the SEC on Form 4, but were not reported. ML and

certain of its affiliates have engaged in additional principal trading activity since that time. ML and certain

of its affiliates have since filed amended or additional reports on Form 4 disclosing the current number of

shares of our common stock held by ML and its affiliates. To date, ML has paid to us approximately

$4.9 million for its ‘‘short-swing’’ profit liability resulting from its principal trading activity that is subject to

recovery by us under Section 16 of the Securities Exchange Act of 1934, as amended. In the event that

ML or its affiliates (including private investment funds managed by certain private equity-arm affiliates of

ML) sell additional shares of our common stock in the future, this amount may change. In 2008 and 2007,

we recorded $0.1 million, net of tax and $2.9 million (net of tax of $1.9 million), respectively, in our

consolidated balance sheet in ‘‘Additional paid-in capital.’’ In. addition, because ML may be deemed to

be an affiliate of Hertz Holdings and there was no registration statement in effect with respect to its sale of

shares during this period, certain of these sales may have been made in violation of Section 5 of the

Securities Act of 1933, as amended.

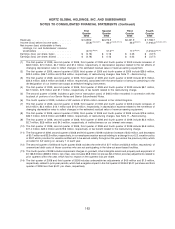

Note 14—Earnings (Loss) Per Share

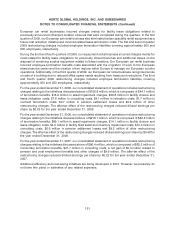

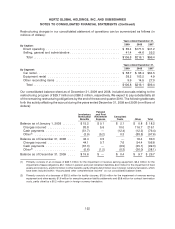

Basic earnings (loss) per share have been computed based upon the weighted average number of

common shares outstanding. Diluted earnings (loss) per share have been computed based upon the

weighted average number of common shares outstanding plus the effect of all potentially dilutive

common stock equivalents, except when the effect would be anti-dilutive.

161