Hertz 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

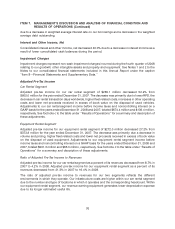

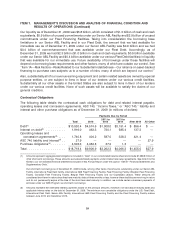

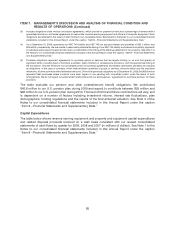

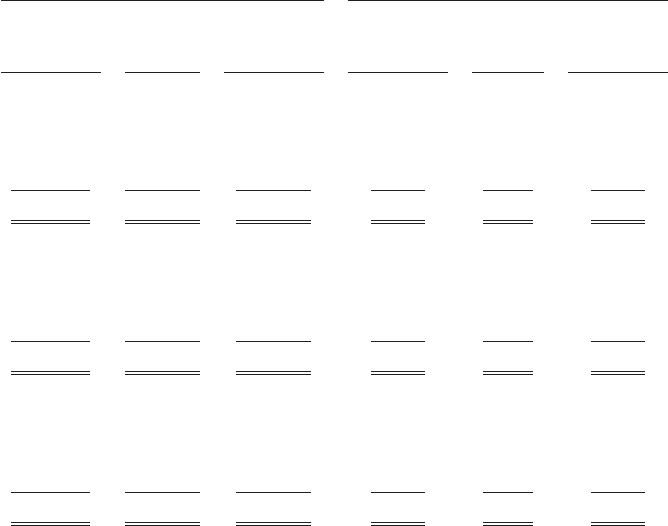

Revenue Earning Equipment Property and Equipment

Net Capital

Expenditures

Capital Disposal (Disposal Capital Disposal Net Capital

Expenditures Proceeds Proceeds) Expenditures Proceeds Expenditures

2009

First Quarter .......... $ 1,399.6 $(2,026.1) $ (626.5) $ 26.7 $ (5.2) $ 21.5

Second Quarter ....... 2,140.9 (1,171.5) 969.4 21.6 0.2 21.8

Third Quarter ......... 1,654.0 (965.1) 688.9 20.7 (1.1) 19.6

Fourth Quarter ........ 2,332.8 (1,862.2) 470.6 31.7 (17.6) 14.1

Total Year .......... $ 7,527.3 $(6,024.9) $ 1,502.4 $100.7 $(23.7) $ 77.0

2008

First Quarter .......... $ 2,451.0 $(2,026.4) $ 424.6 $ 48.2 $(34.5) $ 13.7

Second Quarter ....... 3,626.4 (2,161.9) 1,464.5 47.8 (13.6) 34.2

Third Quarter ......... 2,811.5 (1,821.9) 989.6 56.8 (14.2) 42.6

Fourth Quarter ........ 1,262.1 (2,501.0) (1,238.9) 41.0 (6.2) 34.8

Total Year .......... $10,151.0 $(8,511.2) $ 1,639.8 $193.8 $(68.5) $125.3

2007

First Quarter .......... $ 2,941.5 $(2,508.4) $ 433.1 $ 41.1 $(21.9) $ 19.2

Second Quarter ....... 3,539.5 (2,238.6) 1,300.9 59.7 (16.6) 43.1

Third Quarter ......... 2,758.9 (1,657.6) 1,101.3 7.0 (15.8) (8.8)

Fourth Quarter ........ 1,917.9 (2,917.2) (999.3) 82.1 (31.5) 50.6

Total Year .......... $11,157.8 $(9,321.8) $ 1,836.0 $189.9 $(85.8) $104.1

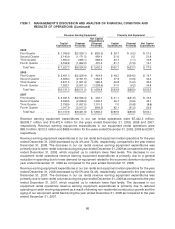

Revenue earning equipment expenditures in our car rental operations were $7,442.3 million,

$9,838.7 million and $10,472.4 million for the years ended December 31, 2009, 2008 and 2007,

respectively. Revenue earning equipment expenditures in our equipment rental operations were

$85.0 million, $312.3 million and $685.4 million for the years ended December 31, 2009, 2008 and 2007,

respectively.

Revenue earning equipment expenditures in our car rental and equipment rental operations for the year

ended December 31, 2009 decreased by 24.4% and 72.8%, respectively, compared to the year ended

December 31, 2008. The decrease in our car rental revenue earning equipment expenditures was

primarily due to lower rental volumes during the year ended December 31, 2009 as compared to the year

ended December 31, 2008, which required us to maintain lower fleet levels. The decrease in our

equipment rental operations revenue earning equipment expenditures is primarily due to a general

reduction in spending due to lower demand for equipment related to the economic downturn during the

year ended December 31, 2009 as compared to the year ended December 31, 2008.

Revenue earning equipment expenditures in our car rental and equipment rental operations for the year

ended December 31, 2008 decreased by 60.5% and 54.4%, respectively, compared to the year ended

December 31, 2007. The decrease in our car rental revenue earning equipment expenditures was

primarily due to lower rental volumes during the year ended December 31, 2008 as compared to the year

ended December 31, 2007, which required us to maintain lower fleet levels. The decrease in our

equipment rental operations revenue earning equipment expenditures is primarily due to reduced

spending on earth moving equipment as a result of slowing non-residential construction growth and the

aging of our equipment rental fleet during the year ended December 31, 2008 as compared to the year

ended December 31, 2007.

86