Hertz 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 1. BUSINESS (Continued)

In the three years ended December 31, 2009, we increased the number of our off-airport rental locations

in the United States by approximately 7% to approximately 1,700 locations. In the future, our strategy will

include selected openings of new off-airport locations, the disciplined evaluation of existing locations

and pursuit of same-store sales growth. We anticipate that same-store sales growth will be driven by our

traditional leisure and business traveler customers and by increasing penetration of the insurance

replacement market, of which we currently have a low market share. In the United States during the year

ended December 31, 2009, approximately one-third of our rental revenues at off-airport locations were

related to replacement rentals. We believe that if we successfully pursue our strategy of profitable

off-airport growth, the proportion of replacement rental revenues will increase. As we move forward, our

determination of whether to continue to expand our U.S. off-airport network will be based upon a

combination of factors, including the concentration of target insurance company policyholders, car

dealerships, auto body shops and other clusters of retail, commercial activity and potential profitability.

We also intend to increase the number of our staffed off-airport rental locations internationally based on

similar criteria.

Our worldwide car rental segment generated $5,979.0 million in revenues and $190.1 million in income

before income taxes and noncontrolling interest during the year ended December 31, 2009.

Customers and Business Mix

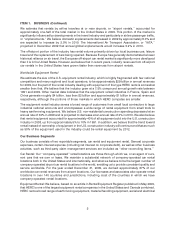

We categorize our car rental business based on two primary criteria—the purpose for which customers

rent from us (business or leisure) and the type of location from which they rent (airport or off-airport). The

table below sets forth, for the year ended December 31, 2009, the percentages of rental revenues and

rental transactions in our U.S. and international operations derived from business and leisure rentals and

from airport and off-airport rentals.

Year ended December 31, 2009

U.S. International

Revenues Transactions Revenues Transactions

Type of Car Rental

By Customer:

Business .............................. 43% 48% 50% 52%

Leisure ............................... 57 52 50 48

100% 100% 100% 100%

By Location:

Airport ............................... 73% 75% 54% 57%

Off-airport ............................. 27 25 46 43

100% 100% 100% 100%

Customers who rent from us for ‘‘business’’ purposes include those who require cars in connection with

commercial activities, the activities of governments and other organizations or for temporary vehicle

replacement purposes. Most business customers rent cars from us on terms that we have negotiated

with their employers or other entities with which they are associated, and those terms can differ

substantially from the terms on which we rent cars to the general public. We have negotiated

arrangements relating to car rental with many large businesses, governments and other organizations,

including most Fortune 500 companies.

10