Hertz 2009 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

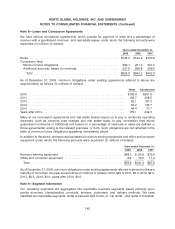

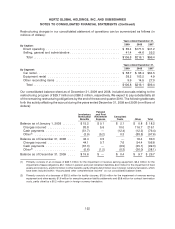

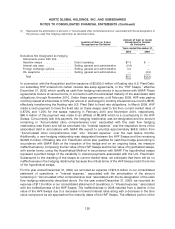

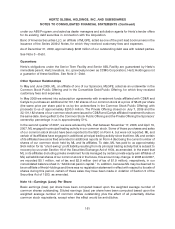

Restructuring charges in our consolidated statement of operations can be summarized as follows (in

millions of dollars):

Years ended December 31,

2009 2008 2007

By Caption:

Direct operating ........................................ $ 65.4 $171.5 $41.2

Selling, general and administrative ........................... 41.4 44.6 55.2

Total ............................................... $106.8 $216.1 $96.4

Years ended December 31,

2009 2008 2007

By Segment:

Car rental ............................................. $ 58.7 $ 98.4 $64.5

Equipment rental ....................................... 38.2 103.2 4.9

Other reconciling items ................................... 9.9 14.5 27.0

Total ............................................... $106.8 $216.1 $96.4

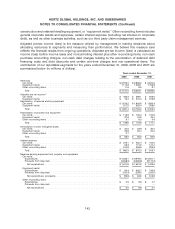

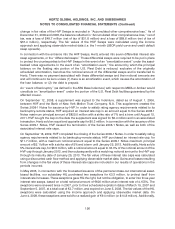

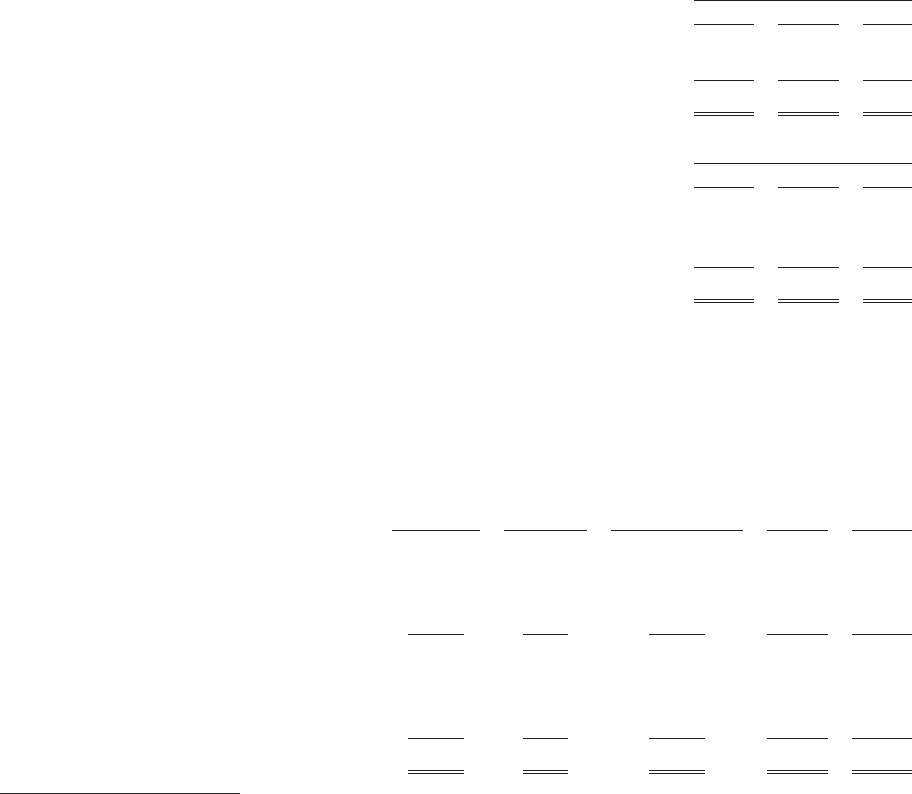

Our consolidated balance sheet as of December 31, 2009 and 2008, included accruals relating to the

restructuring program of $29.7 million and $60.3 million, respectively. We expect to pay substantially all

of the remaining restructuring obligations by the end of the second quarter 2010. The following table sets

forth the activity affecting the accrual during the years ended December 31, 2009 and 2008 (in millions of

dollars):

Pension

Involuntary and Post

Termination Retirement Consultant

Benefits Expense Costs Other Total

Balance as of January 1, 2008 ....... $15.2 $ 0.1 $ 2.1 $ 0.8 $ 18.2

Charges incurred ............... 83.8 5.6 10.0 116.7 216.1

Cash payments ................ (51.7) —(12.4) (12.3) (76.4)

Other(1) ...................... (3.9) (5.2) 0.3 (88.8) (97.6)

Balance as of December 31, 2008 .... 43.4 0.5 — 16.4 60.3

Charges incurred ............... 44.1 0.7 7.6 54.4 106.8

Cash payments ................ (67.3) —(6.9) (25.1) (99.3)

Other(2) ...................... (0.6) (1.2) (0.3) (36.0) (38.1)

Balance as of December 31, 2009 .... $19.6 $ — $ 0.4 $ 9.7 $ 29.7

(1) Primarily consists of an increase of $83.7 million for the impairment of revenue earning equipment, $5.4 million for the

impairment of lease obligations, $5.1 million in pension and post retirement liabilities, $4.0 million for the impairment of fixed

assets and inventory, and $1.5 million in other benefits, partly offset by $2.2 million loss in foreign currency translation, which

have been included within ‘‘Accumulated other comprehensive income’’ on our consolidated balance sheet.

(2) Primarily consists of a decrease of $20.5 million for facility closures, $15.6 million for the impairment of revenue earning

equipment and other assets, $1.6 million for executive pension liability settlements and $0.8 million for contract termination

costs, partly offset by a $0.2 million gain in foreign currency translation.

152