Hertz 2009 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

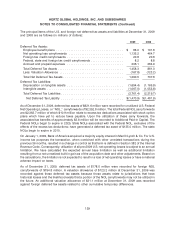

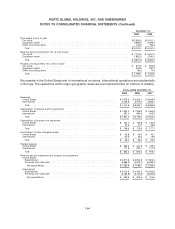

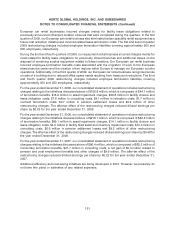

December 31,

2009 2008

Total assets at end of year

United States ........................................................ $10,669.7 $10,921.6

International ......................................................... 5,332.7 5,529.8

Total ............................................................ $16,002.4 $16,451.4

Revenue earning equipment, net, at end of year

United States ........................................................ $6,432.3 $ 6,132.8

International ......................................................... 2,419.3 2,558.7

Total ............................................................ $8,851.6 $ 8,691.5

Property and equipment, net, at end of year

United States ........................................................ $ 953.7 $ 1,010.5

International ......................................................... 234.4 244.1

Total ............................................................ $1,188.1 $ 1,254.6

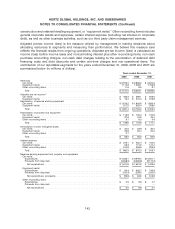

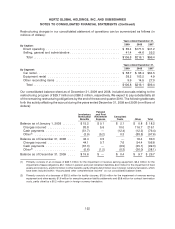

(a) The following table reconciles adjusted pre-tax income to income (loss) before income taxes and noncontrolling interest for the years

ended December 31, 2009, 2008 and 2007 (in millions of dollars):

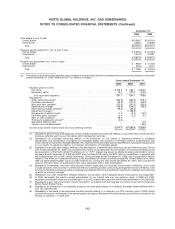

Years ended December 31,

2009 2008 2007

Adjusted pre-tax income

Car rental ........................................... $465.3 $ 289.1 $ 605.0

Equipment rental ...................................... 76.4 272.0 373.8

Total reportable segments ............................... 541.7 561.1 978.8

Adjustments:

Other reconciling items(1) ................................. (342.8) (323.9) (318.1)

Purchase accounting(2) ................................... (90.3) (101.0) (95.2)

Non-cash debt charges(3) ................................. (171.9) (100.2) (105.9)

Restructuring charges ................................... (106.8) (216.2) (96.4)

Restructuring related charges(4) ............................. (46.5) (26.3) —

Impairment charges(5) ................................... —(1,168.9) —

Management transition costs ............................... (1.0) (5.2) (15.0)

Derivative gains (losses)(6) ................................. 2.4 (2.2) 4.1

Gain on debt buyback(7) .................................. 48.5 ——

Third-party bankruptcy accrual(8) ............................. (4.3) ——

Secondary offering costs ................................. ——(2.0)

Vacation accrual adjustment(9) .............................. ——36.5

Income (loss) before income taxes and noncontrolling interest ............ $(171.0) $(1,382.8) $ 386.8

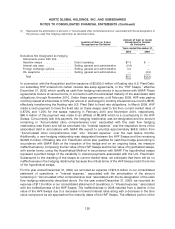

(1) Represents general corporate expenses, certain interest expense (including net interest on corporate debt), as well as other

business activities such as our third-party claim management services.

(2) Represents the purchase accounting effects of the Acquisition on our results of operations relating to increased

depreciation and amortization of tangible and intangible assets and accretion of revalued workers’ compensation and

public liability and property damage liabilities. Also represents the purchase accounting effects of subsequent acquisitions

on our results of operations relating to increased amortization of intangible assets.

(3) Represents non-cash debt charges relating to the amortization of deferred debt financing costs and debt discounts. For the

year ended December 31, 2009, also includes $74.6 million associated with the amortization of amounts pertaining to the

de-designation of the Hertz Vehicle Financing LLC, or ‘‘HVF,’’ interest rate swaps as effective hedging instruments. During

the years ended December 31, 2008 and 2007, also includes $11.8 million and $20.4 million, respectively, associated with

the ineffectiveness of our HVF interest rate swaps. During the year ended December 31, 2008, also includes $30.0 million

related to the write-off of deferred financing costs associated with those countries outside the United States as to which

take-out asset-based facilities have not been entered into. During the year ended December 31, 2007, also includes the

write-off of $16.2 million of unamortized debt costs associated with a debt modification.

(4) Represents incremental, one-time costs incurred directly supporting our business transformation initiatives. Such costs

include transition costs incurred in connection with our business process outsourcing arrangements and incremental costs

incurred to facilitate business process re-engineering initiatives that involve significant organization redesign and extensive

operational process changes.

(5) Represents non-cash impairment charges related to our goodwill, other intangible assets and property and equipment.

(6) In 2009, represents the mark-to-market adjustments on our interest rate cap and gasoline swap. In 2008 and 2007,

represents unrealized losses and a realized gain on our HIL interest rate swaptions which were terminated in October 2008.

(7) Represents a gain (net of transaction costs) recorded in connection with the buyback of portions of our Senior Notes and

Senior Subordinated Notes.

(8) Represents an allowance for uncollectible program car receivables related to a bankrupt European dealer affiliated with a

U.S. car manufacturer.

(9) Represents a decrease in the employee vacation accrual relating to a change in our U.S. vacation policy in 2007 which

provides for vacation entitlement to be earned ratably throughout the year versus the previous policy which provided for full

vesting on January 1 of each year.

145