Hertz 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

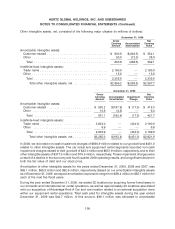

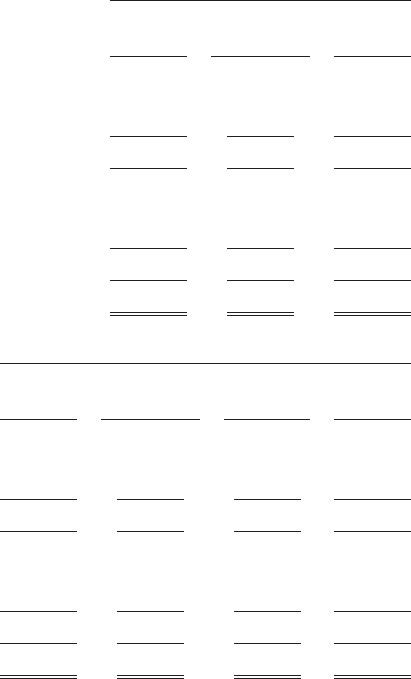

Other intangible assets, net, consisted of the following major classes (in millions of dollars):

December 31, 2009

Gross Net

Carrying Accumulated Carrying

Amount Amortization Value

Amortizable intangible assets:

Customer-related ................................. $ 600.6 $(246.5) $ 354.1

Other ......................................... 50.0 (12.0) 38.0

Total ........................................ 650.6 (258.5) 392.1

Indefinite-lived intangible assets:

Trade name ..................................... 2,190.0 — 2,190.0

Other ......................................... 15.6 — 15.6

Total ........................................ 2,205.6 — 2,205.6

Total other intangible assets, net .................. $2,856.2 $(258.5) $2,597.7

December 31, 2008

Gross Net

Carrying Accumulated Impairment Carrying

Amount Amortization Charge Value

Amortizable intangible assets:

Customer-related ........................ $ 620.2 $(187.9) $ (17.0) $ 415.3

Other ................................ 10.9 (4.5) — 6.4

Total ............................... 631.1 (192.4) (17.0) 421.7

Indefinite-lived intangible assets:

Trade name ............................ 2,624.0 — (434.0) 2,190.0

Other ................................ 9.9 ——9.9

Total ............................... 2,633.9 — (434.0) 2,199.9

Total other intangible assets, net .......... $3,265.0 $(192.4) $(451.0) $2,621.6

In 2008, we recorded non-cash impairment charges of $694.9 million related to our goodwill and $451.0

related to other intangible assets. The car rental and equipment rental segments recorded non-cash

impairment charges related to their goodwill of $43.0 million and $651.9 million, respectively, and to their

other intangible assets of $377.0 million and $74.0 million, respectively. These impairment charges were

a result of a decline in the economy and fourth quarter 2008 operating results, and a significant decline in

both the fair value of debt and our stock price.

Amortization of other intangible assets for the years ended December 31, 2009, 2008 and 2007, was

$66.1 million, $66.3 million and $62.6 million, respectively. Based on our amortizable intangible assets

as of December 31, 2009, we expect amortization expense to range from $59.4 million to $65.1 million for

each of the next five fiscal years.

During the year ended December 31, 2009, we added 32 locations by acquiring former franchisees in

our domestic and international car rental operations, as well as approximately 20 locations associated

with our acquisition of Advantage Rent A Car and one location related to an external acquisition done

within our equipment rental operations. Total cash paid for intangible assets during the year ended

December 31, 2009 was $44.7 million, of this amount, $39.1 million was allocated to amortizable

109