Hertz 2009 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

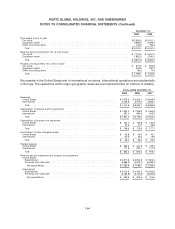

The foreign NOL carryforwards of $754.8 million include $637.2 million which have an indefinite

carryforward period and associated deferred tax assets $143.3 million. The remaining foreign NOLs of

$117.6 million are subject to expiration beginning in 2015 and have associated deferred tax assets of

$34.7 million.

As of December 31, 2009, deferred tax assets for U.S. Foreign Tax Credit carryforwards were

$20.8 million which relate to credits generated as of December 31, 2007. The carryforwards will begin to

expire in 2015. A valuation allowance of $13.5 million at December 31, 2009 was recorded against a

portion of the U.S. foreign tax credit deferred tax assets in the likelihood that they may not be utilized in

the future. A deferred tax asset was also recorded for various state tax credit carryforwards of

$3.9 million, which will begin to expire in 2027.

In determining the valuation allowance, an assessment of positive and negative evidence was performed

regarding realization of the net deferred tax assets in accordance with ASC 740-10, ‘‘Accounting for

Income Taxes,’’ or ‘‘ASC 740-10.’’ This assessment included the evaluation of scheduled reversals of

deferred tax liabilities, the availability of carryforwards and estimates of projected future taxable income.

Based on the assessment, as of December 31, 2009, total valuation allowances of $167.8 million were

recorded against deferred tax assets. Although realization is not assured, we have concluded that it is

more likely than not the remaining deferred tax assets of $1,290.5 million will be realized and as such no

valuation allowance has been provided on these assets.

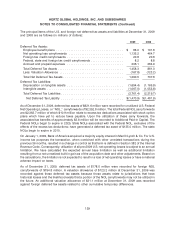

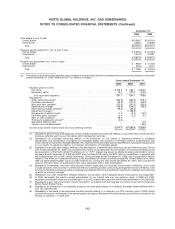

The significant items in the reconciliation of the statutory and effective income tax rates consisted of the

following:

Years ended December 31,

2009 2008 2007

Statutory Federal Tax Rate ............................... 35.0% 35.0% 35.0%

Foreign tax differential ................................... 21.1 (0.5) (9.8)

State and local income taxes, net of federal income tax benefit ..... 6.0 0.7 2.1

Change in state statutory rates, net of federal income tax benefit .... 3.5 0.1 (3.7)

Effect of impairment charges .............................. —(16.6) —

Federal permanent differences ............................ 2.0 0.1 (1.0)

Withholding taxes ...................................... (4.8) (0.5) 1.4

Uncertain tax positions .................................. (2.8) (0.4) 2.1

Increase (decrease) in valuation allowance .................... (26.2) (3.8) —

All other items, net ..................................... 1.1 0.1 0.4

Effective Tax Rate .................................... 34.9% 14.2% 26.5%

The increase in the 2009 effective tax rate is primarily due to nonrecurring 2008 impairment losses.

As of December 31, 2009, our foreign subsidiaries have net undistributed earnings of $228.1 million.

Deferred taxes have not been recorded for such earnings because it is management’s current intention

to permanently reinvest undistributed earnings and there is no foreseeable need to distribute offshore

reserves or earnings as it is not practical to determine such deferred tax liabilities. If, in the future,

undistributed earnings are repatriated to the United States, or it is determined such earnings will be

repatriated in the foreseeable future, deferred taxes will be recorded.

The provisions of FASB Interpretation No. 48, ‘‘Accounting for Uncertainty in Income Taxes—an

Interpretation of FASB Statement No. 109,’’ which was incorporated in ASC 740-10, were adopted on

January 1, 2007. Upon adoption, an $18.9 million increase to liabilities for unrecognized tax benefits was

140