Hertz 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

Our liquidity as of December 31, 2009 was $5.8 billion, which consisted of $1.0 billion of cash and cash

equivalents, $0.9 billion of unused commitments under our Senior ABL Facility and $3.9 billion of unused

commitments under our Fleet Financing Facilities. Taking into consideration the borrowing base

limitations in our Senior ABL Facility and in our Fleet Debt, the amount that we had available for

immediate use as of December 31, 2009 under our Senior ABL Facility was $0.9 billion and we had

$0.4 billion of over-enhancement that was available under our Fleet Debt. Accordingly, as of

December 31, 2009 we had $2.3 billion ($1.0 billion in cash and cash equivalents, $0.9 billion available

under our Senior ABL Facility and $0.4 billion available under our various Fleet Debt facilities) in liquidity

that was available for our immediate use. Future availability of borrowings under these facilities will

depend on borrowing base requirements and other factors, many of which are outside our control. See

‘‘Item 1A—Risk Factors—Risks Related to our Substantial Indebtedness—Our reliance on asset-backed

financing to purchase cars subjects us to a number of risks, many of which are beyond our control.’’

Also, substantially all of our revenue earning equipment and certain related assets are owned by special

purpose entities, or are subject to liens in favor of our lenders under our various credit facilities.

Substantially all our other assets in the United States are also subject to liens in favor of our lenders

under our various credit facilities. None of such assets will be available to satisfy the claims of our

general creditors.

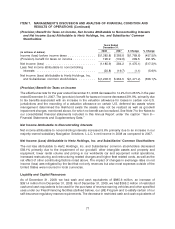

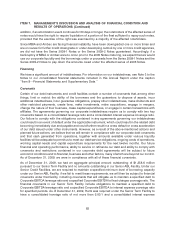

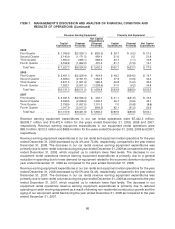

Contractual Obligations

The following table details the contractual cash obligations for debt and related interest payable,

operating leases and concession agreements, ASC 740, ‘‘Income Taxes,’’ or ‘‘ASC 740,’’ liability and

interest and other purchase obligations as of December 31, 2009 (in millions of dollars):

Payments Due by Period

2011 to 2013 to

Total 2010 2012 2014 After 2014 All Other

Debt(1) ................... $10,530.4 $4,574.6 $1,908.0 $3,151.4 $ 896.4 $ —

Interest on debt(2) ........... 1,916.0 463.3 730.1 585.4 137.2 —

Operating leases and

concession agreements(3) .... 1,740.8 404.2 587.0 328.2 421.4 —

ASC 740 liability and interest(4) . . 27.9 ————27.9

Purchase obligations(5) ........ 4,503.3 4,464.8 37.2 1.3 ——

Total ..................... $18,718.4 $9,906.9 $3,262.3 $4,066.3 $1,455.0 $27.9

(1) Amounts represent aggregate debt obligations included in ‘‘Debt’’ in our consolidated balance sheet and include $1,598.9 million of

other short-term borrowings. These amounts exclude estimated payments under interest rate swap agreements. See Note 3 to the

Notes to our consolidated financial statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’

Our short-term borrowings as of December 31, 2009 include, among other items, the amounts outstanding under our Senior ABL

Facility, International Fleet Debt facility, International ABS Fleet Financing Facility, Fleet Financing Facility, Brazilian Fleet Financing

Facility, Canadian Fleet Financing Facility, Belgian Fleet Financing Facility and our Capitalized Leases. These amounts are

considered short-term in nature since they have maturity dates of three months or less; however these facilities are revolving in nature

and do not permanently expire at the time of the short-term debt maturity. In addition, we include certain scheduled payments of

principal under our ABS Program as short-term borrowings.

(2) Amounts represent the estimated interest payments based on the principal amounts, minimum non-cancelable maturity dates and

applicable interest rates on the debt at December 31, 2009. The minimum non-cancelable obligations under the U.S. Fleet Debt,

International Fleet Debt, Senior ABL Facility, International ABS Fleet Financing Facility and the Fleet Financing Facility mature

between June 2010 and December 2015.

84