Hertz 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

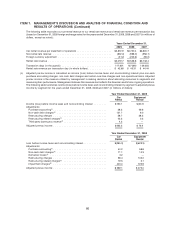

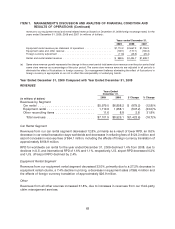

For the year ended December 31, 2009, based on publicly available information, we believe some U.S.

car rental companies experienced declines in transaction days and varying rental rate revenue per

transaction day, or ‘‘RPD,’’ compared to the year ended December 31, 2008. For the year ended

December 31, 2009, in the United States, we experienced a 7.1% decrease in transaction days and a

1.6% decrease in RPD versus 2008. During the year ended December 31, 2009, in our European

operations, we experienced a low double digit decrease in transaction days and a low single digit

decrease in RPD versus 2008.

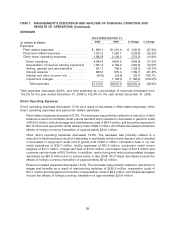

In the three years ended December 31, 2009, we increased the number of our off-airport rental locations

in the United States by approximately 7% to approximately 1,700 locations. Revenues from our U.S.

off-airport operations represented $954.0 million, $975.9 million and $963.8 million of our total car rental

revenues in the years ended December 31, 2009, 2008 and 2007, respectively. In 2010 and subsequent

years, our strategy will include selected openings of new off-airport locations, the disciplined evaluation

of existing locations and the pursuit of same-store sales growth. Our strategy includes increasing

penetration in the off-airport market and growing the online leisure market, particularly in the longer

length weekly sector, which is characterized by lower vehicle costs and lower transaction costs at a

lower RPD. Increasing our penetration in these sectors is consistent with our long-term strategy to

generate profitable growth. When we open a new off-airport location, we incur a number of costs,

including those relating to site selection, lease negotiation, recruitment of employees, selection and

development of managers, initial sales activities and integration of our systems with those of the

companies who will reimburse the location’s replacement renters for their rentals. A new off-airport

location, once opened, takes time to generate its full potential revenues and, as a result, revenues at new

locations do not initially cover their start-up costs and often do not, for some time, cover the costs of their

ongoing operations.

For the years ended December 31, 2007, 2008 and 2009, based on publicly available information, we

believe the U.S. equipment rental industry experienced downward pricing. HERC experienced higher

equipment rental volumes and pricing worldwide for the year ended December 31, 2007, with pricing

increases in 2007 attributable to higher price activity in Canada and Europe offsetting lower price activity

in the U.S. HERC experienced lower equipment rental volumes and pricing worldwide for the years

ended December 31, 2008 and 2009.

Critical Accounting Policies and Estimates

Our discussion and analysis of financial condition and results of operations are based upon our

consolidated financial statements, which have been prepared in accordance with accounting principles

generally accepted in the United States of America, or ‘‘GAAP.’’ The preparation of these financial

statements requires management to make estimates and judgments that affect the reported amounts in

our financial statements and accompanying notes.

We believe the following critical accounting policies affect the more significant judgments and estimates

used in the preparation of our financial statements and changes in these judgments and estimates may

impact our future results of operations and financial condition. For additional discussion of our

accounting policies, see Note 1 to the Notes to our consolidated financial statements included in this

Annual Report under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Revenue Earning Equipment

Our principal assets are revenue earning equipment, which represented approximately 55% of our total

assets as of December 31, 2009. Revenue earning equipment consists of vehicles utilized in our car

59