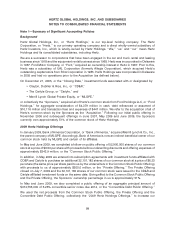

Hertz 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

to the Prior Plans will continue to be subject to and governed by the terms of the Prior Plans. As of

December 31, 2009, there were 13.0 million shares of our common stock underlying awards outstanding

under the Prior Plans. In addition, as of December 31, 2009, there were 8.1 million shares of our common

stock underlying awards outstanding under the Omnibus Plan.

In addition to the 21.1 million shares underlying outstanding awards as of December 31, 2009, we had

8.9 million shares of our common stock available for issuance under the Omnibus Plan. The shares of

common stock to be delivered under the Omnibus Plan may consist, in whole or in part, of common

stock held in treasury or authorized but unissued shares of common stock, not reserved for any other

purpose.

In February 2009, we granted options to acquire 52,500 shares of our common stock at an exercise price

of $3.24 per share under the Omnibus Plan.

In 2009, we granted 6,465,239 Restricted Stock Units, or ‘‘RSUs,’’ to key executives and employees and

Performance Stock Units, or ‘‘PSUs.’’

For the year ended December 31, 2009, we recognized compensation cost of approximately

$34.5 million ($21.1 million, net of tax) for options, RSUs and PSUs granted pursuant to our Prior Plans

and the Omnibus Plan.

On February 28, 2008, upon recommendation of the compensation committee of our Board of Directors,

our Board of Directors adopted the Hertz Global Holdings, Inc. Employee Stock Purchase Plan, or the

‘‘ESPP,’’ and the plan was approved by our stockholders on May 15, 2008. The ESPP is intended to be

an ‘‘employee stock purchase plan’’ within the meaning of Section 423 of the Internal Revenue Code.

The maximum number of shares that may be purchased under the ESPP is 3,000,000 shares of our

common stock, subject to adjustment in the case of any change in our shares, including by reason of a

stock dividend, stock split, share combination, recapitalization, reorganization, merger, consolidation or

change in corporate structure.

For the year ended December 31, 2009, we recognized compensation cost of approximately $0.5 million

($0.3 million, net of tax) for the amount of the discount on the stock purchased by our employees.

Approximately 1,800 employees participated in the ESPP as of December 31, 2009.

See Note 5 of the Notes to our consolidated financial statements included in this Annual Report under

the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

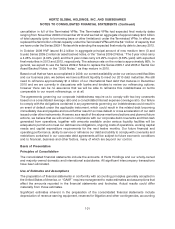

Recent Accounting Pronouncements

For a discussion of recent accounting pronouncements, see Note 1 to the Notes to our consolidated

financial statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

See ‘‘Item 7—Management’s Discussion and Analysis of Financial Condition and Results of

Operations—Market Risks’’ included elsewhere in this Annual Report.

92