Hertz 2009 Annual Report Download - page 125

Download and view the complete annual report

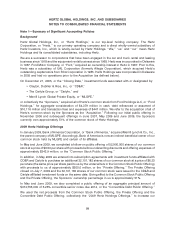

Please find page 125 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

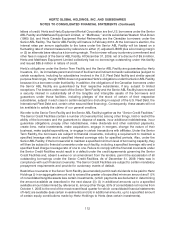

been used for speculative or trading purposes. In addition, derivative financial instruments are entered

into with a diversified group of major financial institutions in order to manage our exposure to

counterparty nonperformance on such instruments. We account for all derivatives in accordance with

GAAP, which requires that all derivatives be recorded on the balance sheet as either assets or liabilities

measured at their fair value. The effective portion of changes in fair value of derivatives designated as

cash flow hedging instruments is recorded as a component of other comprehensive income. The

ineffective portion is recognized currently in earnings within the same line item as the hedged item,

based upon the nature of the hedged item. For derivative instruments that are not part of a qualified

hedging relationship, the changes in their fair value are recognized currently in earnings. See Note 12—

Financial Instruments.

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to

differences between the financial statement carrying amounts of existing assets and liabilities and their

respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected

to apply to taxable income in the years in which those temporary differences are expected to be

recovered or settled. The effect of a change in tax rates is recognized in the statement of operations in

the period that includes the enactment date. Valuation allowances are recorded to reduce deferred tax

assets when it is more likely than not that a tax benefit will not be realized. Subsequent changes to

enacted tax rates and changes to the global mix of earnings will result in changes to the tax rates used to

calculate deferred taxes and any related valuation allowances. Provisions are not made for income taxes

on undistributed earnings of international subsidiaries that are intended to be indefinitely reinvested

outside the United States or are expected to be remitted free of taxes. Future distributions, if any, from

these international subsidiaries to the United States or changes in U.S. tax rules may require a change to

reflect tax on these amounts.

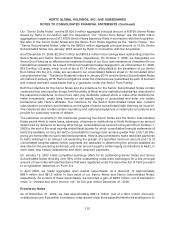

Prior to the Acquisition, Hertz and its domestic subsidiaries filed a consolidated federal income tax return

with Ford. Pursuant to a tax sharing agreement, with Ford, current and deferred taxes were reported and

paid to Ford, as if Hertz had filed its own consolidated tax returns with its domestic subsidiaries. The tax

sharing agreement provided that Hertz was reimbursed for foreign tax credits in accordance with the

utilization of those credits by the Ford consolidated tax group.

On December 21, 2005, in connection with the Acquisition, the tax sharing agreement with Ford was

terminated. Upon termination, all tax payables and receivables with Ford were cancelled and neither

Hertz nor Ford has any future rights or obligations under the tax sharing agreement. Hertz may be

exposed to tax liabilities attributable to periods it was a consolidated subsidiary of Ford. While Ford has

agreed to indemnify Hertz for certain tax liabilities pursuant to the arrangements relating to our

separation from Ford, we cannot offer assurance that payments in respect of the indemnification

agreement will be available.

See Note 7—Taxes on Income.

Advertising

Advertising and sales promotion costs are expensed as incurred. We incurred net advertising expense

for the years ended December 31, 2009, 2008 and 2007 of $116.3 million, $163.2 million and

$173.5 million, respectively.

105