Hertz 2009 Annual Report Download - page 77

Download and view the complete annual report

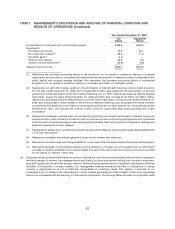

Please find page 77 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

investment in commercial construction and the industrial markets slow. The United States and

international markets are currently experiencing a significant decline in economic activities, including a

tightening of the credit markets, reduced airline passenger traffic, reduced consumer spending and

volatile fuel prices. During 2008 and 2009, these market conditions resulted in a rapid decline in the

volume of car rental and equipment rental transactions, soft industry pricing and lower residual values

for the non-program cars and equipment that we sold. See ‘‘Item 1A—Risk Factors’’ in this Annual

Report.

Our profitability is primarily a function of the volume, mix and pricing of rental transactions and the

utilization of cars and equipment. Significant changes in the purchase price or residual values of cars

and equipment or interest rates can also have a significant effect on our profitability depending on our

ability to adjust pricing for these changes. We continue to increase the proportion of non-program cars

we have in our worldwide fleet. In the U.S., for the year ended December 31, 2009, the percentage of

non-program cars was 51% as compared to 45% for the year ended December 31, 2008. For the year

ended December 31, 2009, the percentage of non-program cars in our international fleet was 39%,

compared to 41% for the year ended December 31, 2008.

In early 2010, Toyota announced recalls. As such, we temporarily took a portion of our Toyota fleet out of

service. Approximately 13% of our total U.S. car rental fleet was affected by the largest of these recalls.

We rapidly made repairs to the recalled vehicles, and this situation is now completely resolved. There

was a short-term impact on our business to cover the costs associated with repairing these vehicles;

however, we believe that this recall will not have a long-term material impact on our business. Also, we

unfortunately turned away some, but not a significant number of rentals as a result of the recall. We are

also working closely with Toyota to minimize our financial exposure. See ‘‘Item 1A—Risk Factors—Risks

Related to Our Business—Manufacturer recalls could create risks to our business.’’

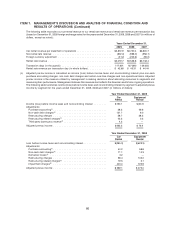

In the year ended December 31, 2009, our per car vehicle depreciation costs decreased approximately

4% and increased approximately 7% in the United States and Europe, respectively, as compared to the

prior year period. Our per car vehicle depreciation costs in the United States for 2008 increased

approximately 6% from our per car vehicle depreciation costs for 2007 and increased approximately

20% in Europe year-over-year. We expect our per car vehicle depreciation costs for the full year of 2010 in

the United States and Europe to be lower than 2009. Our business requires significant expenditures for

cars and equipment, and consequently we require substantial liquidity to finance such expenditures.

See ‘‘Liquidity and Capital Resources’’ below.

Our car rental and equipment rental operations are seasonal businesses, with decreased levels of

business in the winter months and heightened activity during the spring and summer. We have the ability

to dynamically manage fleet capacity, the most significant portion of our cost structure, to meet market

demand. For instance, to accommodate increased demand, we increase our available fleet and staff

during the second and third quarters of the year. As business demand declines, fleet and staff are

decreased accordingly. A number of our other major operating costs, including airport concession fees,

commissions and vehicle liability expenses, are directly related to revenues or transaction volumes. In

addition, our management expects to utilize enhanced process improvements, including efficiency

initiatives and the use of our information technology systems, to help manage our variable costs.

Approximately two-thirds of our typical annual operating costs represent variable costs, while the

remaining one-third is fixed or semi-fixed. We also maintain a flexible workforce, with a significant

number of part time and seasonal workers. However, certain operating expenses, including minimum

concession fees, rent, insurance, and administrative overhead, remain fixed and cannot be adjusted for

seasonal demand.

57