Hertz 2009 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

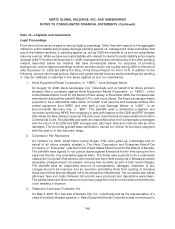

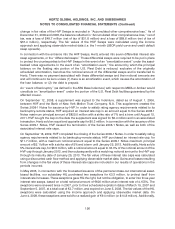

the District Court of Wyandotte County, Kansas. The case was subsequently transferred to the

District Court of Johnson County, Kansas. The Fun Services matter purports to be a class action

on behalf of all persons in Kansas and throughout the United States who on or after four years

prior to the filing of the action were sent facsimile messages of advertising materials relating to

the availability of property, goods or services by HERC and who did not provide express

permission for sending such faxes. The plaintiffs seek an unspecified amount of compensatory

damages, attorney’s fees and costs. In August 2009, the court issued an order that stayed all

activity in this litigation pending a decision by the Kansas Supreme Court in Critchfield Physical

Therapy, Inc. v. Taranto Group, Inc., another Telephone Consumer Protection Act case. The

Kansas Supreme Court heard oral argument in the Critchfield case in January of 2010 and we

believe that the stay in the Fun Services litigation will remain in effect until approximately

mid-2010.

4. California Tourism Assessments

We are currently a defendant in a proceeding that purports to be a class action brought by

Michael Shames and Gary Gramkow against The Hertz Corporation, Dollar Thrifty Automotive

Group, Inc., Avis Budget Group, Inc., Vanguard Car Rental USA, Inc., Enterprise Rent-A-Car

Company, Fox Rent A Car, Inc., Coast Leasing Corp., The California Travel and Tourism

Commission, and Caroline Beteta. Originally filed in November of 2007, the action is pending in

the United States District Court for the Southern District of California, and plaintiffs claim to

represent a class of individuals or entities that purchased rental car services from a defendant

at airports located in California after January 1, 2007. The complaint alleges that the defendants

agreed to charge consumers a 2.5% tourism assessment and not to compete with respect to

this assessment, while misrepresenting that this assessment is owed by consumers, rather

than the rental car defendants, to the California Travel and Tourism Commission, or the

‘‘CTTC’’. The complaint also alleges that defendants agreed to pass through to consumers a

fee known as the Airport Concession Fee, which fee had previously been required to be

included in the rental car defendants’ individual base rates, without reducing their base rates.

Based on these allegations, the complaint seeks treble damages, disgorgement, injunctive

relief, interest, attorneys’ fees and costs. The court has dismissed all claims against the CTTC,

and plaintiffs dropped their claims against Caroline Beteta. The court also dismissed all claims

against the rental car defendants except for the federal antitrust claim. The plaintiffs’ have

appealed the dismissal of their claims against the CTTC to the United States Court of Appeals

for the Ninth Circuit. The remaining claim against us, the federal antitrust claim, is in the

discovery stage.

We are currently a defendant in a consolidated action captioned ‘‘In re Tourism Assessment

Fee Litigation’’ pending in the United States District Court for the Southern District of California.

Originally filed as two separate actions in December of 2007, the consolidated action purports

to be a class action brought on behalf of all persons and entities that have paid an assessment

since the inception of the Passenger Car Rental Industry Tourism Assessment Program in

California on January 1, 2007. The other defendants include various of our competitors,

including Avis Budget Group, Inc., Vanguard Car Rental USA, Inc., Dollar Thrifty Automotive

Group, Inc., Advantage Rent-A-Car, Inc., Avalon Global Group, Enterprise Rent-A-Car

Company, Fox Rent A Car, Inc., Beverly Hills Rent-A-Car, Inc., Rent4Less, Inc., Autorent Car

Rental, Inc., Pacific Rent-A-Car, Inc., ABC Rent-A-Car, Inc., as well as The California Travel and

Tourism Commission, and Dale E. Bonner. The complaint sought injunctive and declaratory

relief, that all assessments collected and to be collected be held in trust, unspecified monetary

147