Hertz 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 1. BUSINESS (Continued)

Over the five years ended December 31, 2009, we have acquired approximately 59% of our cars as

program cars. Program cars as a percentage of all cars purchased by our U.S. operations, decreased

from 55% for the year ended December 31, 2008 to 49% for the year ended December 31, 2009.

Program cars as a percentage of all cars purchased by our international operations increased from 59%

for the year ended December 31, 2008 to 61% for the year ended December 31, 2009. Taking our U.S.

operations and international operations together, program cars as a percentage of all cars purchased

decreased from 57% for the year ended December 31, 2008 to 53% for the year ended December 31,

2009. Under these programs, the manufacturers agree to repurchase cars at a specified price or

guarantee the depreciation rate on the cars during established repurchase or auction periods, subject

to, among other things, certain car condition, mileage and holding period requirements. Repurchase

prices under repurchase programs are based on either a predetermined percentage of original car cost

and the month in which the car is returned or the original capitalized cost less a set daily depreciation

amount. Guaranteed depreciation programs guarantee on an aggregate basis the residual value of the

cars covered by the programs upon sale according to certain parameters which include the holding

period, mileage and condition of the cars. These repurchase and guaranteed depreciation programs

limit our residual risk with respect to cars purchased under the programs and allow us to determine

depreciation expense in advance, however, typically the acquisition cost is higher for these program

cars.

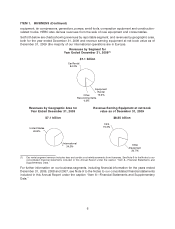

Over the five years ended December 31, 2009, approximately 31% of the cars acquired by us for our U.S.

car rental fleet, and approximately 27% of the cars acquired by us for our international fleet, were

manufactured by Ford and its subsidiaries. During the year ended December 31, 2009, approximately

12% of the cars acquired by us domestically were manufactured by Ford and its subsidiaries and

approximately 24% of the cars acquired by us for our international fleet were manufactured by Ford and

its subsidiaries. The percentage of the fleet which we purchase from Ford has declined during the past

five years as we try to further diversify our fleet to meet customer demands and minimize overall costs.

Historically, we have also purchased a significant percentage of our car rental fleet from General Motors

Corporation and its successor, General Motors Company, together ‘‘General Motors.’’ Over the five

years ended December 31, 2009, approximately 21% of the cars acquired by us for our U.S. car rental

fleet, and approximately 14% of the cars acquired by us for our international fleet, were manufactured by

General Motors. During the year ended December 31, 2009, approximately 17% of the cars acquired by

our U.S. car rental fleet, and approximately 11% of the cars acquired by us for our international fleet,

were manufactured by General Motors. We have also increased the percentage of our car rental fleet

purchased from Toyota Motor Corporation, or ‘‘Toyota.’’ Over the five years ended December 31, 2009,

approximately 16% of the cars acquired by us for our U.S. car rental fleet, and approximately 7% of the

cars acquired by us for our international fleet, were manufactured by Toyota. During the year ended

December 31, 2009, approximately 27% of the cars acquired by our U.S. car rental fleet, and

approximately 8% of the cars acquired by us for our international fleet, were manufactured by Toyota. In

early 2010, Toyota announced recalls. Approximately 13% of our total U.S. car rental fleet was affected

by the largest of the recalls. This situation is now completely resolved. See ‘‘Item 7—Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Overview,’’ included in this

Annual Report.

In the past several years, Ford and General Motors, which are significant suppliers of cars to us on both a

program and non-program basis, have experienced deterioration in their operating results and

significant declines in their credit ratings. General Motors has required significant government

assistance to continue their operations. See ‘‘Item 1A—Risk Factors—Risks Related to Our Business—If

we are unable to purchase adequate supplies of competitively priced cars or equipment and the cost of

13