Hertz 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

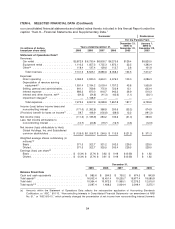

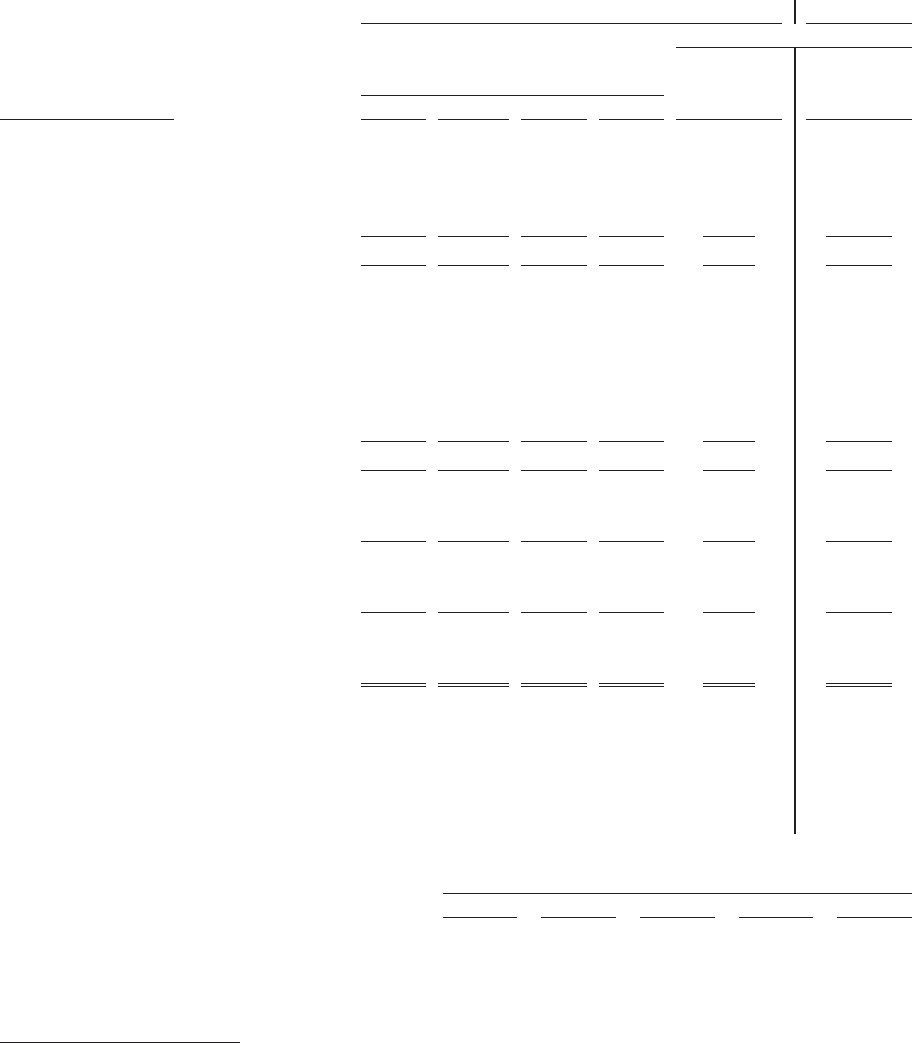

ITEM 6. SELECTED FINANCIAL DATA (Continued)

our consolidated financial statements and related notes thereto included in this Annual Report under the

caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Successor Predecessor

For the Periods From

December 21, January 1,

2005 to 2005 to

Years ended December 31,

(In millions of dollars, December 31, December 20,

except per share data) 2009 2008 2007 2006 2005 2005

Statement of Operations Data(a)

Revenues:

Car rental ...................... $5,872.9 $ 6,730.4 $6,800.7 $6,273.6 $129.4 $5,820.5

Equipment rental ................. 1,110.2 1,657.3 1,755.3 1,672.1 22.5 1,392.4

Other(b) ....................... 118.4 137.4 129.6 112.7 2.6 101.8

Total revenues ................. 7,101.5 8,525.1 8,685.6 8,058.4 154.5 7,314.7

Expenses:

Direct operating .................. 4,084.2 4,930.0 4,644.1 4,476.0 103.0 4,086.3

Depreciation of revenue earning

equipment(c) ................... 1,931.4 2,194.2 2,003.4 1,757.2 43.8 1,555.9

Selling, general and administrative ...... 641.1 769.6 775.9 723.9 15.1 623.4

Interest expense ................. 680.3 870.0 916.7 943.3 26.9 510.3

Interest and other income, net(d) ....... (64.5) (24.8) (41.3) (42.6) (1.1) (36.1)

Impairment charges(e) .............. — 1,168.9 —— — —

Total expenses ................. 7,272.5 9,907.9 8,298.8 7,857.8 187.7 6,739.8

Income (loss) before income taxes and

noncontrolling interest .............. (171.0) (1,382.8) 386.8 200.6 (33.2) 574.9

(Provision) benefit for taxes on income(f) . . . 59.7 196.9 (102.6) (68.0) 12.2 (191.3)

Net income (loss) .................. (111.3) (1,185.9) 284.2 132.6 (21.0) 383.6

Less: Net income attributable to

noncontrolling interest .............. (14.7) (20.8) (19.7) (16.7) (0.3) (12.3)

Net income (loss) attributable to Hertz

Global Holdings, Inc. and Subsidiaries’

common stockholders .............. $(126.0) $(1,206.7) $ 264.5 $ 115.9 $ (21.3) $ 371.3

Weighted average shares outstanding (in

millions)(g)

Basic ......................... 371.5 322.7 321.2 242.5 229.5 229.5

Diluted ........................ 371.5 322.7 325.5 243.4 229.5 229.5

Earnings (loss) per share(g)

Basic ......................... $ (0.34) $ (3.74) $ 0.82 $ 0.48 $ (0.09) $ 1.62

Diluted ........................ $ (0.34) $ (3.74) $ 0.81 $ 0.48 $ (0.09) $ 1.62

December 31,

2009 2008 2007 2006 2005

Balance Sheet Data

Cash and cash equivalents .................. $ 985.6 $ 594.3 $ 730.2 $ 674.5 $ 843.9

Total assets(h) ........................... 16,002.4 16,451.4 19,255.7 18,677.4 18,580.9

Total debt ............................. 10,364.4 10,972.3 11,960.1 12,276.2 12,515.0

Total equity(i)(j) ........................... 2,097.4 1,488.3 2,934.4 2,549.4 2,275.1

(a) Amounts within the Statement of Operations Data reflects the retrospective application of Accounting Standards

Codification, or ‘‘ASC,’’ 810-10, ‘‘Noncontrolling Interests in Consolidated Financial Statements—an amendment of ARB

No. 51,’’ or ‘‘ASC 810-10,’’ which primarily changed the presentation of net income from noncontrolling interest (formerly

54