Hertz 2009 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SCHEDULE I (Continued)

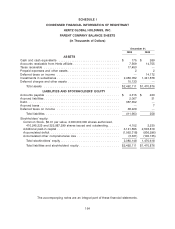

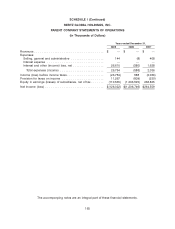

HERTZ GLOBAL HOLDINGS, INC.

NOTES TO PARENT COMPANY FINANCIAL STATEMENTS

Note 1—Background and Basis of Presentation

Hertz Global Holdings, Inc., or ‘‘Hertz Holdings,’’ is the top-level holding company that conducts

substantially all of its business operations through its indirect subsidiaries. Hertz Holdings was

incorporated in Delaware on August 31, 2005 in anticipation of the December 21, 2005 acquisition by its

subsidiary, Hertz Investors, Inc., of the Hertz Corporation.

There are significant restrictions over the ability of Hertz Holdings to obtain funds from its indirect

subsidiaries through dividends, loans or advances. Accordingly, these condensed financial statements

have been presented on a ‘‘parent-only’’ basis. Under a parent-only presentation, the investments of

Hertz Holdings in its consolidated subsidiaries are presented under the equity method of accounting.

These parent-only financial statements should be read in conjunction with the consolidated financial

statements of Hertz Holdings included in this Annual Report under the caption ‘‘Item 8—Financial

Statements and Supplementary Data.’’ For a discussion of background and basis of presentation, see

Note 1 to the Notes to the consolidated financial statements included in this Annual Report under the

caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Note 2—Debt

Convertible Senior Notes

In May and June 2009, we issued $474.8 million in aggregate principal amount of 5.25% convertible

senior notes due January 2014. Our Convertible Senior Notes may be convertible by holders into shares

of our common stock, cash or a combination of cash and shares of our common stock, as elected by us,

initially at a conversion rate of 120.6637 shares per $1,000 principal amount of notes, subject to

adjustment. However, we have a policy of settling the conversion of our Convertible Senior Notes using a

combination settlement, which calls for settling the fixed dollar amount per $1,000 in principal amount in

cash and settling in shares, the excess conversion value, if any. Proceeds from the Convertible Debt

Offering were allocated between ‘‘Debt’’ and ‘‘Additional paid-in capital.’’ The value assigned to the debt

component was the estimated fair value, as of the issuance date, of a similar debt instrument without the

conversion feature, and the difference between the proceeds for the Convertible Senior Notes and the

amount reflected as a debt liability was recorded as ‘‘Additional paid-in capital.’’ As a result, the debt was

recorded at a discount of $117.9 million reflecting its below market coupon interest rate. The debt is

subsequently accreted to its par value over its expected life, with the rate of interest that reflects the

market rate at issuance being reflected in the consolidated statements of operations.

On December 1, 2009, Hertz Holdings made the first semi-annual interest payment of $12.8 million on

the convertible notes. Hertz Holdings made this payment with a combination of cash on hand and

proceeds from the repayment of an inter-company loan from Hertz.

In the future, if our cash on hand and proceeds from the repayment of inter-company loans from Hertz is

not sufficient to pay the semi-annual interest payment, we would need to receive a dividend, loan or

advance from our subsidiaries. However, none of our subsidiaries are obligated to make funds available

to us and certain of Hertz’s credit facilities have requirements that must be met prior to it making

dividends, loans or advances to us. In addition, Delaware law imposes requirements that may restrict

Hertz’s ability to make funds available to Hertz Holdings.

For a discussion of the debt obligations of the indirect subsidiaries of Hertz Holdings, see Note 3 to the

Notes to the consolidated financial statements included in this Annual Report under the caption

‘‘Item 8—Financial Statements and Supplementary Data.’’

168