Hertz 2009 Annual Report Download - page 120

Download and view the complete annual report

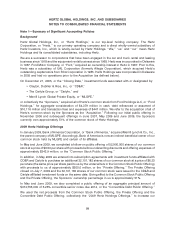

Please find page 120 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

liquidity and for general corporate purposes, including the repayment of principal amounts with respect

to debt under the fleet financing facilities of certain of our consolidated subsidiaries.

Liquidity

The car and equipment rental industries are significantly influenced by general economic conditions. In

the final three months of 2008 and throughout 2009, both the car and equipment rental markets

experienced unprecedented declines due to the precipitous slowdown in consumer spending as well as

significantly reduced demand for industrial and construction equipment. The car rental industry is also

significantly influenced by developments in the travel industry, and, particularly, in airline passenger

traffic, while the equipment rental segment is being impacted by the difficult economic and business

environment as investment in commercial construction and the industrial markets slow. The United

States and international markets are currently experiencing a significant decline in economic activities,

including a tightening of the credit markets, reduced airline passenger traffic, reduced consumer

spending and volatile fuel prices. These conditions are expected to continue into 2010. During 2008 and

2009, this resulted in a rapid decline in the volume of car rental and equipment rental transactions, soft

industry pricing and lower residual values for the non-program cars and equipment that we sold.

‘‘Non-program cars’’ mean cars not purchased under repurchase or guaranteed depreciation programs

for which the car rental company is exposed to residual risk.

In response to the economic downturn, in 2008 we implemented aggressive strategic actions to reduce

costs and improve liquidity. These actions included reducing wage and benefit costs through significant

headcount reductions, accelerating fleet deletions and delaying additions to right-size the fleet to current

demand levels and rationalizing our location footprint by closing a number of locations. In an effort to

mitigate the impact of continued revenue declines on our results of operations, we reduced costs further

through the additional headcount reductions.

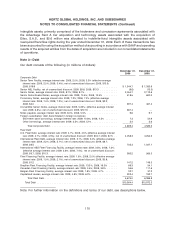

As of December 31, 2009, we had $10,364.4 million of total indebtedness outstanding. Accordingly, we

are highly leveraged and a substantial portion of our liquidity needs arise from debt service on

indebtedness incurred in connection with the Acquisition and from the funding of our costs of operations

and capital expenditures.

In 2009 we raised new capital intended to fund the 2010 fleet debt maturities as they occur. We began

addressing these liquidity needs at the end of the second quarter and the beginning of the third quarter

by completing the 2009 Hertz Holdings Offerings, pursuant to which we received approximately

$990 million of net proceeds, after deducting underwriting discounts and commissions and before

offering expenses payable by Hertz Holdings.

On September 18, 2009, Hertz Vehicle Financing LLC, or ‘‘HVF,’’ a bankruptcy-remote special purpose

entity wholly-owned by Hertz, completed the closing of a new variable funding note facility referred to as

the Series 2009-1 Variable Funding Rental Car Asset Backed Notes, or the ‘‘Series 2009-1 Notes.’’ The

facility has an expected maturity date of January 2012 and a 3 month controlled amortization period

beginning in November 2011. The aggregate principal amount of such facility is $2.1 billion and such

facility is available to HVF on a revolving basis until the controlled amortization period begins in

November 2011.

Immediately prior to the issuance of the Series 2009-1 Notes, HVF caused the termination of the series

supplements and note purchase agreements relating to its Series 2005-3 Variable Funding Rental Car

Asset Backed Notes, or the ‘‘Series 2005-3 Notes,’’ Series 2005-4 Variable Funding Rental Car Asset

Backed Notes, or the ‘‘Series 2005-4 Notes,’’ and Series 2008-1 Variable Funding Rental Car Asset

Backed Notes, or the ‘‘Series 2008-1 Notes,’’ or the ‘‘Terminated VFNs,’’ and caused the repayment and

100