Hertz 2009 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2009 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

the form of shares of our common stock having a fair market value at such time equal to the amount of

such fees. Any such shares are paid to the director when cash fees would otherwise be payable,

although, if a director so chooses, these shares may be payable on a tax-deferred basis in phantom

shares if the requirements regarding such deferral are met in accordance with applicable tax law, in

which case the actual shares of our common stock are paid to the director promptly following the date

on which he or she ceases to serve as a director (or, if earlier, upon a change in control as defined in the

Director Plan or the Omnibus Plan).

Options granted under the Director Compensation Policy must be granted at an exercise price no less

than fair market value of such shares on the date of grant. Options granted as part of a director’s annual

retainer fee will be fully vested at the time of grant and will generally have a 10-year term.

In May 2009, the Board of Directors approved an amendment to the Director Compensation Policy,

whereby the equity portion of the annual retainer fee will now be paid in the form of shares of Hertz

Holdings common stock instead of options. In addition, the Board of Directors also passed a resolution

reducing the annual retainer fee by 20% for the period from May 2009 to May 2010 or such earlier date as

Hertz Holdings fully restores the salary reductions of its officers. In the fall of 2009, Hertz Holdings fully

restored the salary reductions of its officers and accordingly, the annual retainer fee for the Board of

Directors was also restored.

A director recognizes ordinary income upon exercising options granted in an amount equal to the fair

market value of the shares acquired on the date of exercise, less the exercise price, and we have a

corresponding tax deduction at that time. In the case of shares issued in lieu of cash fees, a director who

is an individual generally recognizes ordinary income equal to the fair market value of such shares on the

date such shares are paid to the director and we have a corresponding tax deduction at that time. For the

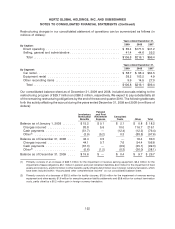

years ended December 31, 2009, 2008 and 2007, we recognized $1.6 million, $1.8 million and

$1.7 million, respectively, of expense relating to the Director Compensation Policy in our consolidated

statement of operations in ‘‘Selling, general and administrative’’ expenses.

All equity awards granted to our directors prior to May 15, 2008 pursuant to the Director Compensation

Policy were granted pursuant the Director Plan, which was approved by our stockholders on October 20,

2006. On February 28, 2008, our Board of Directors adopted the Omnibus Plan, which was approved by

our stockholders at the annual meeting of stockholders held on May 15, 2008. The Omnibus Plan

provides that no further equity awards will be granted pursuant to the Director Plan. However, awards

that had been previously granted pursuant to the Director Plan prior to May 15, 2008 will continue to be

subject to and governed by the terms of the Director Plan. Accordingly, all equity awards granted to our

directors on May 15, 2008 as part of our Director Compensation Policy were (and those that are granted

in the future pursuant to the Director Compensation Policy will be) granted pursuant to the Omnibus

Plan.

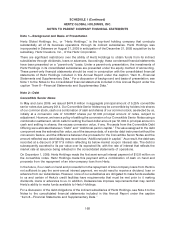

Financing Arrangements with Related Parties

Affiliates of ML Global Private Equity, L.P. and its related funds (which are stockholders of Hertz Holdings)

and of Merrill Lynch & Co., Inc., or ‘‘ML,’’ one of the underwriters in the initial public offering of our

common stock and the June 2007 secondary offering by the Sponsors, were lenders under the Hertz

Holdings Loan Facility (which was repaid with the proceeds of our initial public offering); are lenders

under the original and amended Senior Term Facility, the original and amended Senior ABL Facility and

the Fleet Financing Facility; acted as initial purchasers with respect to the offerings of the Senior Notes,

the Senior Subordinated Notes and the Series 2008-1 Notes; acted as structuring advisors and agents

160