HSBC 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006

Annual Report and Accounts

HSBC Holdings plc

Table of contents

-

Page 1

2006 Annual Report and Accounts HSBC Holdings plc -

Page 2

...the world. Its international network comprises over 10,000 properties in 82 countries and territories in Europe; Hong Kong; Rest of Asia-Pacific, including the Middle East and Africa; North America and Latin America. With listings on the London, Hong Kong, New York, Paris and Bermuda stock exchanges... -

Page 3

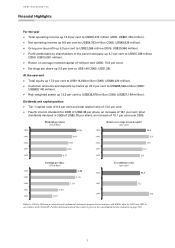

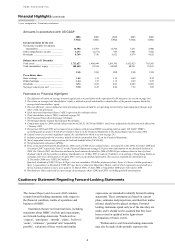

...,928 million (2005: US$98,226 million). Customer accounts and deposits by banks up 23.2 per cent to US$996,528 million (2005: US$809,146 million). Risk-weighted assets up 13.5 per cent to US$938,678 million (2005: US$827,164 million). Dividends and capital position • • Tier 1 capital ratio of... -

Page 4

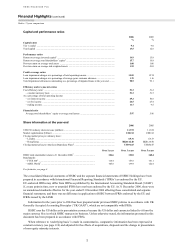

... (billion) ...Closing market price per ordinary share: - London ...- Hong Kong ...Closing market price per American Depositary Share4 ...Over 1 year HSBC total shareholder return to 31 December 2006 ...Benchmarks: - FTSE 1006 ...- MSCI World7 ...For footnotes, see page 4. 5 2005 11,334 US... -

Page 5

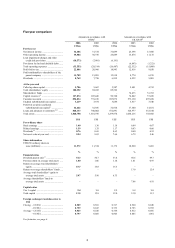

... ...Loan impairment charges and other credit risk provisions ...Provisions for bad and doubtful debts ...Total operating expenses ...Profit before tax ...Profit attributable to shareholders of the parent company ...Dividends ...At the year-end Called up share capital ...Total shareholders' equity... -

Page 6

...before loan impairment charges and other credit risk provisions. 4 Each American Depositary Share ('ADS') represents five ordinary shares. 5 Total shareholder return ('TSR') is defined on page 281. 6 The Financial Times-Stock Exchange 100 Index. 7 The Morgan Stanley Capital International World Index... -

Page 7

... government-established exchange rates (for example, between the Hong Kong dollar and US dollar); volatility in interest rates; volatility in equity markets, including in the smaller and less liquid trading markets in Asia and South America; lack of liquidity in wholesale funding markets in periods... -

Page 8

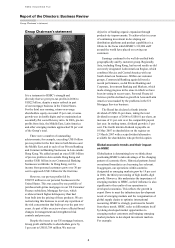

... cent of the Group's total. There were a number of outstanding achievements, for example, exceeding US$1 billion pre-tax profits for the first time in both Mexico and the Middle East, and in each of our Private Banking and Commercial Banking businesses in Asia outside Hong Kong. We added around an... -

Page 9

... Financing Review. Our Global Markets business was named Best at Treasury and Risk Management in Asia by Euromoney for the ninth consecutive year. increased and the alternative fund management sector expanded. The customer base of International Premier, the Group's personal banking service targeted... -

Page 10

... minutes. In Hong Kong in the past four years, processing has been moved from the branches in favour of sales-related activities, with the result that less than 5 per cent of transactions are now being handled physically in the branches. In the UK retail network, product simplification has reduced... -

Page 11

... international bank, we opened 13 new offices, taking the total to 45. We made significant progress in developing our personal and commercial distribution platforms throughout Asia, the Middle East and Latin America. We added 25 consumer finance offices in India and 28 in Indonesia. We established... -

Page 12

...by facilitating trade flows. Additionally, financial markets are providing more sophisticated tools to help personal customers plan their long-term financial affairs, corporates to hedge their business risks and investors to manage their portfolio risks. The demand for financial services, therefore... -

Page 13

... services. Headquartered in London, HSBC operates through long-established businesses and has an international network of over 10,000 properties in 82 countries and territories in five geographical regions: Europe; Hong Kong; Rest of Asia-Pacific, including the Middle East and Africa; North America... -

Page 14

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Customer groups > Summary / Business highlights Customer groups and global businesses Summary HSBC manages its business through two customer groups, Personal Financial Services and Commercial Banking, and two global businesses,... -

Page 15

... designed modern customer-friendly branches in selected markets; facilitating direct multi-channel access to the Group's services, and building a high quality system to help manage banking relationships; enhancing HSBC Premier as a signature product for the Group, offering a premium banking service... -

Page 16

... launch of seven-day opening in selected UK, US and Hong Kong branches. Investment in the retail network continued in Europe, North America and parts of Asia-Pacific. • In the latter, HSBC began to introduce its Group-wide credit card system, expanded consumer finance in India and Indonesia, and... -

Page 17

... by the success of new products such as the High Rate Savings Account, deposit balances rose. Rest of Asia-Pacific • HSBC invested in selected markets within the region, notably in cards, consumer finance, insurance, direct banking and Islamic banking. New branches were opened in India, mainland... -

Page 18

...Share of HSBC's profit before tax ...Cost efficiency ratio ...Selected balance sheet data5 Loans and advances to customers (net) ...Total assets ...Customer accounts ...For footnotes, see page 26. 2 Strategic direction HSBC's strategy is to be the leading international business bank for Commercial... -

Page 19

...sales. • • Hong Kong • HSBC was named 'World's Best Trade Finance Bank in Hong Kong' by Global Finance magazine, recognising the bank's efforts developing a centre of excellence for international trade. A new micro-business lending programme was launched, with a streamlined loan application... -

Page 20

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Business highlights Corporate, Investment Banking and Markets Profit before tax Year ended 31 December 2006 2005 2004 US$m US$m US$m Net interest income ...Net fee income ...Trading income excluding net interest income ...Net ... -

Page 21

... services Balance sheet management ...Group Investment Businesses ...Private equity ...Other1 ...Total operating income ...Selected balance sheet data5 Loans and advances to: - customers (net) ...- banks (net) ...Total assets ...Customer accounts ...Trading assets, financial instruments designated... -

Page 22

... data5 Loans and advances to customers (net) ...Total assets ...Customer accounts ...For footnotes, see page 26. 3 2 Strategic direction The strategy for Private Banking is to be one of the world's leading international private banks, by providing excellent client service. HSBC's global network and... -

Page 23

... managed products, which reached a value of US$4.8 billion. Recognising the value to be derived from closer links with other customer groups, dedicated teams working with Commercial Banking, Personal Financial Services and Corporate, Investment Banking and Markets produced a significant increase... -

Page 24

... region Europe ...Hong Kong ...Rest of Asia-Pacific ...North America4 ...Latin America4 ...Profit/(loss) before tax ...Share of HSBC's profit before tax ...Cost efficiency ratio ...Selected balance sheet data5 Loans and advances to customers (net) ...Total assets ...Customer accounts ...(625... -

Page 25

... and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial assets designated at fair value, and financial investments ...- deposits by banks ...For footnotes, see page 26. Personal Financial Commercial Services... -

Page 26

... assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial assets designated at fair value, and financial investments ...- deposits by banks ...For footnotes, see page 26. 2 1 Personal Financial Services... -

Page 27

... balance sheet data5 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial assets designated at fair value... -

Page 28

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Geographical regions > Summary / Competitive environment Basis of preparation The results are presented in accordance with the accounting policies used in the preparation of HSBC's consolidated financial statements. HSBC's ... -

Page 29

... Hong Kong and mainland China, the HSBC Group conducts business in 21 countries in the Asia-Pacific region, primarily through branches and subsidiaries of The Hongkong and Shanghai Banking Corporation, with particularly strong coverage in India, Indonesia, South Korea, Singapore and Taiwan. HSBC... -

Page 30

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Competitive environment and the investment banking operations of other commercial banks. Regulators routinely monitor and investigate the competitiveness of the financial services industry (of which HSBC is a part) in a number ... -

Page 31

... market. Robust equity markets buoyed sales of investment products and also benefited investmentrelated loans. The sustained appreciation of the Chinese currency during 2006 had no marked effect on Hong Kong's renminbi deposit business. Instead, funds were attracted to Chinese stocks listed in Hong... -

Page 32

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Competitive environment / Europe > 2006 consolidate. Within the banking sector, consolidation continued in 2006, with a greater focus on national networks and retail branch banking. The Group's principal US subsidiaries, HSBC ... -

Page 33

... Profit/(loss) before tax by country within customer groups and global businesses 2006 US$m Personal Financial Services ...United Kingdom ...France1 ...Turkey...Other ...Commercial Banking ...United Kingdom ...France1 ...Turkey...Other ...Corporate, Investment Banking and Markets2 ...United Kingdom... -

Page 34

... 6,974 % Share of HSBC's profit before tax ...Cost efficiency ratio ...Year-end staff numbers (full-time equivalent) ...31.5 60.1 78,311 US$m Selected balance sheet data1 Loans and advances to customers (net) ...Loans and advances to banks (net) ...Trading assets, financial instruments designated at... -

Page 35

... and current accounts, with higher balances achieved through targeted sales and marketing efforts. Interest income from credit cards and mortgages also increased. A focus on liabilities helped boost new UK savings account volumes markedly in a buoyant yet highly competitive savings market. HSBC... -

Page 36

... work and shopping patterns among its customers and the increasing acceptance of direct channels. HSBC appraised its UK property portfolio during the year, and higher other operating income reflected Personal Financial Services' share of revenue from branch sale and lease-back transactions. Personal... -

Page 37

... support business expansion throughout the region. Credit quality was stable. In the UK, HSBC invested to expand sales capacity and improve service through recruitment and the opening of commercial centres. To support HSBC's strategic intention to lead the market in international commercial banking... -

Page 38

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Europe > 2006 to raising deposits through transactional and savings accounts and, as a result, deposit balances rose by 37 per cent and current account balances by 8 per cent. The benefit of this volume growth was partly offset... -

Page 39

... structured derivatives and Credit and Rates. In Group Investment Businesses, a robust performance resulted in higher staff and support costs. A rise in operational expenditure was driven by increased volumes as well as new business won in respect of payments and cash management funds administration... -

Page 40

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Europe > 2006 / 2005 mix change towards higher fee-generating discretionary and advisory managed funds, including the continued success of the SIS and CIS products and the launch of the 'Actively Managed Portfolio' product. A ... -

Page 41

... rate calculation under IFRSs. New lending was strongest in the first time buyer market, where successful pricing and marketing strategies helped gain market share of new sales in a market which contracted overall. Net interest income from UK credit cards increased by 24 per cent, driven by balance... -

Page 42

... unsecured lending in the UK increased by 4 per cent. The launch of differentiated pricing initiatives in April, notably through preferential personal lending rate offers to lower-risk customers, helped boost average loan balances by 9 per cent, and increase HSBC's market share of gross advances... -

Page 43

...first UK high street clearing bank to share full customer credit performance data in 2005. Underwriting activity was also further centralised. Collections capabilities were enhanced, resulting in an increase in amounts collected, and resources were added to the Retail Credit Risk Management function... -

Page 44

... sales staff to support business expansion, and success led to higher performance-related remuneration. Campaigns targeting top tier commercial customers and supporting product launches led to an increase in marketing expenditure, while rebranding and supporting activity to emphasise the 'HSBC... -

Page 45

...short-term rates. Customer deposit balances increased by 23 per cent and spreads improved by 9 basis points. Net fees rose by 7 per cent, partly due to an increase in earnings from the equity capital markets business. Additionally, as equity markets became more buoyant, HSBC Securities Services fees... -

Page 46

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Europe > 2005 / Profit/(loss) before tax with the wider Group contributed to nearly one quarter of the US$1.6 billion of new money. A US$20 million lower performance fee from a public equity fund dedicated to Russia was more ... -

Page 47

... sheet data2 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial instruments designated at fair value, and... -

Page 48

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Europe > Profit/(loss) before tax Profit/(loss) before tax by customer groups and global businesses (continued) Year ended 31 December 2005 Corporate, Investment Banking & Private Markets Banking Other US$m US$m US$m 827 1,339 ... -

Page 49

... sheet data2 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial instruments designated at fair value, and... -

Page 50

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Hong Kong > 2006 Hong Kong Profit/(loss) before tax by customer groups and global businesses 2006 US$m Personal Financial Services ...Commercial Banking ...Corporate, Investment Banking and Markets ...Private Banking ...Other ... -

Page 51

... from savings and current accounts and increased fee income. Marketing activities were successful, helping HSBC enlarge its share of the credit card and mortgage markets and attract higher deposit balances. As a result, customer numbers increased by over 100,000. The cost efficiency ratio improved... -

Page 52

...the small business banking market, including customer service enhancements, improvements to account opening procedures and targeted promotional activity. As a result, Commercial Banking customer numbers increased (by 13,000 to 377,000), as did the number of products sold per customer. Investments to... -

Page 53

... promotional activity, including the launch of the global Commercial Banking campaign to build market share. Cost efficiency was improved by the continuing migration of sales and transaction activity to lower-cost direct channels. Corporate, Investment Banking and Markets reported a pre-tax profit... -

Page 54

...as trading activity increased in response to volatility in the value of the US dollar and economic conditions in certain local markets. Investments in equity sales and trading operations in previous years led to higher revenues. HSBC also benefited from internal synergies linking product structuring... -

Page 55

... of the investment made to support business expansion. Pretax profits of Personal Financial Services and Commercial Banking grew by 27 per cent and 6 per cent respectively, benefiting from a sharp rise in deposit spreads as short-term interest rates increased in a benign credit environment. The... -

Page 56

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Hong Kong > 2005 Net fees fell by 6 per cent to US$740 million, driven mainly by lower sales of unit trusts and capital guaranteed funds, partly offset by higher sales of structured deposit products and open-ended funds. A 34 ... -

Page 57

...Global Investment Banking advisory platform for Asia in Hong Kong. A 19 per cent decline in total operating income was driven by a 74 per cent fall in balance sheet management and money market revenues due to rising short-term US and Hong Kong interest rates and flattening yield curves. In Corporate... -

Page 58

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Hong Kong > 2005 / Profit/(loss) before tax extend coverage along industry sector lines. In total, over 90 people were recruited to support the expansion. Technology and infrastructure costs rose as support and control ... -

Page 59

......Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial instruments designated at fair value, and financial investments ...- deposits by banks ... 35... -

Page 60

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Hong Kong > Profit/(loss) before tax Profit/(loss) before tax by customer groups and global businesses (continued) Year ended 31 December 2005 Corporate, Investment Private Banking & Other Banking Markets US$m US$m US$m 607 431... -

Page 61

......Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial instruments designated at fair value, and financial investments ...- deposits by banks ... 10... -

Page 62

... HOLDINGS PLC Report of the Directors: Business Review (continued) Rest of Asia-Pacific > 2006 Rest of Asia-Pacific (including the Middle East) Profit/(loss) before tax by customer groups and global businesses and by country 2006 US$m Personal Financial Services ...Commercial Banking ...Corporate... -

Page 63

... ...Year-end staff numbers (full-time equivalent) ...16.0 52.8 72,265 US$m Selected balance sheet data1 Loans and advances to customers (net) ...Loans and advances to banks (net) ...Trading assets, financial instruments designated at fair value, and financial investments ...Total assets ...Deposits... -

Page 64

... credit card business, increased marketing activity and expansion of the sales force. 36 new branches and 28 consumer loan centres were opened in 13 countries, most notably Indonesia, mainland China and the Middle East, and at the end of 2006, HSBC had 396 branches in the Rest of AsiaPacific region... -

Page 65

... were also factors in the rise in operating expenses. Marketing costs rose as HSBC increased advertising and promotional activity directed to attracting new customers, enlarging HSBC's share of the credit card, mortgage and unsecured personal lending markets and increasing deposit balances. In 63 -

Page 66

... In India, current account and deposit balances increased by 40 per cent, partly from liquidity chasing new IPOs, which surged in line with strong local equity markets. In 2006, HSBC successfully launched a number of initiatives designed to increase asset balances throughout the Rest of Asia-Pacific... -

Page 67

... credit quality remained strong. Operating expenses increased by 21 per cent to US$554 million in support of business expansion. HSBC recruited additional sales and support staff, increased its Commercial Banking presence in the branch network and committed to higher marketing activity in a number... -

Page 68

... CIS products, proved successful. Trading and other operating income was slightly lower than in 2005, due to sluggish stock market performance and correspondingly subdued client activity. Client assets increased by 12 per cent to US$16 billion, benefiting from the recruitment of front office staff... -

Page 69

... by strong asset and deposit growth, increased fee income and higher income from investments in the Middle East and mainland China. Costs in support of business expansion rose and were broadly in line with revenue growth. Higher loan impairment charges reflected growth in credit card lending and the... -

Page 70

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Rest of Asia-Pacific > 2005 43 per cent. The benefits of higher mortgage balances were partly offset by lower spreads as pricing stayed highly competitive. The credit card business continued to expand in a number of countries. ... -

Page 71

... strategy, resulting in a 16 per cent increase in costs. In India, the recruitment of additional sales staff boosted customer facing staff by 85 per cent in 2005. In South Korea, staff recruitment and heightened marketing activity supported HSBC's four recently established commercial banking centres... -

Page 72

.... HSBC's operations in the Middle East reported a 63 per cent rise in customer advances, primarily due to strong demand for corporate credit, driven by government spending on regional infrastructure projects. Global Transaction Banking revenues increased, as payments and cash management benefited... -

Page 73

...ratio. Front office recruitment in most countries contributed to a small increase in staff costs, and expenditure on marketing and administrative expenses rose to support business growth. In Other, the Group's Service Centres continued to expand to support HSBC's productivity improvements, incurring... -

Page 74

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Rest of Asia-Pacific > Profit before tax Profit before tax by customer groups and global businesses Year ended 31 December 2006 Corporate, Investment Banking & Private Markets Banking Other US$m US$m US$m 802 688 717 - 717 4 38... -

Page 75

... sheet data2 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial instruments designated at fair value, and... -

Page 76

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Rest of Asia-Pacific > Profit before tax / North America > 2006 Profit before tax by customer groups and global businesses (continued) Rest of Asia-Pacific (including the Middle East) Net interest income ...Net fee income ...... -

Page 77

North America Profit/(loss) before tax by country within customer groups and global businesses 2006 US$m Personal Financial Services ...United States ...Canada ...Bermuda ...Commercial Banking ...United States ...Canada ...Bermuda ...Corporate, Investment Banking and Markets ...United States ...... -

Page 78

... 4,668 % Share of HSBC's profit before tax ...Cost efficiency ratio ...Year-end staff numbers (full-time equivalent) ...21.1 47.1 55,642 US$m Selected balance sheet data2 Loans and advances to customers (net) ...Loans and advances to banks (net) ...Trading assets, financial instruments designated at... -

Page 79

..., Investment Banking and Markets, strong trading results more than offset lower balance sheet management revenues, which were constrained by compressed spreads in a flat interest rate yield curve environment. Underlying operating expenses increased by 13 per cent to support investment in business... -

Page 80

... in personal non-credit card lending balances. Asset spreads narrowed, largely from lower yields which reflected changes in product mix and competitive market conditions. Average deposit balances grew by 6 per cent compared with 2005, with the notable success of a new high rate savings account and... -

Page 81

... wealth management business resulted in higher investment administration fees, and credit card fee income rose, driven by increased lending. Trading income fell by 17 per cent, due to lower income on HSBC Finance's Decision One mortgage balances held for resale to secondary market purchasers. This... -

Page 82

... business expansion and new branch openings. Greater emphasis placed on increasing the quality and number of branch staff dedicated to sales and customer relationship activities, which changed the staff mix, also contributed to cost growth. The continued promotion of the on-line savings product, new... -

Page 83

... increase in fees, reflecting a growth in funds under management within Group Investment Businesses, coupled with higher fees from the lending business and HSBC Securities Services. Net trading income more than doubled to US$818 million. In Global Markets, a wider product offering and improved sales... -

Page 84

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) North America > 2006 / 2005 tailored solutions. Revenues in the foreign exchange business remained robust against the backdrop of a weakening US dollar. In Canada, trading income more than doubled, with higher gains from ... -

Page 85

... personal non-credit card portfolios continued to grow. The benefits of strong asset growth were largely offset by lower spreads as interest rates rose. Additional resources were focused on the core retail banking business in the US as high priority was given to growing the deposit base. Investment... -

Page 86

... benefit of higher balances was more than offset by higher funding costs. Yields, however, improved due to a combination of higheryielding sub-prime receivable balances, increased pricing on variable rate products and other re-pricing initiatives. In the retail services cards business, average loan... -

Page 87

...Credit card balances also grew, following the successful launch of a MasterCard programme. Net fee income grew by 23 per cent to US$3,050 million, driven by the strong performance in the US, where the 23 per cent increase was mainly from retail and credit card services, the mortgage banking business... -

Page 88

...from lower account origination fees. In HSBC's US bank, costs grew to support business expansion and new branch openings. Brand awareness programmes in the second and fourth quarters increased marketing costs, and expenditure was incurred on promoting the online savings product. The benefit of these... -

Page 89

... Global Transaction Banking fees rose, reflecting higher customer volumes in payments and cash management. Income from trading activities increased, due in part to higher revenues in the US from credit trading following losses in 2004, and a tightening of credit spreads. Business lines in which HSBC... -

Page 90

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) North America > Profit/(loss) before tax Profit/(loss) before tax by customer groups and global businesses Year ended 31 December 2006 Corporate, Investment Banking & Private Markets Banking Other US$m US$m US$m 266 656 746 72 ... -

Page 91

... sheet data2 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial instruments designated at fair value, and... -

Page 92

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) North America > Profit/(loss) before tax / Latin America > 2006 Profit/(loss) before tax by customer groups and global businesses (continued) Year ended 31 December 20044 Corporate, Investment Banking & Private Markets Banking ... -

Page 93

... America Profit/(loss) before tax by country within customer groups and global businesses 2006 US$m Personal Financial Services ...Mexico ...Brazil ...Argentina ...Other ...Commercial Banking ...Mexico ...Brazil ...Argentina ...Other ...Corporate, Investment Banking and Markets ...Mexico ...Brazil... -

Page 94

... ...Year-end staff numbers (full-time equivalent) ...7.9 61.0 67,116 US$m Selected balance sheet data2 Loans and advances to customers (net) ...Loans and advances to banks (net) ...Trading assets, financial instruments designated at fair value, and financial investments ...Total assets ...Deposits... -

Page 95

... banks, improving its market share by 35 basis points. A strong increase in low-cost deposits was reflective of the continuing success of 'Tu Cuenta', the first integrated financial services product of its kind offered locally, with nearly 400,000 new accounts opened in 2006. HSBC Premier performed... -

Page 96

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Latin America > 2006 improvements in card activation times. These initiatives helped HSBC become the market leader in credit card balance growth, improving market share by 2.3 per cent. The number of cards in circulation ... -

Page 97

... brands and internal cross-selling initiatives led to a rise in motor, home and extended-warranty insurance premium income. Life and annuity premiums also increased in line with higher customer salaries. The 'Maxima' pension funds business delivered higher revenues helped by improvements in the... -

Page 98

... signed, generating US$50 million of new loans. HSBC's share of the trade services market continued to grow, building on the Group's international network and product capabilities. Fees from international factoring and domestic invoicing payment products also rose, as new products were successfully... -

Page 99

...$167 million, predominantly through increased performance-related fees on emerging markets funds managed by Group Investment Businesses. Income in HSBC Securities Services benefited from strong equity market indices and growth in new business as assets under custody increased significantly to US$89... -

Page 100

... transfer of some customers to the Commercial Banking segment, pre-tax profits rose. This was driven by strong revenue growth from higher deposit balances and widening spreads, strong loan growth and higher fee income, partly offset by the non-recurrence in 2005 of loan impairment provision releases... -

Page 101

...launch in February 2005, over 600,000 accounts were opened in the year, averaging some 2,300 new customers per day. The continued success of HSBC's competitive fixed rate mortgage product in Mexico, helped by strong demand from first time buyers, led to average mortgage balances increasing by 93 per... -

Page 102

... incurred in improving customer service levels within the branch network, and a rise in bonus costs in line with increased sales. Marketing costs grew to support the credit cards business, evidenced by the 80 per cent increase in the number of cards in circulation. IT costs rose as new systems were... -

Page 103

.... Trade services fee income increased by 63 per cent as a result of customer acquisition and increased cross-sales to existing customers, nearly doubling the bank's market share in a growing market. In Brazil, the increase was due to higher fees from payments and cash management, current accounts... -

Page 104

... in balances. Brazil reported a decrease in balance sheet management and money market revenues as a result of high short-term interest rates and an inverted yield curve. Net fee income rose by 12 per cent reflecting higher fees in Global Transaction Banking. The payments and cash management business... -

Page 105

......Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial instruments designated at fair value, and financial investments ...- deposits by banks ... 16... -

Page 106

HSBC HOLDINGS PLC Report of the Directors: Business Review (continued) Latin America > Profit/(loss) before tax Profit/(loss) before tax by customer groups and global businesses (continued) Year ended 31 December 20053 Corporate, Investment Banking & Private Markets Banking Other US$m US$m US$m ... -

Page 107

...balance sheet data Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: - loans and advances to banks (net) ...- trading assets, financial instruments designated at fair value... -

Page 108

... and the positioning of HSBC's local businesses. Typically, products provided include current and savings accounts, mortgages and personal loans, credit cards, and local and international payment services. HSBC uses its global reach to offer tailored financial services to customers banking in more... -

Page 109

...accept credit card payments either in store or on the internet. Insurance: HSBC offers insurance services in 25 sites, which cover a full range of commercial insurance products designed to meet the needs of businesses and their employees, including employee benefit, pension and healthcare programmes... -

Page 110

... subsidiaries and offices of its clients on a global basis. Corporate, Investment Banking and Markets is managed as three principal business lines: Global Markets, Global Banking and Group Investment Businesses. This structure allows HSBC to focus on relationships and sectors that best fit the Group... -

Page 111

..., equities, derivatives, options, futures, structured products, mutual funds and alternative products, such as hedge funds and fund of funds. By accessing regional expertise located within six major advisory centres in Hong Kong, Singapore, Geneva, New York, Paris and London, Private Banking seeks... -

Page 112

... ...Net insurance claims incurred and movement in policyholders' liabilities ...Loan impairment charges and other credit risk provisions ...Operating expenses ...Share of profit in associates and joint ventures ...Asset deployment ...Trading assets and financial investments ...Funds under management... -

Page 113

... made to the exchange rates used to translate assets and liabilities denominated in foreign currencies into the functional currencies of any HSBC branch, subsidiary, joint venture or associate. 2006 compared with 2005 As Constant reported currency on an underlying basis % % 2005 compared with 2004... -

Page 114

...at the balance sheet date which will only be individually identified in the future. The collective impairment allowance is determined after taking into account: • historical loss experience in portfolios of similar credit risk characteristics (for example, by industry sector, loan grade or product... -

Page 115

...to ensure they remain appropriate. The portfolio approach is generally applied to the following types of portfolios low value, homogeneous small business accounts in certain jurisdictions; residential mortgages; credit cards and other unsecured consumer lending products; and motor vehicle financing... -

Page 116

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Critical accounting policies / Key performance indicators acquired business is greater than the cost of acquisition, the excess is recognised immediately in the income statement. Goodwill is allocated to cash-generating units ... -

Page 117

... continue up to 2008. The plan is aimed at guiding the Group to achieve management's vision for HSBC to be the world's leading financial services company. To support the Group's strategy and ensure that HSBC's performance can be monitored, management utilises a number of financial KPIs. The table... -

Page 118

... significant credit losses in the mortgage services business in the US described on page 189. Management aims to improve risk-adjusted performance over time. Return on average invested capital measures the return on the capital investment made in the business, enabling management to benchmark HSBC... -

Page 119

... its main markets over many years. Going forward, HSBC will use a consistent measure of recommendation to gauge customer satisfaction with the services provided by the Group's Personal Financial Services and Commercial Banking businesses, and benchmark the measures of reported customer satisfaction... -

Page 120

... and the success of the Group's IT function in meeting straight-through delivery processing targets. Customer transactions processed HSBC's IT function establishes with its end users service level agreements for systems performance (e.g. systems up-time 99.9 per cent of the time and credit card... -

Page 121

......Net insurance claims incurred and movement in policyholders' liabilities ...Net operating income before loan impairment charges and other credit risk provisions ...Loan impairment charges and other credit risk provisions ...Net operating income ...Employee compensation and benefits ...General and... -

Page 122

... Services in North America, and in Corporate, Investment Banking and Markets, where the cost efficiency ratio improved slightly as strong revenue growth offset the first full year effect of investment expenditure in previous years. HSBC's share of profit in associates and joint ventures increased... -

Page 123

... East and Latin America contributed to cost growth. Productivity improvements achieved in the UK and Hong Kong allowed the Group to continue building its Personal Financial Services and Commercial Banking businesses in the Rest of AsiaPacific, and expanding its capabilities in Corporate, Investment... -

Page 124

...the Personal Financial Services and Commercial Banking businesses in Asia and the UK, and also improved the value of cash balances within the Group's custody and payments and cash management businesses and increased the resultant investment income; the cumulative effect of higher short-term interest... -

Page 125

... business through network expansion, customer recruitment and targeted marketing and promotions. In Personal Financial Services, the emphasis on the recruitment of HSBC Premier customers generated strong deposit growth throughout the region, which funded increased mortgage and credit card borrowing... -

Page 126

... in mortgage, card and unsecured personal lending balances was strong, offsetting spread contraction as the cost of funds rose with progressive interest rate rises. Core deposit growth benefited from expansion of the branch network and the launch of new savings products, including an online savings... -

Page 127

...$m Cards ...Account services ...Funds under management ...Broking income ...Insurance ...Credit facilities2 ...Global custody ...Imports/exports ...Unit trusts ...Remittances ...Underwriting ...Corporate finance ...Trust income ...Maintenance income on operating leases ...Mortgage servicing ...Other... -

Page 128

... unit trust, broking and custody fees. • There was an increase in cards in issue, which drove higher transaction volumes and balances and led to a 16 per cent rise in card fee income, principally in the US; Strong equity market performance also benefited HSBC's asset management activities. Funds... -

Page 129

... customer numbers and greater card utilisation. Account service fees increased by 9 per cent, reflecting increased customer numbers, the launch of a new packaged product in the UK and the introduction of a Small Business Tariff in Commercial Banking. Buoyant equity markets benefited custody fees... -

Page 130

... products. Overall, customer volumes rose, as increased hedging activity and a change in risk appetite among investors drove a general improvement in market sentiment towards developing economies. On an underlying basis trading income in the Rest of Asia-Pacific grew by 35 per cent, driven by HSBC... -

Page 131

...income on trading activities'. The offset to the net internal funding is reported as 'Net interest income' within the lending customer group. The resulting 'Net trading income' line comprises all gains and losses from changes in the fair value of financial assets and financial liabilities classified... -

Page 132

... held to meet liabilities under insurance and investment contracts ...Change in fair value of liabilities to customers under investment contracts ...Movement in fair value of HSBC's long-term debt issued and related derivatives ...- change in own credit spread on long-term debt ...- other changes... -

Page 133

..., like the related assets, were included within the heading 'Net income from financial instruments designated at fair value'. The element of the increase in liabilities under insurance contracts that reflected investment performance was reported separately within 'Net insurance claims incurred and... -

Page 134

... decrease. In Hong Kong, net earned premium income increased by 13 per cent, driven by the life insurance business. New products, many designed to meet financial needs identified in HSBC's global study on the future of retirement, were supported by increased promotional and marketing activity, and... -

Page 135

... number of personal insurance policies, resulting from an expansion of HSBC's insurance operations in the region. In North America, increased cross-sales of insurance products through the branch network, combined with strong sales of other personal insurance-related products, resulted in an increase... -

Page 136

...back transactions. In Hong Kong, the modest increase in other operating income reflected profits earned from the sale of the former head office building of Hang Seng Bank and income received from the transfer of the credit card acquiring business into a joint venture between HSBC and Global Payments... -

Page 137

...movement in the liability that arises, primarily from the attribution of investment performance to savings-related policies. Consequently, claims rise in line with increases in sales of savings-related business and with investment market growth. In Europe, net insurance claims incurred and movement... -

Page 138

...system in 2005 reduced the amount of reserves held for liabilities in respect of income protection products, bringing additional benefits in terms of capital efficiency of the UK life operation. Loan impairment charges and other credit risk provisions 2006 US$m By geographical region Europe ...Hong... -

Page 139

...lien and adjustable rate mortgages acquired from correspondent brokers and banks in 2005 and in the first half of 2006; 10 per cent underlying lending growth (excluding lending to the financial sector and settlement accounts), notably in the UK, the US, Mexico, Brazil and Asia; the continuing effect... -

Page 140

... cent of this increase, principally in mortgages, credit cards and other personal lending products. At 31 December 2005, personal lending accounted for 56 per cent of the customer loan portfolio, in line with 2004. The proportion of the portfolio attributable to corporate and commercial lending was... -

Page 141

... 2003 awards under the HSBC Holdings Group Share Option Plan ('the Plan'). As explained in the Annual Report and Accounts 2005, in light of the impressive and sustained performance and shareholder returns over the three years covered by the 2003 awards, the Group Remuneration Committee exercised its... -

Page 142

... opening hours in the branch network and the expansion of Commercial Banking, and an increase in revenue-driven performance-related awards drove staff costs higher. Marketing expenditure incurred on advertising and promotional activities rose in support of credit card and investment fund products... -

Page 143

... HSBC's branch network was extended in mainland China, South Korea, and India, and additional sales and support staff were recruited in Personal Financial Services and Commercial Banking. Staff numbers also increased in response to the migration of call centre activities to the Group Service Centres... -

Page 144

...geographical region Europe ...Hong Kong ...Rest of Asia-Pacific ...North America1 ...Latin America1 ...Share of profit in associates and joint ventures ...(72) 19 865 30 4 846 business expansion exceeded revenue growth. The cost efficiency ratio in Corporate, Investment Banking and Markets improved... -

Page 145

...-office operation in Shanghai became fully functional and the centralisation of the life insurance underwriting and claims business was completed. • HSBC's share of income from Bank of Communications rose by 44 per cent, driven by wider spreads and an improved product mix, with increased corporate... -

Page 146

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Asset deployment / Funds under management / Assets held in custody driven by strong investment banking performance, a buoyant stock market and rapid growth in ShariahAsset deployment compliant products and services. At 31 ... -

Page 147

... Group Investment Businesses and Private Banking delivered good investment performance and strong net new money. HSBC is among the world's largest emerging market asset managers with US$62 billion of funds under management invested in emerging market assets. Group Investment Businesses managed US... -

Page 148

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Economic profit / Other financial information Economic profit HSBC's internal performance measures include economic profit, a calculation which compares the return on financial capital invested in HSBC by its shareholders with... -

Page 149

... North America Latin America Other operations ... Trading assets2 Europe Hong Kong HSBC Bank ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank USA ...HSBC Bank Canada ...HSBC Markets... -

Page 150

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Other financial information > Average balance sheet Assets (continued) 2006 Average Interest balance income US$m US$m Loans and advances to customers Europe HSBC Bank ...226,528 HSBC Private Banking Holdings (Suisse) ...7,134 ... -

Page 151

...-earning assets Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East HSBC Bank USA ...HSBC Finance ...HSBC Bank... -

Page 152

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Other financial information > Average balance sheet Assets (continued) 2006 % Distribution of average total assets Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...HSBC Finance ...Hang Seng Bank ...... -

Page 153

...25 6.24 5.71 1.84 2.01 North America Latin America Other operations ... Customer accounts5 Europe HSBC Bank ...221,369 HSBC Private Banking Holdings (Suisse) ...25,346 HSBC France ...23,579 Hang Seng Bank ...54,267 The Hongkong and Shanghai Banking Corporation ...104,441 The Hongkong and Shanghai... -

Page 154

... Review (continued) Other financial information > Average balance sheet Total equity and liabilities (continued) 2006 Average Interest balance expense US$m US$m Financial liabilities designated at fair value - own debt issued6 Europe North America HSBC Holdings ...HSBC Bank ...HSBC Bank USA ...HSBC... -

Page 155

... America Other operations ... 3.88 907,995 3.17 879,158 2.20 Summary Total interest-margin liabilities ...1,067,646 Trading liabilities...224,050 Financial liabilities designated at fair value (excluding own debt issued) ...12,537 Non-interest-bearing current accounts ...71,744 Total equity... -

Page 156

...with 2005 Increase/(decrease) 2006 Volume Rate US$m US$m US$m Short-term funds and loans and advances to banks Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation... -

Page 157

... Rate US$m US$m US$m Financial investments Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East ...HSBC Bank USA... -

Page 158

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Other financial information > Changes in net interest income / Share capital and reserves Interest expense 2006 compared with 2005 Increase/(decrease) 2006 Volume Rate US$m US$m US$m Customer accounts Europe HSBC Bank ...HSBC ... -

Page 159

... within shareholders' equity and other non interest-bearing liabilities and the related coupon payments were included within 'Profit attributable to minority interests'. Share capital and reserves The following events in relation to the share capital of HSBC Holdings occurred during the year... -

Page 160

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Other financial information > Share capital and reserves / Short term borrowings / Contractual obligations / Loan maturity Authority to repurchase ordinary shares 12. At the Annual General Meeting in 2006, shareholders renewed... -

Page 161

...Commercial, industrial and international trade Real estate and other property related ...Non-bank financial institutions ...Governments ...Other commercial ...Hong Kong Government Home Ownership Scheme ...Residential mortgages and other personal loans Loans and advances to customers ...Interest rate... -

Page 162

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Other financial information > Deposits Deposits The following tables analyse the average amount of bank deposits, customer deposits and certificates of deposit ('CDs') and other money market instruments (which are included ... -

Page 163

Year ended 31 December 2006 Average Average balance rate US$m % Customer accounts Europe Demand and other - non-interest bearing ...Demand - interest bearing ...Savings ...Time ...Other ...Hong Kong Demand and other - non-interest bearing ...Demand - interest bearing ...Savings ...Time ...Other ...... -

Page 164

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Other financial information > Certificates of deposit and other time deposits / Off-balance sheet arrangements Certificates of deposit and other time deposits At 31 December 2006, the maturity analysis of certificates of ... -

Page 165

... loan, advised overdraft limits, and mortgage offers awaiting customer acceptance. HSBC generally has the right to change or terminate any conditions of a personal customer's overdraft, credit card or other credit line upon notification to the customer. In respect of corporate commitments to lend... -

Page 166

HSBC HOLDINGS PLC Report of the Directors: Financial Review (continued) Other financial information > Off balance sheet arrangements / Regulation and supervision party. The cash flows received by SPEs on pools of receivables are used to service the finance provided by investors. HSBC administers ... -

Page 167

...on The Stock Exchange of Hong Kong Limited is set out in the 'Report of the Directors: Governance' on page 248. HSBC's operations throughout the world are regulated and supervised by approximately 510 different central banks and regulatory authorities in those jurisdictions in which HSBC has offices... -

Page 168

... the FSMA. These include retail banking, life and general insurance, pensions, mortgages, custody and branch sharedealing businesses, and treasury and capital markets activity. HSBC Bank is HSBC's principal authorised institution in the UK. FSA rules establish the minimum criteria for authorisation... -

Page 169

... the HKMA certain returns and other information and establishes certain minimum standards and ratios relating to capital adequacy (see below), liquidity, capitalisation, limitations on shareholdings, exposure to any one customer, unsecured advances to persons affiliated with the bank and holdings of... -

Page 170

... Office of the Comptroller of the Currency ('OCC') and the Federal Deposit Insurance Corporation ('FDIC') govern many aspects of HSBC's US business. HSBC and its US operations are subject to supervision, regulation and examination by the Federal Reserve Board because HSBC is a 'bank holding company... -

Page 171

... have adopted 'leverage' capital requirements that generally require US banks and bank holding companies to maintain a minimum amount of capital in relation to their balance sheet assets (measured on a non-risk-weighted basis). The Federal Deposit Insurance Corporation Improvement Act of 1991... -

Page 172

... risk, operational risk, pension risk, insurance risk and sustainability (environmental or social) risks. Market risk includes foreign exchange, interest rate and equity price risk. HSBC's risk management policies are designed to identify and analyse these risks, to set appropriate risk limits... -

Page 173

... their detailed credit policies and procedures. Issuing policy guidelines to HSBC's operating companies on the Group's attitude toward, and appetite for, credit risk exposure to specified market sectors, activities and banking products. Each HSBC operating company and major business unit is required... -

Page 174

... operating company is required to implement credit policies, procedures and lending guidelines which conform to HSBC Group standards, with credit approval authorities delegated from the Board of Directors of HSBC Holdings to the relevant Chief Executive Officer. In each major subsidiary, management... -

Page 175

... of similar assets to assess the quality of the loan book and other exposures; a consideration of any oversight or review work performed by Credit and Risk functions; review of model validation procedures; review of management objectives and a check that Group and local standards and policies are... -

Page 176

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Credit risk management are reviewed regularly and amendments, where necessary, are implemented promptly. The credit quality of unimpaired loans is assessed by reference to the Group's standard credit rating... -

Page 177

... numbers of relatively lowvalue assets are managed using a portfolio approach, typically low-value, homogeneous small business accounts in certain countries or territories; residential mortgages that have not been individually assessed; credit cards and other unsecured consumer lending products... -

Page 178

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Credit risk management / Exposure Collectively assessed allowances are generally calculated monthly and charges for new allowances, or reversals of existing allowances, are determined for each separately ... -

Page 179

...total gross lending to customers, broadly in line with 2005. Commercial, industrial and international trade lending grew strongly in 2006, notably to the service industry. This increased this class of lending by a percentage point to 18 per cent of total gross loans and advances to customers. Within... -

Page 180

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk Credit risk > Exposure > 2006 Financial investments (Unaudited) At US$205 billion, total financial investments were 12 per cent higher than at the end of 2005. Investments of US$93 billion in corporate debt and other securities ... -

Page 181

... of gross loans and advances to customers. In North America, growth in other personal lending was largely driven by credit card activity and increased second lien mortgage balances. In the US, increased uptake of both prime and non-prime credit cards was driven by targeted marketing campaigns and... -

Page 182

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Exposure > 2006 / By industry sector launches in the Middle East, Sri Lanka and Singapore and marketing and incentive campaigns across the region. Other unsecured lending balances rose during 2006, partly ... -

Page 183

... collectively assessed loans and advances. Included in personal lending in North America are the following balances relating to the US: (Unaudited) Residential mortgages - HSBC Bank USA ...Residential mortgages - HSBC Finance ...Motor vehicle finance ...MasterCard/Visa credit cards ...Private label... -

Page 184

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Exposure > By industry sector Loans and advances to customers by industry sector and by geographical region (Audited) At 31 December 2005 (restated5) Gross loans and Latin advances to America customers US$m... -

Page 185

...Other personal ...70,546 57,920 128,466 Corporate and commercial Commercial, industrial and international trade ...Commercial real estate ...Other property-related ...Government ...Other commercial2 ... Hong Kong US$m 29,373 9,105 38,478 Rest of AsiaPacific US$m 14,860 9,079 23,939 North America... -

Page 186

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Exposure > By industry sector Loans and advances to customers by industry sector and by geographical region (continued) (Unaudited) At 31 December 20032 (restated7) Gross loans and advances to customers US... -

Page 187

...Other personal ...38,719 26,748 65,467 Corporate and commercial Commercial, industrial and international trade ...Commercial real estate ...Other property-related ...Government ...Other commercial3 ... Hong Kong US$m 31,094 7,066 38,160 Rest of AsiaPacific US$m 7,507 5,900 13,407 North America US... -

Page 188

...) Credit risk > Exposure > Rest of Asia-Pacific and Latin America / Banks / Financial assets Loans and advances to customers by principal area within Rest of Asia-Pacific and Latin America (Audited) Loans and advances (gross) Commercial, international trade and PropertyOther other related personal... -

Page 189

... liabilities for financial reporting purposes. However, the exposure to credit risk relating to the respective financial assets is mitigated as follows. At 31 December 2006 Carrying amount US$m Loans and advances held at amortised cost Loans and advances to customers ...Loans and advances to banks... -

Page 190

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Exposure > Debt securities / Areas of special interest Debt securities and other bills by rating agency designation (Audited) The following table presents an analysis by rating agency designation of debt ... -

Page 191

...Other personal lending' in the market sector analysis. In addition to capital or principal repayment mortgages that may be subject to either fixed or variable interest rates, HSBC responds to customer needs by periodically testing and underwriting an increasing range of mortgage products designed to... -

Page 192

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Exposure > Areas of special interest / Cross-border distribution 1 HSBC Finance includes lending in Canada and the UK and excludes loans transferred to HSBC USA Inc. 2 Total mortgage lending includes ... -

Page 193

...mortgage lending which is reported within 'Other personal lending' in the market sector analysis. At 31 December 2006, the outstanding balance of interest-only loans in the US mortgage services business was US$6.3 billion, or 1.3 per cent of the Group's gross loans and advances to personal customers... -

Page 194

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Exposure / Credit quality > Loans and advances outstandings comprise loans and advances (excluding settlement accounts), amounts receivable under finance leases, acceptances, commercial bills, In-country ... -

Page 195

...The credit quality of the portfolio of loans and advances that were neither past due nor impaired can be assessed by reference to the Group's standard credit grading system, as described on page 173. The following information is based on that system: At 31 December 2005 Loans and Loans and advances... -

Page 196

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Credit quality > Loans and advances > 2006 Impaired loans and advances (Audited) At 31 December 2006 US$m Total impaired loans and advances to: - banks ...- customers ...15 13,785 13,800 Total allowances ... -

Page 197

... mortgage balances originated through the branch-based consumer lending business, rose modestly, driven by growing portfolio maturity and a higher mix of credit card receivables following the Metris acquisition. In Canada, impaired loans increased as a small number of commercial customers in... -

Page 198

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Credit quality / Impairment allowances and charges Interest forgone on impaired loans (Audited) Interest income that would have been recognised under the original terms of impaired and restructured loans ... -

Page 199

...of loans and advances to customers (Unaudited) At 31 December 2006 % Total impairment allowances to gross lending1 Individually assessed impairment allowances ...Collectively assessed impairment allowances ...0.30 1.28 1.58 1 Net of reverse repo transactions, settlement accounts and stock borrowings... -

Page 200

...HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Impairment allowances > 2006 / 2005 Movement in impairment allowances by industry segment and by geographical region The following tables show details of the movements in HSBC's impairment allowances by location... -

Page 201

... booked in Hong Kong may cover assets booked in branches located outside Hong Kong, principally in the Rest of Asia-Pacific, as well as those booked in Hong Kong. 3 In 2006, Mexico and Panama were reclassified from the North America segment to the Latin America segment. Comparative information has... -

Page 202

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Provisions for bad and doubtful debts > 2004 / 2003 Movement in provisions by industry segment and by geographical region (Unaudited) 2004 (restated3) Rest of AsiaNorth Pacific America US$m US$m 1,181 (21) ... -

Page 203

...North America transferred in on the acquisition of HSBC Finance Corporation, and of US$116 million in Latin America transferred in on the acquisition of Lloyds TSB Group's Brazilian businesses and assets. 3 General provisions are allocated to geographical segments based on the location of the office... -

Page 204

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Provisions for bad and doubtful debts > 2002 / Impairment charges > 2006 / 2005 Movement in provisions by industry segment and by geographical region (continued) (Unaudited 2002 (restated4) Rest of ... -

Page 205

... losses ...Banks ...Customers ...1,984 (5) 1,989 % Charge for impairment losses as a percentage of closing gross loans and advances ...31 December 2005 Impaired loans ...Impairment allowances ... Year ended 31 December 2005 (restated1) Rest of Latin North AsiaHong America America Pacific Kong US... -

Page 206

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Charge to P&L Account > 2004 to 2002 / Impairment charges > 2006 Net charge to the profit and loss account for bad and doubtful debts by geographical region (continued) (Unaudited) Year ended 31 December ... -

Page 207

.... In response, HSBC tightened underwriting controls in the second half of 2005, reduced its market share of unsecured personal lending and changed the product mix of new business towards lower-risk customers. In 2006 there were early signs of improvement in more recent unsecured lending. New loan... -

Page 208

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Impairment charges > 2006 / 2005 of several significant recoveries in 2005 led to a large fall in France. In Hong Kong, new loan impairment charges declined by 22 per cent to US$243 million, reflecting the ... -

Page 209

...to a small number of individual allowances for corporate and commercial customers. However, overall credit quality improved, evidenced by a decline in impaired loans as a proportion of gross advances, reflecting a strong economy with low unemployment. Releases and recoveries in Hong Kong declined by... -

Page 210

...-off policies relating to retail and credit card balances. Excluding these factors, credit quality improved year on year, reflecting an improving economic environment. This contributed to the fall in new impairment allowances, which was only partially offset by increased requirements due to loan... -

Page 211

...contractual delinquency (as a percentage of loans and advances) within Personal Financial Services in the US: (Unaudited) 31 December 2006 % Residential mortgages ...Second lien mortgage lending ...Vehicle finance1 ...Credit card2 ...Private label ...Personal non-credit card Total2 ...2.59 4.02 3.16... -

Page 212

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Impairment losses / HSBC Holdings / Risk elements Charge for impairment losses as a percentage of average gross loans and advances to customers (Unaudited) Europe % Year ended 31 December 2006 New ... -

Page 213

... year if the debt performs in accordance with the new terms. Troubled debt restructurings were broadly in line with 2005. Unimpaired loans past due 90 days or more (Unaudited) Credit risk elements also cover potential problem loans. These are loans where information about borrowers' possible credit... -

Page 214

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Credit risk > Risk elements / Liquidity and funding > Policies / Primary sources of funding Risk elements (Unaudited) The following table provides an analysis of risk elements in the loan portfolios at 31 December for ... -

Page 215

... in the operating companies of HSBC in accordance with practices and limits set by the Group Management Board. These limits vary by local financial unit to take account of the depth and liquidity of the market in which the entity operates. It is HSBC's general policy that each banking entity should... -

Page 216

... and accessing additional funding sources such as interbank or asset-backed markets. A key measure used by the Group for managing liquidity risk is the ratio of net liquid assets to customer liabilities. Generally, liquid assets comprise cash balances, short-term interbank deposits and highly-rated... -

Page 217

... liquidity position of the Group's banking entities. Year ended 31 December 2006 2005 % % Year-end ...Maximum ...Minimum ...Average ...20.6 22.1 17.1 19.3 17.1 17.5 14.4 16.3 deploys in short-term bank deposits or liquidity funds. HSBC Holdings' primary uses of cash are investments in subsidiaries... -

Page 218

...so designated but not held with trading intent is disclosed separately. Non-trading portfolios primarily arise from the interest rate management of HSBC's retail and commercial banking assets and liabilities. The management of market risk is principally undertaken in Global Markets using risk limits... -

Page 219

... Group's balance sheet management activities. The daily VAR, for both trading and non-trading portfolios, for HSBC Global Markets was as follows: Daily total VAR for Global Markets (US$m) (Unaudited) Revenues (US$m) Profit and loss frequency Year ended 31 December 2005 Number of days Revenues... -

Page 220

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Market risk > Value at risk / Trading portfolios / Non-trading portfolios Fair value and price verification control (Audited) Where certain financial instruments are carried on the Group's balance sheet at fair values, ... -

Page 221

... captured by the risk transfer process. For example, both the flow from customer deposit accounts to alternative investment products and the precise prepayment speeds of mortgages will vary at different interest rate levels. In such circumstances, simulation modelling is used to identify the... -

Page 222

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Market risk > Non-trading portfolios / Sensitivity of NII Once market risk has been consolidated in Global Markets or ALCO-managed books, the net exposure is typically managed through the use of interest rate swaps ... -

Page 223

... its management of market risk in non-trading portfolios, to mitigate the impact of prospective interest rate movements which could reduce future net interest income, while balancing the cost of such hedging activities on the current net revenue stream. For simulation modelling, businesses use... -

Page 224

... that HSBC Finance has a substantial fixed rate, real estate secured, lending portfolio which is primarily funded with interest rate sensitive short-term liabilities. Residual interest rate risk is managed within Global Markets. This reflects the Group's policy of transferring all interest rate risk... -

Page 225

...the Group's businesses; providing dividend payments to HSBC Holdings' equity shareholders and interest payments to providers of debt capital; and maintaining a supply of short-term cash resources. It does not take proprietary trading positions. The objectives of HSBC Holdings' market risk management... -

Page 226

...funds received have generally been used to increase long-term investments in subsidiaries. Residual value risk management (Unaudited) A significant part of a lessor's return from operating leases is dependent upon its management of residual value risk. This arises from operating lease transactions... -

Page 227

... unable to successfully defend a claim brought against any HSBC company; or HSBC being unable to take action to enforce its rights through the courts. • operational risk management responsibility is assigned to senior management within each business operation; information systems are used to... -

Page 228

... asset and liability management strategy and related monitoring mechanisms to the market risks inherent in the scheme. These techniques include: • • regular assessments of funding positions; regular reviews of investment performance against market benchmarks; half-yearly reviews of the pension... -

Page 229

...be high, and supporting HSBC's operating companies to assess similar risks of a lower magnitude; building and implementing systems-based processes to ensure consistent application of policies, reduce the costs of sustainability risk reviews and capture management information to measure and report on... -

Page 230

... assigned assets falling below that required to support benefit payments. HSBC manages this risk by conducting regular actuarial investigations on the sustainability of the bonus rates. Credit life insurance provides protection in the event of death or unemployment. Credit life insurance business is... -

Page 231

...life business uses written premiums as representing the best available measure of risk exposure. Both life and non-life business insurance risks are controlled through high level procedures set centrally, and can be supplemented with procedures set locally which take account of specific local market... -

Page 232

...provided and claims experience risk is the risk that portfolio experience is worse than expected. HSBC manages these risks through pricing (for example, imposing restrictions and deductibles in the policy terms and conditions), product design, risk selection, claims handling, investment strategy and... -

Page 233

...at the time. A key aspect of risk management in the insurance business, in particular the life insurance business, is the need to match assets and liabilities. Models are used to assess the impact of a range of future scenarios on the value of financial assets and associated liabilities. The results... -

Page 234

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Insurance operations > Insurance risk / Financial risks Insurance contracts Contracts with DPF1 US$m At 31 December 2005 Financial assets: - trading assets ...- financial assets designated at fair value - derivatives ... -

Page 235

... financial risk, for example, when the proceeds from financial assets are not sufficient to fund the obligations arising from non-linked insurance and investment contracts. Certain insurance-related activities undertaken by HSBC subsidiaries such as insurance broking, insurance management (including... -

Page 236

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Insurance operations > Financial risks / Market risk Financial assets held by insurance underwriting operations (Audited) At 31 December 2006 Life linked Life non-linked Non-life insurance1 insurance2 insurance3 US$m US... -

Page 237

...6 Comprises mainly loans and advances to banks and cash. In life linked insurance, premium income less charges levied is invested in unit-linked funds. HSBC manages the financial risk of this product by holding appropriate assets in segregated funds or portfolios to which the liabilities are linked... -

Page 238

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Insurance operations > Market risk / Credit risk • annual return: the annual return is guaranteed to be no lower that a specified rate. This can be the investment return credited to the policyholder every year (... -

Page 239

...by establishing limits on the net positions by currency and the total net short position that each insurance subsidiary may hold. The risk is also monitored by tracking the effect of predetermined exchange differences on the total profit and net assets of the insurance underwriting subsidiaries. The... -

Page 240

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Insurance operations > Credit risk (Audited) At 31 December 2006 Supporting liabilities under non-linked insurance contracts AAA ...AA- to AA+ ...A- to A+ ...Lower than A- ...Unrated ...Supporting shareholders' funds1 ... -

Page 241

... ...Of which issued by: - government ...- local authorities ...- corporates ...- other ...Of which classified as: - trading assets ...- financial instruments designated at fair value ...- available-for-sale securities ...- held-to-maturity investments ... Treasury bills US$m Other eligible bills US... -

Page 242

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Insurance operations > Credit risk / Liquidity risk / PVIF (Audited) Reinsurers' share of liabilities under insurance contracts Linked Non-linked insurance insurance contracts contracts US$m US$m 10 33 - 15 - 58 106 812... -

Page 243

... framework for the evaluation of insurance and related risks. The value of the PVIF asset at 31 December 2006 was US$1,549 million (2005: US$1,400 million). The present value of the shareholders' interest in the profits expected to emerge from the book of in-force policies at 31 December can be... -

Page 244

HSBC HOLDINGS PLC Report of the Directors: The Management of Risk (continued) Insurance operations > PVIF / Capital management and allocation The following table shows the movements recorded during the year in respect of PVIF and the Movements in PVIF and net assets of insurance operations (... -

Page 245