Dollar General 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

transportation efficiencies, global sourcing, and pricing and markdown optimization. With respect

to category management, the mix of sales affects profitability because the gross margin

associated with sales within our consumables category generally is lower than that associated

with sales within our non-consumables categories. Even within each category, however, there are

varying levels of gross margin associated with the specific items. With respect to inventory shrink

reduction, the progress in 2015 was broad-based with shrink declining across all four product

categories. For a discussion of the sales mix, as well as the results of certain other margin-

related initiatives in 2015, see ‘‘Results of Operations’’ below.

The degree of success of these initiatives is often reflected in our same-store sales results and in

the level of improvement in shopper frequency and number of items sold and average transaction

amount. For the 2015 fourth quarter, we believe these ongoing initiatives helped to drive the

same-store sales growth in three out of our four product categories, reflecting increases in both

customer traffic and average transaction amount for the 32nd consecutive quarter when compared to the

prior year quarter.

To support our other operating priorities we also are focused on capturing growth opportunities and

innovating within our channel. We continued to expand our store count, opening 730 stores during 2015.

We also have continued our store remodeling efforts and remodeled or relocated a total of 881 stores

during 2015. In fiscal 2016, we have plans to open 900 stores and to relocate or remodel 875 stores, and we

plan to maintain our accelerated square footage growth of approximately six to eight percent during 2017.

We continue to innovate within our channel, and during 2016 we will implement the DG16 store format.

This store format will include additional cooler doors, a redesigned queueing area, and other enhancements

that are focused on meeting the evolving demands of our core customer while also delivering on our

operating priorities. In addition, we are testing a smaller format store (less than 6,000 square feet) which

we believe could allow us to capture growth opportunities in metropolitan areas.

We have established a position as a low-cost operator, continuously seeking ways to control costs that

do not affect our customer’s shopping experience. We have enhanced this position during the latter part of

2015 and into 2016 through our zero-based budgeting initiative, streamlining our business while also

reducing expenses. Our goal is to lower the same-store sales growth required to leverage selling, general

and administrative (‘‘SG&A’’) expenses. As part of this initiative we reduced approximately 255 positions

within our corporate support function in the third quarter of 2015 and expect to reinvest a portion of these

savings in the business as we deem appropriate. In addition, at the store level, we remain committed to

simplifying or eliminating various tasks so that those time savings can be reinvested by our store managers

in other areas such as ensuring customer service, improved in-stock levels, and improved store standards.

We will continue to seek additional opportunities to enhance our low-cost position.

Our employees are a competitive advantage, and we are always searching for ways to continue

investing in them. Our training programs are continually evolving, as we work to ensure that our

employees have the tools necessary to be successful in their positions. We invest in our employees in an

effort to create an environment that attracts and retains talented personnel, as we believe that,

particularly at the store level, employees who are promoted from within generally have longer tenures

and are greater contributors to improvements in our financial performance. Furthermore, we believe

that reducing our store manager turnover likely results in improved store financial performance in

areas such as shrink and sales. We have also implemented training programs for high-potential

employees, and believe that these and other efforts will produce a more stable, engaged workforce.

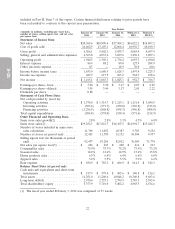

Our continued focus on these four operating priorities, coupled with strong cash flow management

and share repurchases resulted in solid overall operating and financial performance in 2015 as

compared to 2014 as follows. Basis points, as referred to below, are equal to 0.01 percent of net sales.

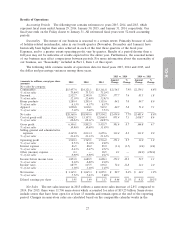

• Net sales in 2015 increased 7.7% over 2014. Sales in same-stores increased 2.8%, with increases

in both customer traffic and average transaction amount. Consumables represented 76% of sales

25