Dollar General 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

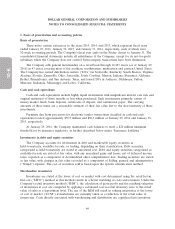

Our most recent testing of our goodwill and indefinite lived trade name intangible assets was

completed during the third quarter of 2015. No indicators of impairment were evident and no

assessment of or adjustment to these assets was required. We are not currently projecting a decline in

cash flows that could be expected to have an adverse effect such as a violation of debt covenants or

future impairment charges.

Property and Equipment. Property and equipment are recorded at cost. We group our assets into

relatively homogeneous classes and generally provide for depreciation on a straight-line basis over the

estimated average useful life of each asset class, except for leasehold improvements, which are

amortized over the lesser of the applicable lease term or the estimated useful life of the asset. Certain

store and warehouse fixtures, when fully depreciated, are removed from the cost and related

accumulated depreciation and amortization accounts. The valuation and classification of these assets

and the assignment of depreciable lives involves judgments and the use of estimates, which we believe

have been materially accurate in recent years.

Impairment of Long-lived Assets. Impairment of long-lived assets results when the carrying value

of the assets exceeds the estimated undiscounted future cash flows generated by the assets. Our

estimate of undiscounted future store cash flows is based upon historical operations of the stores and

estimates of future profitability which encompasses many factors that are subject to variability and are

difficult to predict. If our estimates of future cash flows are not materially accurate, our impairment

analysis could be impacted accordingly. If a long-lived asset is found to be impaired, the amount

recognized for impairment is equal to the difference between the carrying value and the asset’s

estimated fair value. The fair value is estimated based primarily upon projected future cash flows

(discounted at our credit adjusted risk-free rate) or other reasonable estimates of fair market value.

Although not currently anticipated, changes in these estimates, assumptions or projections could

materially affect the determination of fair value or impairment.

Insurance Liabilities. We retain a significant portion of the risk for our workers’ compensation,

employee health, property loss, automobile and general liability. These represent significant costs

primarily due to our large employee base and number of stores. Provisions are made for these liabilities

on an undiscounted basis. Certain of these liabilities are based on actual claim data and estimates of

incurred but not reported claims developed using actuarial methodologies based on historical claim

trends, which have been and are anticipated to continue to be materially accurate. If future claim

trends deviate from recent historical patterns, or other unanticipated events affect the number and

significance of future claims, we may be required to record additional expenses or expense reductions,

which could be material to our future financial results.

Contingent Liabilities—Income Taxes. Income tax reserves are determined using the methodology

established by accounting standards relating to uncertainty in income taxes. These standards require

companies to assess each income tax position taken using a two-step process. A determination is first

made as to whether it is more likely than not that the position will be sustained, based upon the

technical merits, upon examination by the taxing authorities. If the tax position is expected to meet the

more likely than not criteria, the benefit recorded for the tax position equals the largest amount that is

greater than 50% likely to be realized upon ultimate settlement of the respective tax position.

Uncertain tax positions require determinations and liabilities to be estimated based on provisions of the

tax law which may be subject to change or varying interpretation. If our determinations and estimates

prove to be inaccurate, the resulting adjustments could be material to our future financial results.

Contingent Liabilities—Legal Matters. We are subject to legal, regulatory and other proceedings

and claims. We establish liabilities as appropriate for these claims and proceedings based upon the

probability and estimability of losses and to fairly present, in conjunction with the disclosures of these

matters in our financial statements and SEC filings, management’s view of our exposure. We review

outstanding claims and proceedings with external counsel to assess probability and estimates of loss,

37