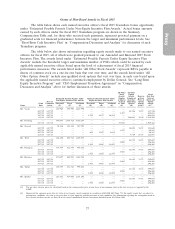

Dollar General 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

The Committee used our 2015 annual financial plan adjusted EBIT target of $1.939 billion as

the target for the 2015 Teamshare program and retained the threshold (below which no bonus may be

earned) and maximum (above which no further bonus may be earned) performance levels at 90% and

120% of the target level, respectively. These threshold and maximum performance levels had been used

in the prior year Teamshare program to more closely reflect the practices of our market comparator

group. Payouts for financial performance are based on actual results and are interpolated on a

straight-line basis between threshold and target and between target and maximum.

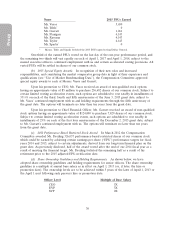

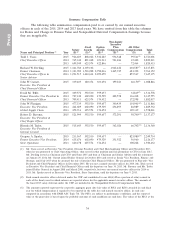

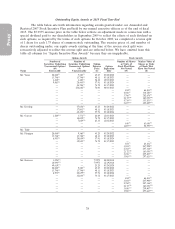

The bonus payable to each named executive officer upon achieving the target level of financial

performance is equal to the applicable percentage of base salary shown in the table below. The target

payout percentage of salary for Mr. Vasos was increased from 80% to 100% and for each of

Mr. Garratt and Ms. Taylor from 50% to 65% in connection with their promotions. Except for the

promotion-related decisions, these percentages for each named executive officer remained unchanged

from those in effect at the end of the prior year based on the Committee’s review of the market

comparator group data. The promotion-related decisions for Messrs. Vasos and Garratt were

determined as a result of the evaluations discussed above.

Target % of

Name Base Salary*

Mr. Vasos 80/100

Mr. Garratt/Ms. Taylor 50/65

All other named executive officers 65

* Percentages for Messrs. Vasos and Garratt and Ms. Taylor are those in effect for each position held

during 2015. The actual payout for each such officer is pro-rated for time in each position held during

2015. For all named executive officers, payout percentages at the threshold and maximum performance

levels would be calculated at 50% and 300%, respectively, of the applicable target percentage of base

salary.

(b) 2015 Teamshare Results. The Compensation Committee certified the adjusted EBIT

performance result at $1.957 billion (100.92% of target) resulting in 2015 Teamshare payouts to each of

Messrs. Vasos, Garratt, Flanigan and Ravener and Ms. Taylor of 109.2% of the target percentages set

forth in the table above. Such amounts are reflected in the ‘‘Non-Equity Incentive Plan Compensation’’

column of the Summary Compensation Table. Messrs. Tehle and Sparks were ineligible to receive a

payout under the terms of the Teamshare program because they were not employed with us on the

payment date.

Long-Term Equity Incentive Program. Long-term equity incentives are an important part of our

pay for performance philosophy and are designed to motivate named executive officers to focus on

long-term success for shareholders while rewarding them for a long-term commitment to us. The

Compensation Committee considers annual equity awards each March at its regular quarterly meeting

and considers special equity awards as necessary in connection with one-time events such as a new hire

or promotion. Equity awards are made under our shareholder-approved Amended and Restated 2007

Stock Incentive Plan.

(a) 2015 Annual Equity Awards. Each year, the Compensation Committee determines a

targeted equity award value for each named executive officer derived from benchmarking information

and the appropriate mix of vehicles in which to deliver such targeted value (see ‘‘Use of Market

Benchmarking Data’’). In 2015, the targeted value for each named executive officer was unchanged

from the prior year based on the Committee’s review of the market comparator group data and, for

Mr. Vasos, a decision to defer consideration of any increase until it was determined whether he would

succeed Mr. Dreiling as CEO. In addition, as in the prior year, the targeted value was delivered 50% in

options, 25% in PSUs and 25% in RSUs, which the Committee previously determined appropriately

28