Dollar General 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

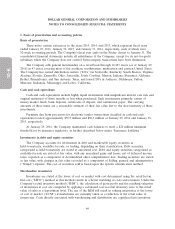

1. Basis of presentation and accounting policies (Continued)

Management estimates

The preparation of financial statements and related disclosures in conformity with accounting

principles generally accepted in the United States requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the consolidated financial statements and the reported amounts of

revenues and expenses during the reporting periods. Actual results could differ from those estimates.

Accounting standards

In May 2014, the Financial Accounting Standards Board (‘‘FASB’’) issued comprehensive new

accounting standards related to the recognition of revenue, which specified an effective date for annual

reporting periods beginning after December 15, 2016, with early adoption not permitted. In August

2015, the FASB deferred the effective date to annual reporting periods beginning after December 15,

2017, with earlier adoption permitted only for annual reporting periods beginning after December 15,

2016. The new guidance allows for companies to use either a full retrospective or a modified

retrospective approach in the adoption of this guidance. The Company is currently evaluating these

transition approaches, as well as the potential timing of adoption and the effect of adoption on its

consolidated financial statements.

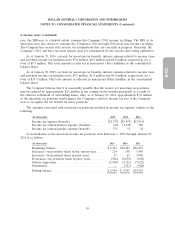

In April 2015, the FASB issued new accounting guidance related to the presentation of debt

issuance costs and requires such costs to be presented as a deduction from the corresponding debt

liability, consistent with the presentation of debt discounts and/or premiums. This guidance is effective

for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years, with

early adoption permitted. The guidance must be applied retrospectively to all periods presented within

the financial statements. The Company adopted this guidance in the third quarter of 2015. As a result,

the presentation of $15.5 million of debt issuance costs (net of accumulated amortization) previously

classified as Other assets, net are reflected in Long-term obligations on the consolidated balance sheet

as of January 30, 2015.

In November 2015, the FASB issued new accounting guidance which will require companies to

classify all deferred tax assets and liabilities as noncurrent on the balance sheet instead of separating

them into current and noncurrent amounts. This guidance is effective for fiscal years beginning after

December 15, 2016, and interim periods within those fiscal years, with early adoption permitted. This

guidance may be adopted on a prospective or retrospective basis. The Company adopted this guidance

retrospectively in the fourth quarter of 2015. As a result, the presentation of $25.3 million of deferred

income taxes previously classified as a current liability are reflected in noncurrent deferred income

taxes on the consolidated balance sheet as of January 30, 2015.

In February 2016, the FASB issued new guidance related to lease accounting. This guidance

requires a dual approach for lessee accounting under which a lessee will account for leases as finance

leases or operating leases. Both finance leases and operating leases will result in the lessee recognizing

a right-of-use asset and a corresponding lease liability on its balance sheet, with differing methodology

for income statement recognition. This guidance is effective for public business entities for fiscal years,

and interim periods within those years, beginning after December 15, 2018, and early adoption is

permitted. A modified retrospective approach is required for all leases existing or entered into after the

beginning of the earliest comparative period in the consolidated financial statements. The Company is

currently assessing the impact that adoption of this guidance will have on its consolidated financial

54