Dollar General 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

29MAR201619275050 29MAR201619275213

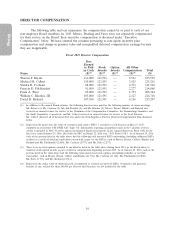

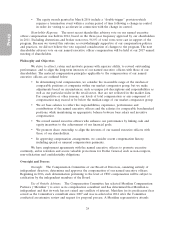

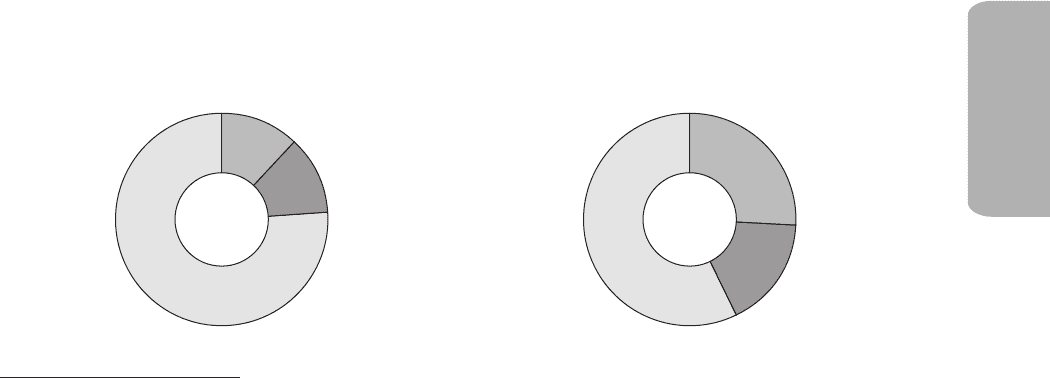

Pay for Performance. Consistent with our philosophy, and as illustrated below, a significant

portion of annualized target total direct compensation for our named executive officers in 2015 was

performance based and exposed to fluctuations in our stock price.

CEO Other NEOs

(Average)

Salary

12%

STI

12%

LTI

76%

Variable/At-Risk: 88%

Salary

26%

STI

17%

LTI

57%

Variable/At-Risk: 74%

‘‘CEO’’ reflects compensation for Mr. Vasos and not Mr. Dreiling; ‘‘Other NEOs’’ reflects compensation only for the other

named executive officers who remained employed after the end of fiscal 2015 (i.e., Messrs. Garratt, Flanigan and Ravener and

Ms. Taylor).

STI—Short-Term Cash Incentive (Teamshare bonus program)

LTI—Long-Term Equity Incentive

The following payouts were earned as a result of strong performance versus the financial

targets used for our 2015 performance-based compensation:

•Teamshare Bonus Program: Participants earned a payout under our annual Teamshare

bonus program of 109.2% of the target payout level based on achieving adjusted EBIT (as

defined and calculated for purposes of the Teamshare bonus program) of $1.957 billion, or

100.92% of the adjusted EBIT target (see ‘‘Short-Term Cash Incentive Plan’’).

•Performance Share Units: The awards granted in March 2015 were earned at 104.5% of

target, based on achieving adjusted EBITDA of $2.347 billion, or 100% of the adjusted

EBITDA target, and Adjusted ROIC of 19.14%, or 100.5% of the adjusted ROIC target,

in each case as defined and calculated in the PSU award agreements (see ‘‘Long-Term

Equity Incentive Program’’).

Significant Compensation-Related Actions. The most significant recent compensation-related

actions pertaining to our named executive officers include:

• In March 2015, the Compensation Committee approved an employment transition

agreement and related compensation to ensure Mr. Dreiling’s smooth transition from Chief

Executive Officer through his January 29, 2016 retirement date. See ‘‘CEO Employment

Transition Agreement.’’

• In June 2015, Mr. Vasos was promoted from Chief Operating Officer to Chief Executive

Officer (‘‘CEO’’), and the Compensation Committee approved his revised compensation

package as discussed in more detail below.

• In December 2015, Mr. Garratt was promoted to Chief Financial Officer to fill the vacancy

created by Mr. Tehle’s retirement in July 2015, and the Compensation Committee

approved a new compensation package for Mr. Garratt as discussed in more detail below.

23