Dollar General 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

Each senior officer is required to retain ownership of 50% of all net after-tax shares acquired

from Dollar General until he or she reaches the target ownership level. Administrative details

pertaining to these matters are established by the Compensation Committee.

(e) Policy Against Hedging and Pledging Transactions. Our policy prohibits Board members

and executive officers from (1) pledging Dollar General securities as collateral, (2) holding Dollar

General securities in a margin account, and (3) hedging their ownership of Dollar General stock, such

as entering into or trading prepaid variable forward contracts, equity swaps, collars, puts, calls, options

(other than those granted by us) or other derivative instruments related to Dollar General stock.

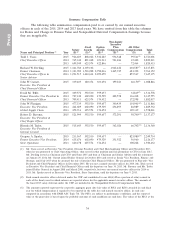

Benefits and Perquisites. Our named executive officers participate in certain benefits on the

same terms that are offered to all of our salaried employees. We also provide them with limited

additional benefits and perquisites for retention and recruiting purposes, to replace benefit

opportunities lost due to regulatory limits, and to enhance their ability to focus on our business. We do

not provide tax gross-up payments on any benefits and perquisites other than relocation-related items.

The primary additional benefits and perquisites include the following:

• We provide a Compensation Deferral Plan (the ‘‘CDP’’) and, for named executive officers

hired or promoted prior to May 28, 2008, a defined contribution Supplemental Executive

Retirement Plan (the ‘‘SERP,’’ and together with the CDP, the ‘‘CDP/SERP Plan’’).

• We pay the premiums for a life insurance benefit equal to 2.5 times base salary up to a

maximum of $3 million.

• We pay administrative fees for short-term disability coverage, which provides income

replacement of up to 70% of monthly base salary in the case of a short-term disability. We

also pay the premiums under a group long-term disability plan, which provides 60% of

base salary up to a maximum of $400,000.

• We provide a relocation assistance program under a policy applicable to officer-level

employees.

• We provide personal financial and estate planning and tax preparation services through a

third party.

CEO Employment Transition Agreement. As previously disclosed, Mr. Dreiling retired on

January 29, 2016 (the ‘‘Retirement Date’’). In light of his announced retirement plans, the

Compensation Committee did not undertake performance reviews for Mr. Dreiling for 2014 or 2015,

but rather deemed his performance to be satisfactory and determined his 2015 compensation as part of

our negotiated employment transition agreement with him, effective March 10, 2015. The terms of the

employment transition agreement were negotiated to secure Mr. Dreiling’s services through the

Retirement Date and ensure a smooth transition to his successor, and we believe the employment

transition agreement successfully achieved those goals. Mr. Dreiling served as our CEO until we

appointed Mr. Vasos as his successor. Thereafter, Mr. Dreiling served as Senior Advisor and as a

member and Chairman of the Board through the Retirement Date. Mr. Dreiling remains subject to the

business protections contained in the employment transition agreement, including non-competition and

non-solicitation provisions, for two years following the Retirement Date.

Pursuant to the employment transition agreement:

• Mr. Dreiling received the same 2.95% base salary increase in 2015 that was budgeted for

our entire U.S.-based employee population.

• Mr. Dreiling participated in the 2015 Teamshare program at the same threshold (50% of

target), target (130%) and maximum (300% of target) base salary percentage levels as the

prior year, and we waived the requirement to be employed on the payment date. As

31