Dollar General 2015 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

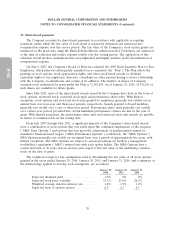

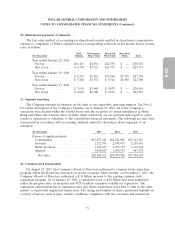

10. Share-based payments (Continued)

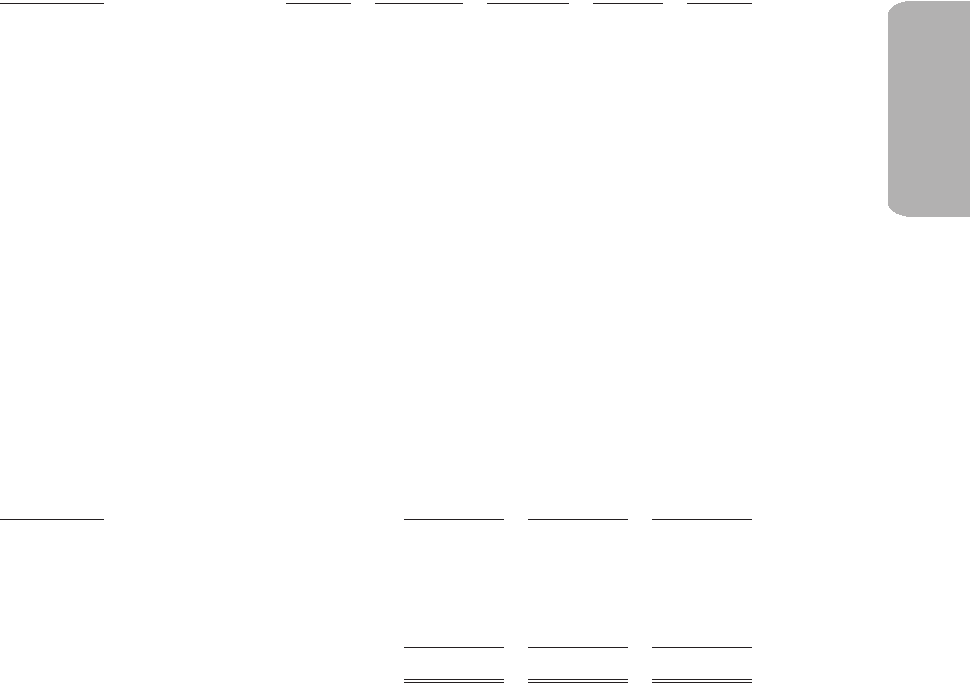

The fair value method of accounting for share-based awards resulted in share-based compensation

expense (a component of SG&A expenses) and a corresponding reduction in net income before income

taxes as follows:

Stock Performance Restricted Restricted

(In thousands) Options Share Units Stock Units Stock Total

Year ended January 29, 2016

Pre-tax ............... $11,113 $4,856 $22,578 $ — $38,547

Net of tax ............. $ 6,779 $2,962 $13,772 $ — $23,513

Year ended January 30, 2015

Pre-tax ............... $ 8,533 $5,461 $15,968 $7,376 $37,338

Net of tax ............. $ 5,206 $3,332 $ 9,742 $4,500 $22,780

Year ended January 31, 2014

Pre-tax ............... $ 7,634 $3,448 $ 9,879 $ — $20,961

Net of tax ............. $ 4,649 $2,100 $ 6,016 $ — $12,765

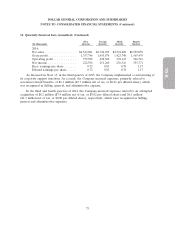

11. Segment reporting

The Company manages its business on the basis of one reportable operating segment. See Note 1

for a brief description of the Company’s business. As of January 29, 2016, all of the Company’s

operations were located within the United States with the exception of certain subsidiaries in Hong

Kong and China and a liaison office in India, which collectively are not material with regard to assets,

results of operations or otherwise, to the consolidated financial statements. The following net sales data

is presented in accordance with accounting standards related to disclosures about segments of an

enterprise.

(In thousands) 2015 2014 2013

Classes of similar products:

Consumables .................... $15,457,611 $14,321,080 $13,161,825

Seasonal ........................ 2,522,701 2,344,993 2,259,516

Home products ................... 1,289,423 1,205,373 1,115,648

Apparel ........................ 1,098,827 1,038,142 967,178

Net sales ...................... $20,368,562 $18,909,588 $17,504,167

12. Common stock transactions

On August 29, 2012, the Company’s Board of Directors authorized a common stock repurchase

program, which the Board has increased on several occasions. Most recently, on December 2, 2015, the

Company’s Board of Directors authorized a $1.0 billion increase to the existing common stock

repurchase program. As of January 29, 2016, a cumulative total of $4.0 billion had been authorized

under the program since its inception and $923.8 million remained available for repurchase. The

repurchase authorization has no expiration date and allows repurchases from time to time in the open

market or in privately negotiated transactions. The timing and number of shares purchased depends on

a variety of factors, such as price, market conditions, compliance with the covenants and restrictions

73