Dollar General 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

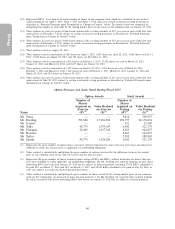

Proxy

Name 2015 PSUs Earned

Mr. Vasos 5,650

Mr. Tehle*0

Mr. Garratt 1,261

Mr. Flanigan 4,143

Mr. Ravener 4,143

Ms. Taylor 4,143

Mr. Sparks*0

* Messrs. Tehle and Sparks forfeited the 2015 PSUs upon leaving Dollar General.

One-third of the earned PSUs vested on the last day of the one-year performance period, and

the remaining two-thirds will vest equally on each of April 1, 2017 and April 1, 2018, subject to the

named executive officer’s continued employment with us and certain accelerated vesting provisions. All

vested PSUs will be settled in shares of our common stock.

(b) 2015 Special Equity Awards. In recognition of their new roles and increased

responsibilities, and considering the market comparator group data in light of their experience and

qualifications (see ‘‘Use of Market Benchmarking Data’’), the Compensation Committee approved

special equity awards to each of Messrs. Vasos and Garratt.

Upon his promotion to CEO, Mr. Vasos received an award of non-qualified stock options

having an approximate value of $5 million to purchase 256,682 shares of our common stock. Subject to

certain limited vesting acceleration events, such options are scheduled to vest ratably in installments of

331⁄3% on each of the third, fourth and fifth anniversaries of the June 3, 2015 grant date, subject to

Mr. Vasos’ continued employment with us and holding requirements through the fifth anniversary of

the grant date. The options will terminate no later than ten years from the grant date.

Upon his promotion to Chief Financial Officer, Mr. Garratt received an award of non-qualified

stock options having an approximate value of $124,000 to purchase 7,829 shares of our common stock.

Subject to certain limited vesting acceleration events, such options are scheduled to vest ratably in

installments of 25% on each of the first four anniversaries of the December 2, 2015 grant date, subject

to Mr. Garratt’s continued employment with us. The options will terminate no later than ten years

from the grant date.

(c) 2012 Performance-Based Restricted Stock Award. In March 2012 the Compensation

Committee awarded Mr. Dreiling 326,037 performance-based restricted shares of our common stock

which could be earned by achieving certain earnings per share (‘‘EPS’’) performance targets for fiscal

years 2014 and 2015, subject to certain adjustments, derived from our long-term financial plan on the

grant date. As previously disclosed, half of the award vested after the end of our 2014 fiscal year as a

result of meeting the financial target. Mr. Dreiling forfeited the remaining half as a result of his

retirement prior to the 2015 adjusted EPS certification date.

(d) Share Ownership Guidelines and Holding Requirements. As shown below, we have

adopted share ownership guidelines and holding requirements for senior officers. The share ownership

guideline is a multiple of annual base salary as in effect on April 1, 2013 (or, if later, the hire or

promotion date). The ownership levels are to be achieved within 5 years of the later of April 1, 2013 or

the April 1 next following such person’s hire or promotion date.

Officer Level Multiple of Base Salary

CEO 5X

EVP 3X

SVP 2X

30